Vinco Ventures (NASDAQ:BBIG) will seek a reverse stock split and an increase to the authorized share count at its April 18 annual meeting. The agenda was described in a U.S. Securities and Exchange Commission (SEC) filing.

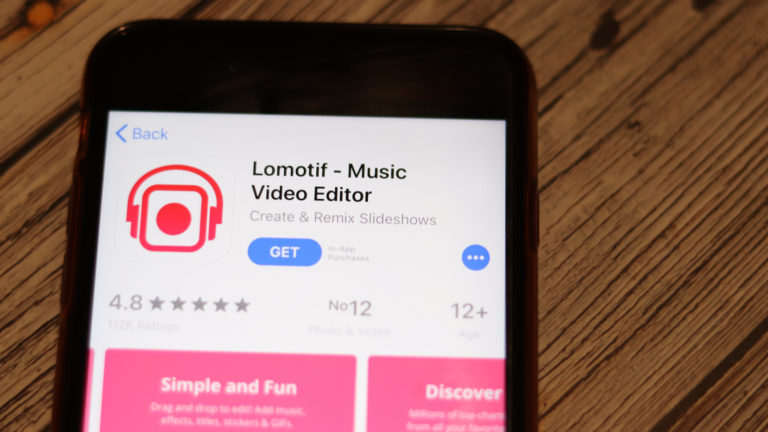

Vinco Ventures owns 80% of Lomotif, described as a competitor to China-based TikTok. A growing number of politicians want TikTok banned for potentially passing data to China. Vinco believes it stands to benefit. The company issued a press release supporting a ban.

BBIG stock opened for trading on March 10 at about 42 cents per share, representing a market capitalization of $107 million.

BBIG Stock: A Look Back

At one point in 2021, at the height of the crypto currency craze, BBIG stock traded at $7 per share.

I was never a fan. Ted Farnsworth, a former chairman of Moviepass, acquired a majority stake that year and brought Lomotif to the company. Before that, BBIG was in the non-fungible token (NFT) business. Farnsworth spun out the crypto business under the name Cryptyde (NASDAQ:TYDE), which is now worth about $10 million.

I called Farnsworth a hustler in November 2021

. I wasn’t the only InvestorPlace contributor who saw through him. But now the hype is back.

A successful meeting will let BBIG get its stock price over $1 per share, a value last seen in August. It will also let management issue more common and preferred shares, with $38 million in new stock funding its part in a joint venture to buy the National Enquirer and associated newspapers.

The partner in the Enquirer venture is called a360 Media. It’s a successor company of the previous owners. BBIG and a360 have signed a syndication agreement, which will link a360 content to the new venture — and to Lomotif.

What Happens Next?

Farnsworth has traded worthless crypto assets for troubled media assets. Anyone who wishes to gamble on the new combination is welcome to do so. I will not be joining you.

On the date of publication, Dana Blankenhorn held no positions in any companies mentioned in this article. The opinions expressed in this article are those of the writer, subject to the InvestorPlace.com Publishing Guidelines.