Take-Two Interactive (NASDAQ:TTWO) is hardly the biggest or baddest gaming company out there, at least by market cap. But what TTWO stock lacks in monetary muscle, it makes up for in its brands.

Its Rockstar Games label publishes some of the most successful game brands in the industry, including Grand Theft Auto, Red Dead Redemption, Max Payne and Manhunt.

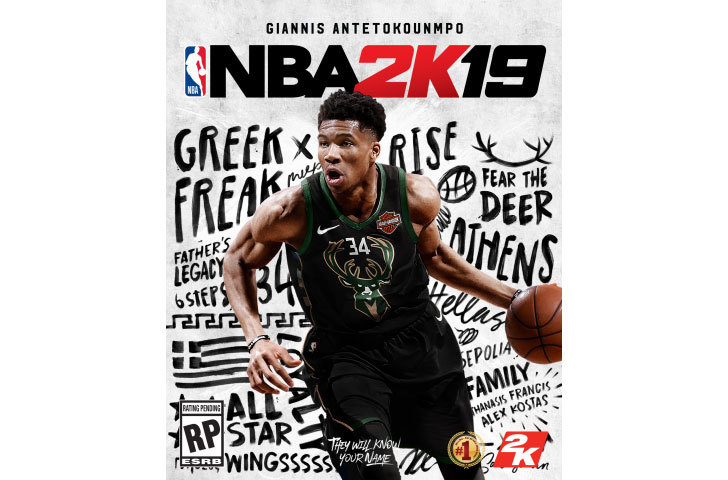

Its 2k Games label has a stable of best sellers like NBA 2k, WWE 2k, Bioshock and Borderlands

as well as others. NBA 2k is the top-rated and top-selling basketball game in the segment.

Unlike some of the bigger gaming firms, TTWO isn’t looking to become a giant publisher. It is certainly interested in growing its empire, but it has and will continue to do it on its own terms.

The Strength of TTWO Stock

You see, TTWO stock is run by Strauss Zelnick, who became Chairman in March 2007 and took over as CEO in 2011. Previous to taking the helm at TTWO, Zelnick ran BMG Entertainment, a major music and entertainment company, as well as 20th Century Fox where he managed the worldwide movie business.

I bring up his past because Zelnick comes from an entertainment background, not a computer background. And this is what he brings to TTWO that’s unique. Zelnick is very interested in building quality experiences in the games they put out.

The visuals, the music, it’s all about quality. And if a game isn’t perfect, he will postpone delivery. In this industry, pushing launch dates can be suicidal. Gamers and analysts wait with great expectation for big releases and build this into the revenue numbers.

A delay could cost a lot more than the millions in revenue the game will make.

But analysts have come to understand that TTWO operates in this fashion and that it makes it work. For example, its huge hit Red Dead Redemption II was supposed to launch in Spring 2018, but the release date was pushed to late October (Q2 in FY2019 for TTWO).

But these hitches in launches don’t punish the stock significantly, since many have come to expect. And up to now, everyone is very happy with the new versions once they’re released.

In September TTWO launched NBA 2k19, and in October WWE 2k19 should be out as well. Q2 for TTWO should be very big, especially with the holidays approaching fast.

Its Q1 numbers were released in early August and they show that TTWO continues to take full advantage of all the biggest trends happening in gaming, including moving to online gaming and their recurring revenue streams.

In its recent numbers you can see where net revenue was down year over year due to late launches for new game versions, but recurring revenue was up 50%. Digitally driven net revenue was up nearly 40% compared to the same quarter last year.

That also means margins are improving since selling games online cuts out all that distribution and manufacturing.

Louis Navellier is a renowned growth investor. He is the editor of four investing newsletters: Growth Investor, Breakthrough Stocks, Accelerated Profits and Platinum Growth. His most popular service, Growth Investor, has a track record of beating the market 3:1 over the last 14 years. He uses a combination of quantitative and fundamental analysis to identify market-beating stocks. Mr. Navellier has made his proven formula accessible to investors via his free, online stock rating tool, PortfolioGrader.com. Louis Navellier may hold some of the aforementioned securities in one or more of his newsletters.