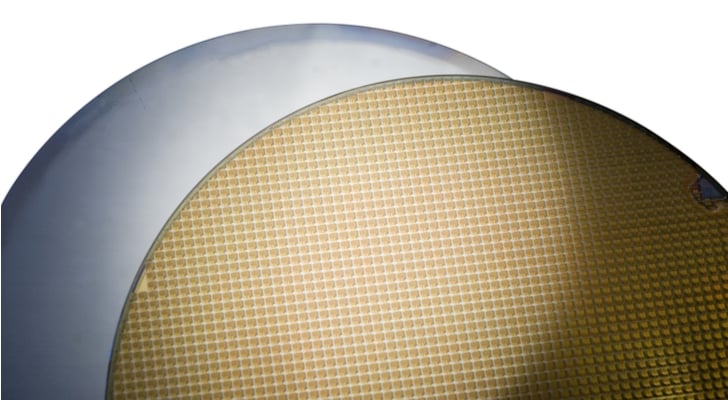

Lam Research Corporation (NASDAQ:LRCX) is in the semiconductor manufacturing business. But it’s not a chipmaker. It’s in an even better spot. It makes semiconductor manufacturing equipment. And almost every chip on the market today was built with its equipment.

As the Internet of Things (IoT), virtual and augmented reality, driverless cars and smartphones become more integrated into our daily lives, it’s fairly easy to say that the processing technology to make it all possible has reached a new level.

In the old days, semiconductor companies rose and fell on desktop and laptop buying trends. Companies would have money to spend and buy equipment for their employees. When times were tight, they would hold off on updates.

It was a cyclical business that followed the typical business cycle. It was just one more added input.

That is no longer the case.

The computing sector is constantly evolving and has its own business cycle at this point, and the trend is, it has a much longer tail than it did before. That means it’s a less boom and bust cycle; it’s more moderated because demand never completely dries up.

What’s more, there is a major shift from hard drive disk memory to flash memory. This is one of those transitions that happens once in a generation. It’s not in the usual business cycle.

It’s why companies like flash memory maker Micron Technology, Inc. (NASDAQ:MU

) are going like gangbusters right now. Chip makers are retooling, adding more flash memory equipment as they race to feed demand.

And LRCX is a key company they turn to. It’s also why LRCX stock is up 41% in the past 12 months.

I’m well aware that the bullish phrase ‘it’s different this time’ can be the kiss of death if uttered too often.

But there is a real structural change underneath the cyclical bull market in semiconductor stocks because the economy is recovering.

The shift toward mobility means devices need to be smaller, use less energy, be more robust and pack more performance in a smaller package. That’s what flash memory does.

And flash powers cloud computing, mobile, AR, VR and virtually all the “smart” devices that are around. This isn’t your typical trend. This is like the transition from personal computers and work stations to the internet. This is a fundamental shift in how computing technology is incorporated into our lives on every level.

So, yes, a 41% run is certainly a good showing. But this kind of growth still has years to run. And LRCX is doing smart things with its fresh success.

It’s doubling its dividend (that will put it around 1.8% at current valuations) and initiating a $2 billion stock buyback program. By taking some of the float out of the stock, that will help lower the volatility. And it shows that the company is shareholder friendly.

As of this writing, Gregg Early did not hold a position in any of the aforementioned securities.