Hello, Reader.

It’s a bird… it’s a plane… it’s a Starlink satellite.

In 2019, Elon Musk’s SpaceX began launching Starlink satellites. Now, around 7,600 of them dot Earth’s low orbit.

Around 2,000 of those were deployed this year, alone.

Now, I don’t mention these small satellites to comment on Starlink’s pursuits… but to better describe an orbital term…

Apogee.

It’s a word you’ve heard me use here at Smart Money over the last week, as it’s the name of my new stock-picking system, which I’ve been telling you about. (Also, I’ll be hosting a free broadcast event on Wednesday, at 10 a.m. Eastern, where I’ll be debuting Apogee to the public for the very first time. Just click here to reserve your spot.)

And, I’ll admit, apogee is an odd word.

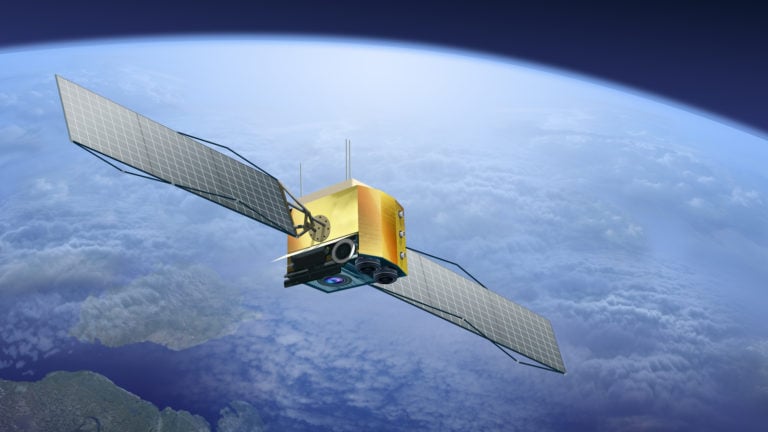

In astronomy, apogee describes the point in an object’s orbit when it is farthest away from the body around which it is orbiting. The image below illustrates this point between a satellite (Starlink, or otherwise) and Earth.

Now in finance, apogee describes when a stock is furthest away from its ultimate potential.

So, you can think of Earth in the image above as a company. Let’s say, Amazon.com Inc. (AMZN), when the stock had crashed after the early-2000s dot-com bust.

The satellite would then represent the company’s highest gain potential. In the early 2000s, there was quite a distance between Amazon and its true potential.

For investors, it feels natural, smart even, to turn away from a company at its lowest point. And I understand. Who wants to add a down-and-out company to their portfolio? The risk feels too great, and the reward seems nowhere in sight.

But that is why I named my new trading system Apogee. It finds stocks when they are furthest away from their true potential and gives a buy signal as they are moving toward that potential.

My system follows a series of patterns to identify if – and when – a company starts moving toward its great potential. This distinction separates my trading system from others… and creates an incredibly high ceiling for optimizing returns.

This risk-reward profile is at the center of Apogee’s decision-making. The point of my system is to find stocks with massive potential and relatively little downside risk.

And I’d like to share one of Apogee’s first official picks with you today, ticker and all.

But first, let’s take a look back at what we covered here at Smart Money last week.

Smart Money Roundup

September 3, 2025

Why Japan May Be the Market That Supercharges Your Portfolio

International stocks can end up being some of the biggest winners in your portfolio. And due to valuation and structural reform, a new cycle of Japanese outperformance is underway.

This is just the start of a greater Japanese trend… and it should signal your attention to stocks outside of the United States. Tom Yeung breaks down the country’s economic journey and then explains how you can diversify some of capital into select foreign investments. Click here to read more.

September 4, 2025

The Hidden Sweet Spot Where 1,000% Winners Live

For the first time, I have translated my internal locating system into a computerized, quantitative set of rules… a powerful new stock-picking system designed to pinpoint precisely when a stock enters the 10X pattern.

Think of it as a fishing radar… or distilling decades of oceanographic science into five simple “10X Factors.” I’d like to give you a sense of what to expect from my system… and share one of its first five “official” recommendations.

September 6, 2025

Why My System Didn’t Pick Tesla… but Dug Up 1,115% Gains in Amazon

My new system – Apogee – has discovered all the factors behind my 41 1,000%-plus gainers. However, Apogee is not designed to pick up every single company that does well. It’s designed to pick companies at their most optimal point.

So, I’d like to share why it selectively identifies certain winners – like Amazon – while bypassing other big names… like Tesla. This discernment is a key feature of Apogee. Click here to continue reading.

September 7, 2025

5 Fresh Buy Signals: Your Shot at 1,000% Winners

Every successful investor has a system. A “north star” that guides their decisions through good times and bad. That’s because luck can make you right once… but only a process can make you right again and again. Apogee is the culmination of my process.

Apogee recently flagged five different “Buys” across a universe of 14,000 stocks. These are all trading at incredible discounts and have simultaneously entered a “sweet spot” that looks ready for a 1,000% breakout. Here’s how to find out more about them…

An Apogee Official Pick

It’s important to note that my Apogee system doesn’t flag every good stock… or even every great one.

It waits for a specific combination of factors: a company must have experienced at least a 40% “down a lot” drop from its highs, then a period of stabilization that turns into an “up a little” move, eventually triggering the rare buy signal.

And as promised, here is one of the Apogee’s picks…

It’s Tidewater Inc. (TDW), a cutting-edge energy play. The company provides ships and equipment to offshore energy firms… both wind and oil and gas.

We all know AI is driving energy demand through the roof, and this company is helping to fill the gap right now.

I’ll reveal four more of the system’s original recommendations, including their names and ticker symbols, during my 10X Breakthrough event on Wednesday, September 10, at 10 a.m. Eastern.

Finally, I’ll demonstrate the system in real time. You’ll watch it sort through a universe of 14,000 stocks… and pinpoint the very, very few with 10X potential.

My special event is only two days away – and this is my last chance to talk to you between now and then – so you’ll want to be sure to reserve your spot here.

I’ll see you there!

Regards,

Eric Fry