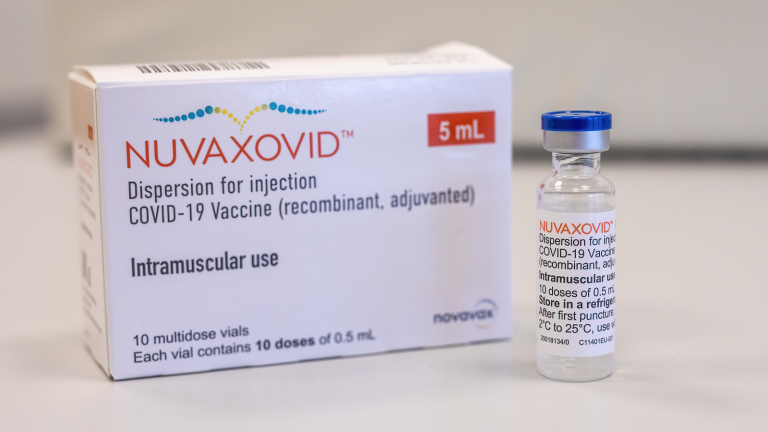

Like a fad that arrived and left, Covid-19 vaccine stocks are out of favor now. Novavax (NASDAQ:NVAX) is facing tremendous selling pressure compared to its peers. Unlike its competitors that received approval for its vaccines and sold them to global markets, Novavax barely started. NVAX stock is either a bargain of the century temping bottom-fishers to buy the dip. Alternatively, its slumping stock price may continue.

Biotechnology investors are well-acquainted with the rise and fall of stocks in this space. Novavax is underperforming because buying momentum is absent. Investors need to estimate how much revenue its vaccine will bring. The Food and Drug Administration’s (FDA) decision on a Covid-19 booster plan is a major game-changer for all vaccine makers. At the FDA’s Vaccines and Related Biological Products Advisory Committee (VRBPAC) meeting, members debated during the eight-hour meeting. They agreed that they need more data before drawing any conclusions. Members acknowledged the value of boosters in preventing hospitalization and death, but little beyond that.

The frequency of boosters remains unanswerable at this time. The committee could consider vaccination every eight weeks. Yet, if vaccines give only 80% protection, that is too high a frequency. And markets agreed.

Novavax shares would have rallied along with

Pfizer (NYSE:PFE) if governments offered boosters that often. The health community simply needs new data on the omicron variant and its subvariants. This strain is less lethal but spreads easily. The market does not currently have a vaccine that specifically targets this version of the virus. Furthermore, hospitals may decide to treat infected individuals and those at risk of mortality with an anti-viral. That would favor Pfizer, which has an anti-viral drug on the market.

Novavax is a high-risk Covid-19 vaccine play. Its failure to get approval for a vaccine during the first few waves may prove costly. Still, the VRBPAC may suggest an annual or bi-annual vaccination schedule. That might open the addressable market. Governments would diversify their vaccine inventory. They would order vaccines made by Novavax. That would end the downtrend in NVAX shares.

On the date of publication, Chris Lau did not have (either directly or indirectly) any positions in the securities mentioned in this article. The opinions expressed in this article are those of the writer, subject to the InvestorPlace.com Publishing Guidelines.