The world of nanotechnology relies on the mastery of the molecular scale. Thus, companies that thrive on the production of materials and chemical interactions at the atomic level could someday hold the keys to our economic future. Yet, many of these under-the-radar nanotech stocks don’t get much attention in the media, mostly due to a lack of landmark news

That’s odd when you consider that predictions for the global nanotechnology market say it could reach $332.73 billion by 2032. Moreover, nanotechnology has consistently broadened its range of applications in a variety of industries, now touching nearly every aspect of the global economy in some way or another.

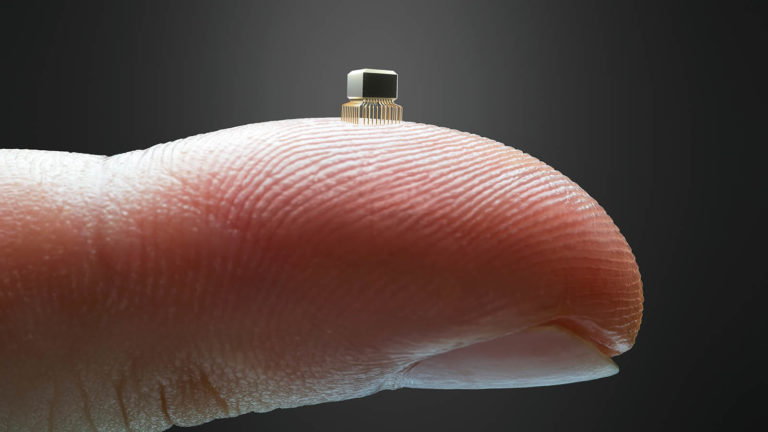

While the term “nanotechnology” might conjure images of microscopic robots, it’s more akin to inorganic chemical compounds that can target a specific system. Thus, these three companies fit the nanotechnology mold through their contributions to manufacturing and materials science.

Applied Materials (AMAT)

A prominent member of the materials engineering industry, Applied Materials (NASDAQ:AMAT) has maintained impressive performance over the last 12 months. Up 82% in the last year, the company has maintained steady growth without any notable price volatility. Yet, even with this growth, the stock is still considered undervalued and commands several strong buy ratings.

Even more exciting, AMAT’s Applied Global Services division reported its 18th straight quarter of year-over-year (YOY) revenue growth, with a record quarterly revenue to boot. With over 17,000 machines earning recurring revenues through maintenance fees, AMAT’s services model has been exceptionally successful. An even better indicator of its quality is its 90% contract renewal rate for said maintenance services.

Furthermore, the company successfully raised its earnings-per-share by over 5%, marking a healthy progression in investor returns. As a result of these metrics, AMAT represents one of the best investing opportunities among under-the-radar nanotech stocks.

Bruker (BRKR)

If you’re looking for success in the nanotech industry, where better to invest than in the company making the tools for molecular research? Bruker (NASDAQ:BRKR) has consistently ensured its innovative edge in the molecular instruments sector by diversifying into several industries. The company offers a wide array of molecular research tools, from its BIOSPIN products to its elemental analyzers.

This has enabled Bruker to become deeply integrated with the entire biochemical nanotechnology industry, as almost all facets of the sector rely on its machinery in some way. Furthermore, Bruker staunchly protects its intellectual property and engineering prowess through legal action.

An example of this is the May 7 ruling by the German Federal Patent Court which struck down patent assertions by one of Bruker’s main rivals, 10x Genomics (NYSE:TXG) This ruling further strengthens BRKR’s position in Germany and central Europe as a whole. Ultimately, BRKR’s broad addressable markets and effective strategic sales make it a buy.

PPG Industries (PPG)

A titan in the coatings industry, PPG Industries (NYSE:PPG) remains the world’s largest coating company by revenue. It has been actively involved in nanotechnology for years. Primarily its products contain nanoparticles developed from its own research and development.

Earnings-per-share rose 2% year-over-year in the first quarter, despite net sales falling 2%. However, this can be partly attributed to slowed European demand for PPG’s materials due to Easter season business closures.

Moreover, the company has seen success in the aerospace industry, as its materials and coatings are returning to pre-pandemic demand. Another big push for PPG will be in the form of strong demand from Mexico as the country’s economy gears up for large construction projects.

With around $150 million in share buybacks completed last quarter, PPG looks like a company that respects its fiduciary responsibilities and the shareholders it answers to. Thanks to this and its relatively stable business model, PPG’s status among under-the-radar nanotech stocks should not be underestimated.

On the date of publication, Viktor Zarev did not have (either directly or indirectly) any positions in the securities mentioned in this article. The opinions expressed in this article are those of the writer, subject to the InvestorPlace.com Publishing Guidelines.