Financial planners are in a great position today. With median pay near $100,000 and 14% expected industry growth, you’d think that gaining clients would be automatic.

Yet — despite strong employment growth prospects — the financial advisory field is competitive. High net-worth clients have many advisers chasing them. Furthermore, there’s the onslaught of robo-advisers placing downward pressure on fees.

Here are seven tips financial planners can use to help gain a competitive edge.

Tips for Financial Planners #1: Market and Grow Your Online Presence

If a client can’t find you online in 2019, then you’re no good. You need to have a compelling website that shows up on search.

If you’re located in Orlando, Florida and a local resident searches for a financial planner, your site needs to show up. A blog along on your website will also drive traffic to your business. You should definitely hire a professional website designer and SEO (search engine optimization) professional — and scrupulously check their credentials.

Make yourself well-known online. By answering questions and publishing on Quora, Investopedia and other financial advisory forums, you can grow your online presence. Answer questions on investing on Facebook, Reddit and other public forums. Become your own brand ambassador.

Tips for Financial Planners #2: Expand Your Social Media Followers

The second tip goes hand in hand with the first. Social media isn’t just for millennials and the president. Michael Kitches, David Waldrop and many others financial advisers have impressive websites and active social media presences.

If you answer questions on public forums and catch people’s attention, you need to hold their attention when they try to learn more. In addition to Facebook, consider profiles on Twitter and LinkedIn.

Clients and potential clients are going to look for you online. You want to be where they can find you.

Tips for Financial Planners #3: Use CRM Management to the Fullest

Used properly, customer relationship management software can streamline your business and free up more time for you to do what you do best, personally interact with your clients.

This software can not only store contact information but can ingratiate you to your clients. Use your CRM software to track your clients’ families and personal situations, from daughter Jenna’s soccer team results to son Jake’s robotics hobby.

Tips for Financial Planners #4: Integrate Technology Into Your Practice

Let technology do what it does best, so you can use your unique skills. Many financial advisers are now using robo-advisers to manage the client investments because the practice frees up more time for advising and counseling.

Additionally, automated appointment calendars and texting access give you the ability to be all things financial for your clients. Consider regular newsletter to clients to provide information and maintain client contact.

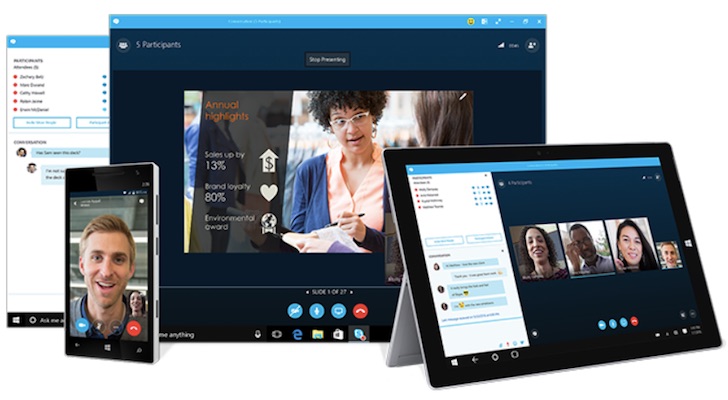

Make certain to offer high-quality video conferencing. Even your local clients might not want to drive over to your shop and may prefer to meet online. Additionally, you increase your reach by marketing yourself as a national adviser.

Tips for Financial Planners #5: Outsource What You Can

Anything you can farm out frees up your schedule for client acquisition and service. From blog writing to report generation, there are services that do it for you.

Consider your time golden and perform only the tasks that you’re uniquely qualified for. Outsource the rest.

Tips for Financial Planners #6: Join Peer Networks

Joining together with like-minded colleagues can give you a competitive edge. Whether it’s a LinkedIn or Facebook group or larger planning network, there are several advantages to these collaborations.

Or, put together your own group of advisers to trade ideas, support one another and refer when appropriate.

A CNBC article profiled a group of six financial advisers, located across the nation who banded together to form Zero Alpha Group. They described themselves as a study group for financial planners.

Tips for Financial Planners #7: Keep Your Fees Competitive

With the advent of technology, low fee robo-advisers and funds, financial advisory fees are getting squeezed. Be prepared to justify your fees, and make sure your justification is based on the value of your services. This requires knowing yourself, your business and what you bring to the table.

Fees aren’t the only differentiator, yet they definitely factor into a client’s decision to hire you or not. Therefore, you must be proactive with the fee conversation when engaging with clients.

The Bottom Line

In conclusion, it is vital to know what you bring to the financial planning table and communicate that to your clients. Streamline your back end and become a technology ninja. To be found, engage online with your peers and social networks. Don’t be afraid to copy what your successful peers are doing online. Differentiate and promote yourself to grow and maintain your clients.

Barbara A. Friedberg, MBA, MS is a veteran portfolio manager, expert investor, and former university finance instructor. She is editor/author of Personal Finance; An Encyclopedia of Modern Money Management and two additional money books. She is CEO of Robo-Advisor Pros.com, a robo-advisor review and information website. Additionally, Friedberg is publisher of the well-regarded investment website Barbara Friedberg Personal Finance.com. Follow her on twitter @barbfriedberg and @roboadvisorpros. As of this writing, she does not hold a position in any of the aforementioned securities.