Vinco Venturers (NASDAQ:BBIG) made some big moves in aftermarket trading on Thursday. BBIG stock rose more than 30%, which extended into Friday’s trading session. Investors may be tempted to buy shares as a momentum play.

Vinco Ventures is a diversified holding company that’s increasingly focused on digital media and content technologies. BBIG stock’s latest rally is linked to an announcement regarding the spinoff of Cryptyde Inc., its cryptocurrency-powered business.

Investors holding Vinco’s shares will receive one Cryptyde share for every 10 BBIG shares they hold as of May 18. Cryptyde stock will trade separately on the Nasdaq under the ticker TYDE following the spinoff.

On one hand, the bullish signal on BBIG stock is that Vinco has further simplified its business profile. The company will focus on expanding its growing social media business. It has removed the extreme volatility associated with crypto ventures. On the other hand, the company is giving away a potential future growth opportunity.

As a result, buying BBIG stock today makes investors eligible to own a freshly-listed Cryptyde venture. The new company could have a bright future if it manages to amass retail crypto mining customers, monetize its music streaming platform and bring its metaverse platform to life.

BBIG stock investors may view Cryptyde stock as a valuable dividend that buys them a metaverse play — a new speculative asset that traders may fall in love with.

That said, I’m not convinced that Vinco Ventures is a good stock to buy for long-term-oriented investors. Despite its uninteresting loss-making and cash-burning operations, I find the BBIG stock investment thesis as fickle as the share price.

The company’s vision isn’t clear. Management historically embraced too many unrelated business models. It could shift its vision again if anything flashy comes along.

In fact, BBIG has gone through several name changes in the recent past. Initially named Idea Lab X Products upon incorporation in July 2017, the company was renamed Xspand Products Lab before changing to Edison Nation in 2018. It finally adopted its merger subsidiary’s name, Vinco Ventures, in a 2020 merger.

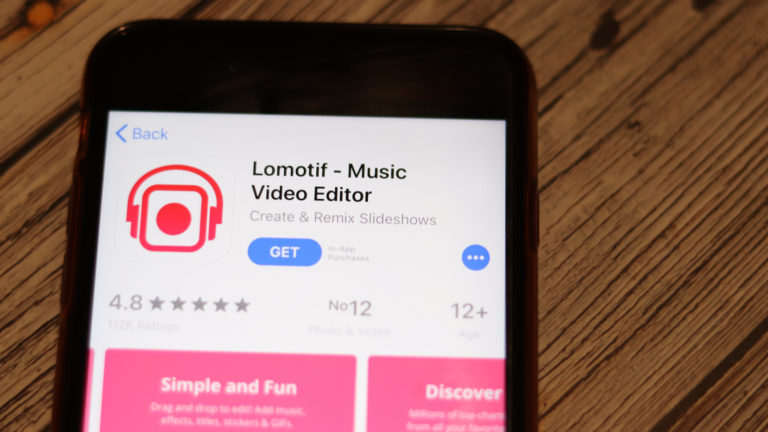

Come 2021, the company shifted from being a personal protective equipment (PPE) vendor to a custom packaging products manufacturer. It’s pivoting to digital media and content marketing following a joint venture with ZASH Global to acquire an 80% stake in a video sharing social network Lomotif.

Long-term-oriented investors may find Vinco Ventures’s business model too fickle, just like its stock price. The company keeps changing its value proposition to the investing community as the hype winds blow.

On the date of publication, Brian Paradza did not hold (either directly or indirectly) any positions in the securities mentioned in this article. The opinions expressed in this article are those of the writer, subject to the InvestorPlace.com Publishing Guidelines.