Heavy Lumber Prices Spell Trouble for Homebuilders

by ETFguide | May 22, 2014 3:25 pm

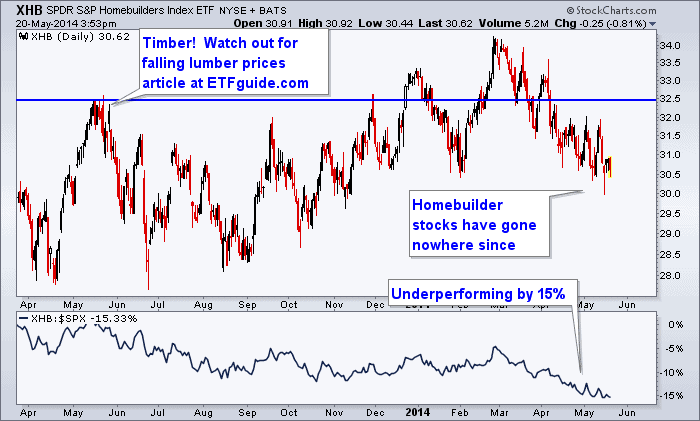

We have been bearish the housing sector since May 2013, when we warned falling lumber prices were a leading indicator of soon to be weakness for homebuilders.

In an article I wrote titled, “Timber![1],” the housing market’s leading economic indicator had already turned down in price from its highest point reached since the financial crisis.

Since last May lumber prices have not looked back, keeping pressure on homebuilders and construction company shares as the homebuilders have now underperformed the S&P 500 by over 15%.

Watch more: How falling lumber prices were a leading indicator for homebuilders’ prices[2]

The first chart below shows the performance of the SPDR S&P Homebuilders ETF (XHB[3]) performance since last May along with its relative performance compared to the S&P 500 at the bottom. Indeed, housing stocks have not done well the past year, as foreshadowed by falling lumber prices.

[4]

[4]

Home Depot Raises Forecast – Was That a Mistake?

One of this week’s big news items came from Home Depot (HD[5]) after it missed its 1Q earnings.

Home Depot, which is XHB’s 6th largest holding, doesn’t think this was anymore than a weather-related hiccup as the company raised its guidance to $4.42 per share for the expected fiscal 2014 earnings.

But just as May 2013’s turn in lumber prices warned of a weaker environment for homebuilders, lumber prices may again be warning things will not turn out near as rosy as Home Depot or others in the housing industry expect.

Lumber Leading Lower?

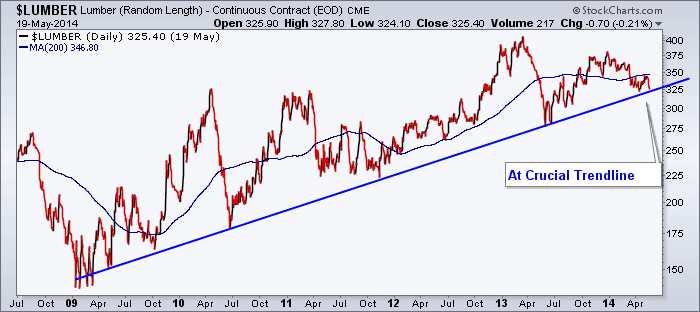

The chart below shows the five-year history of the lumber future’s price and how it peaked in price in early 2013 near $400 per 1,000 board feet.

That peak led to weakness in the housing sector over the past year, leading to the homebuilders’ sizable 15% underperformance.

That weakness continues today where prices are poised precariously at $325, on the edge of the five-year trendline that thus far has held the uptrend.

[6]

[6]

If that uptrend support holds, Home Depot may be proved correct and the housing recovery may continue — but if lumber prices continue to decline and break their trend then it is likely homebuilder stocks will follow, continuing their trend of underperformance.

XHB and iShares U.S. Home Construction (ITB[7]) are in similar boats as lumber prices, sitting right on key price supports, could setup nice shorting opportunities if they break to the downside.

A breakdown in lumber prices will be the first clue to be on the short side of those ETFs.

The homebuilder ETFs are currently on our watch list, and a continued decline in lumber prices would warn those short setups will come to fruition. It also will mean individual homebuilder stocks such as Lennar (LEN[8]), KB Home (KBH[9]), Beazer (BZH[10]), and Home Depot are likely to continue their underperformance.

The ETF Profit Strategy Newsletter & Technical Forecast[11] provides technical, sentiment, and fundamental research along with actionable trading ideas. Homebuilders have already been struggling the last year, and a continued deterioration in lumber prices would likely lead further weakness.

Follow us on Twitter @ETFguide[12]

- Timber!: http://archive.etfguide.com/commentary/1045/Timber!-Watch-out-for-Falling-Lumber-Prices/

- How falling lumber prices were a leading indicator for homebuilders’ prices: https://www.youtube.com/watch?v=vfx5NSCCRH8

- XHB: http://studio-5.financialcontent.com/investplace/quote?Symbol=XHB

- [Image]: https://www.etfguide.com/wp-content/uploads/2014/05/XHB-vs-SPX-May-2013.png

- HD: http://studio-5.financialcontent.com/investplace/quote?Symbol=HD

- [Image]: https://www.etfguide.com/wp-content/uploads/2014/05/LUmber-prices.png

- ITB: http://studio-5.financialcontent.com/investplace/quote?Symbol=ITB

- LEN: http://studio-5.financialcontent.com/investplace/quote?Symbol=LEN

- KBH: http://studio-5.financialcontent.com/investplace/quote?Symbol=KBH

- BZH: http://studio-5.financialcontent.com/investplace/quote?Symbol=BZH

- ETF Profit Strategy Newsletter & Technical Forecast: https://www.etfguide.com/newsletter/

- @ETFguide: https://twitter.com/etfguide

Source URL: https://investorplace.com/2014/05/lumber-homebuilder-etfs/