Are 401(k)s Without Matching Contributions Worth It?

by NerdWallet | September 27, 2013 1:00 pm

Since 401(k)s were introduced in 1980, employer matching programs have been an important incentive for workers to fund their retirement accounts. However, no company is required to provide a match, and for financial reasons, many choose not to… 42% of U.S. companies[1] do not offer an employer match.

While 401(k)s are an obvious first choice for any retirement savings if your employer matches contributions, what if they don’t? Are 401(k)s still a good option?

401(k)s vs. IRAs

Even if your employer doesn’t offer a 401(k) match, you still need to save for retirement[2]. If anything, you need to save more. But should you use a 401(k)? An IRA? Both?

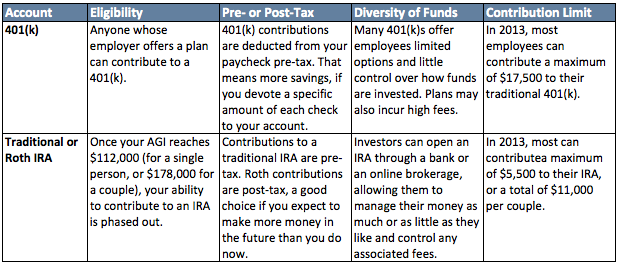

When deciding (or prioritizing) between IRAs and 401(k)s, there are a few aspects you’ll definitely want to consider: contribution limits, the diversity of funds available and whether the money is deducted from your paycheck pre- or post-tax. IRAs also have eligibility[3] requirements that may make your choice obvious.

Be Flexible

Because of the rules[4] governing 401(k)s and IRAs, and your changing financial situation, your best approach for retirement saving should change over time. For example:

- First Job: You’ve started your first job, making $35,000 per year. Even if you’re able to devote 10% of your income to retirement savings – which would be a lot if you have student loans – you won’t run up against the contribution limits for IRAs. In this case, opting out of your employer’s 401(k) plan and saving in an IRA will probably be your best bet.

- Mid-Career: Now you’ve been working for fifteen years and are married. You and your spouse both make about $60,000 per year, so you’re eligible to make a full contribution to an IRA. If you’ve kept your debt under control and are able to put 10% of your income toward retirement, though, an IRA alone isn’t going to cut it. You’ll want to save in both an IRA and a 401(k) – matching or not – to keep on track for retirement.

- Nearing Retirement: You’re in your 50s. You and your spouse earn a combined total of $190,000 annually, which makes you ineligible to contribute to an IRA. If you’ve maxed out your 401(k) contribution – including any catch-up deferrals – you can still use a brokerage account to invest in low-risk securities.

Note: If you’re 50 or over and you (or you and your spouse) are still eligible to contribute to an IRA, your annual limit increases – to $6,500 in 2013.

If You Have to Pick

Because each financial situation is so specific, you should consult a financial advisor before choosing between a 401(k) and an IRA, if you must. But in general:

- Contribute to an IRA first. Without an employer match, the main reason to prioritize your 401(k) is gone. Assuming you qualify, your IRA is likely to provide you with more flexibility than a 401(k), both in terms of your investments and your tax preferences. Many financial institutions also offer no-fee IRAs and automatic withdrawals from your checking account.

- Don’t dump your 401(k). Even if you save as much as possible in an IRA and earn a respectable return on your investment, you can expect to retire with less than $300,000. That’s more than many Americans have saved for retirement, but still not necessarily enough. If you can afford to contribute more, put it in a 401(k), with or without the match.

Most importantly, choose whatever option – or combination of options – lets you maximize your retirement savings, and adjust as your salary and circumstances change.

Read More From NerdWallet:

-

401(k) Rollovers: How to roll over a 401(k) to a No Fee IRA[5]

- U.S. companies: http://www.thestreet.com/story/11911313/1/more-us-firms-shutter-401ks-matching-programs.html

- retirement: http://www.nerdwallet.com/blog/investing/2013/hidden-401k-fees-plan-retirement-account-study/

- eligibility: http://www.nerdwallet.com/blog/investing/2013/high-income-roth-ira-backdoor/

- rules: http://www.irs.gov/Retirement-Plans/Plan-Sponsor/Types-of-Retirement-Plans-1

- 401(k) Rollovers: How to roll over a 401(k) to a No Fee IRA: http://www.nerdwallet.com/blog/investing/2013/401k-rollovers-roll-401k-no-fee-ira/

Source URL: https://investorplace.com/2013/09/are-401ks-without-matching-contributions-worth-it/