Stocks, Bonds, And Gold: Where Do We Go From Here?

by David Fabian | June 6, 2013 10:30 am

Over the last month, the market has taught us a great deal about volatility. Stocks have finally started to waver, bonds got crushed in May, and gold has continued to teeter sideways. In my experience, this type of uncertainty is a rare occurrence. Typically when stocks get volatile, you will see a flight to quality in gold or bonds which will help balance out the price fluctuations in your portfolio. Conversely, when interest rates rise (and bond prices fall) you generally see a jump in stocks as investors rotate into inflationary assets.

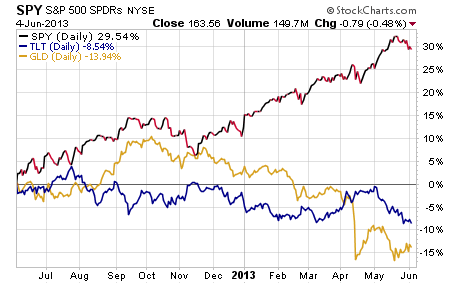

If you look at a one-year chart comparing the SPDR S&P 500 ETF (SPY), SPDR Gold Shares (GLD), and the iShares 20+ Year Treasury Bond Fund (TLT), you can see that stocks have clearly been the winning trade. Both TLT and GLD have posted negative returns over the last 12 months which is to be expected considering the strength in equities.

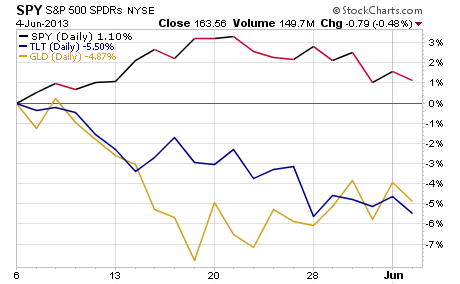

However, more recent data suggests that stocks are losing momentum which should be a plus for either gold or bonds. The problem is that these money flows have yet to materialize as a meaningful boost for either asset class. This may be due to a more significant shift in investor sentiment as being bearish towards these traditional safe havens. The one-month chart below shows how SPY has started to roll over and yet neither GLD nor TLT have benefited from this momentum.

Investors have clearly soured on these asset classes in the short-term which may be a sign that money is flowing out of stocks and into cash for the time being. Cash is still king when it comes to protecting your hard earned nest egg from the threats of volatility. The drawback to cash is that it is not paying any yield; however, you still have the absolute safety and guarantee of stable value.

I personally believe that the reactions in interest rates from the Federal Reserve comments regarding tapering asset purchases have been overblown. In my opinion, the Fed will continue to inflate the economy for the foreseeable future which makes bond prices even more attractive at these levels. I am not looking to buy treasuries right here, but I am closely watching the price action of interest rates[1] and individual bond sectors to determine my next opportunistic purchases for my income clients.

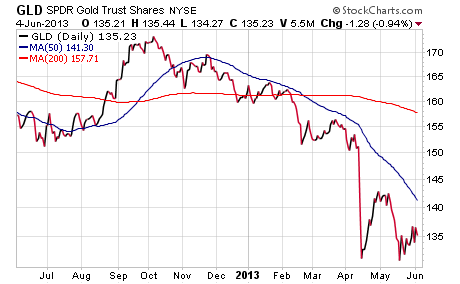

In addition, I am closely monitoring the price action in GLD for a meaningful break in either direction[2]. The floor has clearly been set at the $130 level which is where many traders will have placed their stop losses. If we break that level, then expect a quick ride down to $120 or even lower. However, if GLD can regain the 50-day moving average, it may have a shot at replenishing its momentum and beginning a new uptrend.

No matter how you are playing these three key segments of the market, remember that this volatility can be used as an opportunity for your portfolio. Use pullbacks as low-risk entry points to establish new positions with tight stop losses[3]. If we start to see the market break down even further, that may re-establish the flight to quality in GLD or TLT that we have historically been accustomed to.

Just keep in mind that the next 12 months will more than likely look nothing like the last 12 months which is why it is so important to be nimble with your portfolio.

David Fabian is the Chief Operations Officer and Managing Partner of Fabian Capital Management. To get more investor insights from Fabian Capital visit their blog here[4] or click to download[5] their latest special report The Strategic Approach to Income Investing.

- watching the price action of interest rates: http://fabiancm.com/evaluating-your-sensitivity-to-market-changes/

- meaningful break in either direction: http://fabiancm.com/gold-double-bottom-or-double-trouble/

- tight stop losses: http://fabiancm.com/wealth-management/risk-management/

- visit their blog here: http://fabiancm.com/investor-insights/blog/

- click to download: http://fabiancm.com/investor-insights/special-reports/

Source URL: https://investorplace.com/2013/06/stocks-bonds-and-gold-where-do-we-go-from-here-gld-spy-tlt/