Align Technology (NASDAQ:ALGN) is certainly not in a sexy sector. But it’s making it sexier, just by its stock performance. ALGN stock has doubled in the last year.

In a way, ALGN is the Amazon.com (NASDAQ:AMZN) of orthodontics. That may sound a bit bizarre, but it’s true. Remember, AMZN’s humble beginnings were as an online bookseller. Now, it’s unlikely that ALGN’s ultimate goal is to move from its current niche into the world of cloud computing, entertainment and logistics … but that doesn’t mean it’s not doing some amazing things.

The Real Beauty of ALGN Stock’s Business

Align has become the dominant player in the next generation of orthodontic correction devices. In plain English, it has developed the next step in braces.

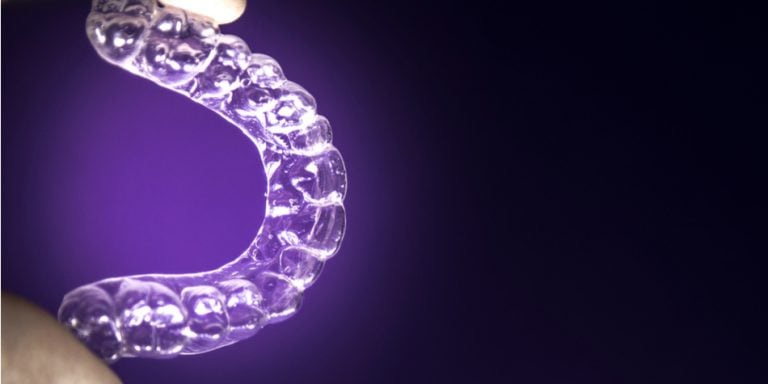

The company calls these new devices aligners rather than braces. They are clear mouth pieces that fit over your teeth and gradually straighten your teeth, just like the traditional metal ones have done for decades.

But there are significant differences just beyond the new material. And the new material — a clear molded plastic that is strong enough to move teeth, yet flexible enough to pop in and out, and not weigh a ton — is impressive in itself.

ALGN has changed the whole process so that even dentists can get in on the traditional orthodontic business.

Bear in mind that not everyone who needs orthodontic work can use an ALGN product, but a large number of patients

can. What’s more, many older people who had their teeth straightened when they were young but didn’t continue to use a retainer to keep their teeth aligned now are looking to get them straighter again.

Because the materials are less expensive, the overall costs are less expensive. That means the price is lower, so more people can access dental alignment.

Another big breakthrough in ALGN’s technology is its proprietary scanners to take intraoral measurements of a patient’s mouth rather than the traditional mouth casts.

This technology is what allows dentists to provide ALGN to their customers, since it does all the analysis.

Align Technology Keeps On Growing

The challenge with proprietary technologies like this are the fact that each part of ALGN’s model will come off patent at some point. The aligners’ proprietary mix, the scanners’ technology, etc.

The key for a company like this one, like it was for Amazon before it, is to grow fast and dominate the market. And ALGN has been very successful doing this.

It has the professionals — orthodontists and dentists. It has moved into brick-and-mortar stores where people can drop in and get fitted. It has even moved to DIY models where you take measurements at home, send them in and get a six-month supply of aligners.

The market in the U.S. is still getting tapped, and Align is already making big inroads in Europe and China as well. With that kind of market presence and plenty of scanner sales already in professionals’ offices, patent cliffs aren’t a big concern at the moment because ALGN stock is doing what it takes to remain a dominant player for many years to come.

Louis Navellier is a renowned growth investor. He is the editor of four investing newsletters: Growth Investor, Breakthrough Stocks, Accelerated Profits and Platinum Growth. His most popular service, Growth Investor, has a track record of beating the market 3:1 over the last 14 years. He uses a combination of quantitative and fundamental analysis to identify market-beating stocks. Mr. Navellier has made his proven formula accessible to investors via his free, online stock rating tool, PortfolioGrader.com. Louis Navellier may hold some of the aforementioned securities in one or more of his newsletters.