BlackBerry (BBRY) hasn’t been a lot of fun for its investors or for its employees lately.

Last year, BlackBerry announced plans to cut 40% of its entire workforce. And since early 2013, BBRY stock has lost more than 20% despite a rise of nearly 40% for the S&P 500 in the same period.

Last year, BlackBerry announced plans to cut 40% of its entire workforce. And since early 2013, BBRY stock has lost more than 20% despite a rise of nearly 40% for the S&P 500 in the same period.

There could be signs of life for BlackBerry stock, however, as shares of BBRY have gained over 20% in the last two months. Furthermore, an internal memo reveals that the restructuring pain at BlackBerry has passed. In a note to BlackBerry employees, CEO John Chen said:

“Barring any unexpected downturns in the market, we will be adding headcount in certain areas such as product development, sales and customer service, beginning in modest numbers.”

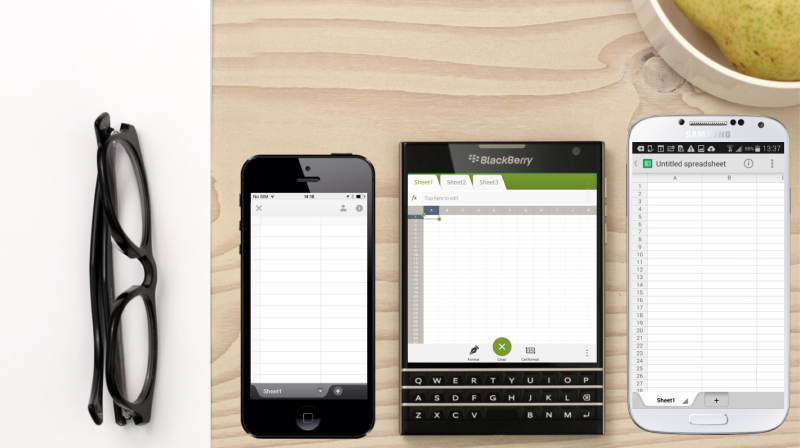

So is this a sign of life for the embattled smartphone company and a bullish indicator for BBRY stock, or is this just the latest chapter in BlackBerry’s long struggle to fend off inevitable irrelevance?

BBRY Stock Analysis

The most important thing for investors to keep in mind is that BBRY stock has little to do with your personal tastes about its smartphones, or your preference for Apple (AAPL) or Google (GOOG) devices. This is mildly a trade to make based on balance sheet analysis, and most importantly, an investment to make based on sentiment.

From a balance sheet perspective, it’s undeniable that BlackBerry is unprofitable and isn’t predicted to turn a profit until after fiscal 2016, according to most Wall Street forecasts. However, the company’s recently released annual report showed operating cash flow was only $159 million in the red on the fiscal year that ended March 1. That’s hardly a brutal cash burn.

Furthermore, BBRY finished the year with $1.58 billion in cash and equivalents — which actually was an increase over the $1.55 billion at the end of the previous fiscal year. So clearly, BlackBerry has some wiggle room here.

Given the burden of restructuring costs on BBRY stock and the benefits of streamlining, the balance sheet will certainly improve going forward.

Of course, let’s be honest — most BBRY investors are trading this pick based on sentiment above all.

For starters, there’s the benefits of restructuring to consider. That’s obvious, and many BlackBerry stock investors are optimistic the moves will pay off.

For starters, there’s the benefits of restructuring to consider. That’s obvious, and many BlackBerry stock investors are optimistic the moves will pay off.

Furthermore, John Chen has made a lot of tough choices and is well-regarded as a turnaround artist after “saving” database software company Sybase from bigger competitors like Oracle (ORCL), then navigating a sale to SAP (SAP) in 2010. That speaks well for the chance of this turnaround sticking.

Lastly, the bears have mostly thrown in the towel after shorting BlackBerry stock heavily from $70 in early 2011 to a low of $5.44 to start this year. Shares actually are up 75% from that level — proving even a dud like BBRY stock can get oversold at some point.

While shares admittedly have rolled back from a high above $11 a few weeks ago, there does appear to be an uptrend and some optimism among buyers.

Throw in the fact that BlackBerry short interest is now at its lowest level in over a year based on mid-July readings, and it’s clear that the bears are leaving the building.

Buy BlackBerry Stock Carefully

To be clear, I’m not saying all this makes BlackBerry stock a lock. BBRY stock is characterized by a lot of volatility, so buyer beware.

Furthermore, there appears to be resistance at around $11.50 a share; BlackBerry flashed an overbought RSI at those levels, volume dried up and BBRY stock quickly rolled back under $10.

Click to Enlarge However, with the 200-day moving average bottoming in early July and moving higher and the stock bouncing off its shorter-term 50-day average lately, there seems to be a technical indication of a turnaround in BBRY stock, too.

I wouldn’t buy and hold this company, because the BlackBerry turnaround tale still has a lot of open questions. However, a purchase under $10 could win you a quick 10% to 15% profit in a matter of weeks.

Just protect yourself with stops if you do.

Right now the news seems to be favorable for BBRY stock, and the short sellers aren’t as interested. But that could change in a hurry, as it has in the past for BlackBerry stock.

Jeff Reeves is the editor of InvestorPlace.com and the author of The Frugal Investor’s Guide to Finding Great Stocks. As of this writing, he did not hold a position in any of the aforementioned securities. Write him at editor@investorplace.com or follow him on Twitter via @JeffReevesIP.