Defensive Sectors Are Showing Signs of Weakness

by David Fabian | May 31, 2013 11:30 am

The recent volatility in the stock and bond market has prompted many investors to look closely at their portfolios to determine where the areas of strength and weakness may be. Your past experience would more than likely lead you to believe that defensive stalwarts such as Healthcare, Utilities, and Consumer Staples would be holding up the best given their history of low volatility.

However, this sell-off has created a new dynamic that I talked about several weeks ago[1] where these sectors have been overbought and may ultimately lead the market lower.

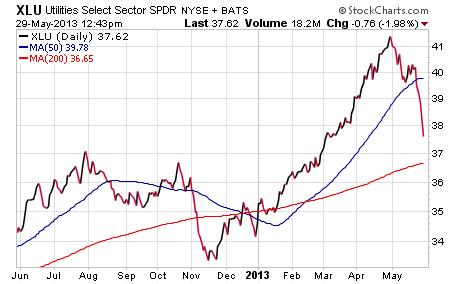

The Utilities Select Sector SPDR (XLU[2]) was the first defensive sector to show signs of weakness when it topped out at the end of April and has since begun a pervasive decline. Interestingly enough this high in XLU also coincided with a low in the 10-Year Treasury Yield Index as well.

The 10-Year yield has rocketed from a low of 1.6% earlier in the month to a new breakout high of over 2.13%. To put it in percentage terms, the benchmark index has risen over 27% just this month alone. Utility stocks can often exhibit an inverse correlation to interest rates because they are capital intensive companies that rely on debt to manage their operations.

Looking at the chart above, you can see that XLU had an incredible run to start the year, which pushed the valuations in this sector to extreme levels. Now this ETF is nearing the 200-day moving average, which will be a key level of support that it will need to sustain in order to regain its footing.

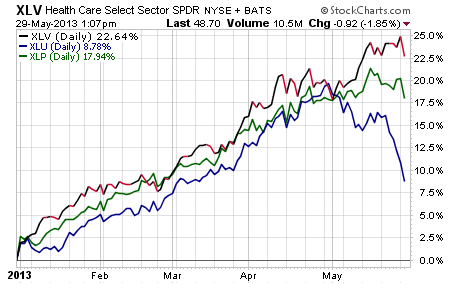

The Healthcare Select Sector SPDR (XLV[3]) and Consumer Staples Select Sector SPDR (XLP[4]) are both starting to show signs of weakness as well. This year-to-date chart comparing each of these three defensive sectors shows that XLV has been leading the pack all year but may be showing signs of topping out.

In addition, it should be noted that all three of these sectors are heavily represented in the PowerShares S&P 500 Low Volatility Portfolio

(SPLV[5]) and iShares MSCI U.S. Minimum Volatility ETF (USMV[6]). Utilities, healthcare, and consumer staples as a group make up nearly 42% of USMV and 60% of SPLV.

Next Moves

I believe that a pullback in defensive stocks will ultimately be healthy for the markets and work off some of the overbought indicators. I am looking at a correction as an opportunity to add to several of these ETFs for both my income and growth clients. However, I want to see how they react to this recent surge in interest rates, which will be key to determining their future growth prospects.

Investors who are looking to diversify their portfolio away from these sectors may want to consider the First Trust NASDAQ Technology Dividend Index Fund (TDIV[7]). Last week I profiled this ETF[8] as a technology dividend value play and its recent performance suggests more defensive resilience than utilities or healthcare. TDIV gives you exposure to technology companies that are focused on rewarding shareholders through cash dividends and share buybacks.

No matter how your portfolio is positioned, I always recommend that you have a risk management game plan[9] in place to protect yourself on the downside. That could include a stop loss that kicks in when your holdings have fallen a certain percentage from their high or broken through a trend line. This will allow you to sleep well at night knowing you have a strategy to protect your hard earned nest egg.

David Fabian is the Chief Operations Officer and Managing Partner of Fabian Capital Management. To get more investor insights from Fabian Capital, visit their blog here[10] or click here to download[11] their latest special report, The Strategic Approach to Income Investing.

- I talked about several weeks ago: http://fabiancm.com/why-you-should-rethink-your-defensive-game-plan/

- XLU: http://studio-5.financialcontent.com/investplace/quote?Symbol=XLU

- XLV: http://studio-5.financialcontent.com/investplace/quote?Symbol=XLV

- XLP: http://studio-5.financialcontent.com/investplace/quote?Symbol=XLP

- SPLV: http://studio-5.financialcontent.com/investplace/quote?Symbol=SPLV

- USMV: http://studio-5.financialcontent.com/investplace/quote?Symbol=USMV

- TDIV: http://studio-5.financialcontent.com/investplace/quote?Symbol=TDIV

- profiled this ETF: http://fabiancm.com/how-to-boost-your-yield-with-tech-stocks/

- risk management game plan: http://fabiancm.com/wealth-management/risk-management/

- visit their blog here: http://fabiancm.com/investor-insights/blog/

- click here to download: http://fabiancm.com/investor-insights/special-reports/

Source URL: https://investorplace.com/2013/05/defensive-sectors-are-showing-signs-of-weakness/