Shipping stocks can be a high-risk area to invest. However, today’s market may provide investors with a great entry point. Not only is there potential for massive gains, but also for high dividend yields.

Even as interest rates hit new lows, many of these companies offer relatively high dividends.

Sounds temping right? Granted, there’s a reason why these shares trade for such high yields. InvestorPlace’s Vince Martin didn’t call the shipping space a “Bermuda Triangle” for nothing. Yet, the current environment may mean smooth sailing for the space.

I’m talking about the oil market’s “super contango” status. What’s contango? In short, the spread between current-month and future-month oil prices is at record highs. What’s causing this? Firstly, the oil price war between Russia and Saudi Arabia which put this in motion. Secondly, demand drops due to the novel coronavirus, which have helped sustain this imbalance.

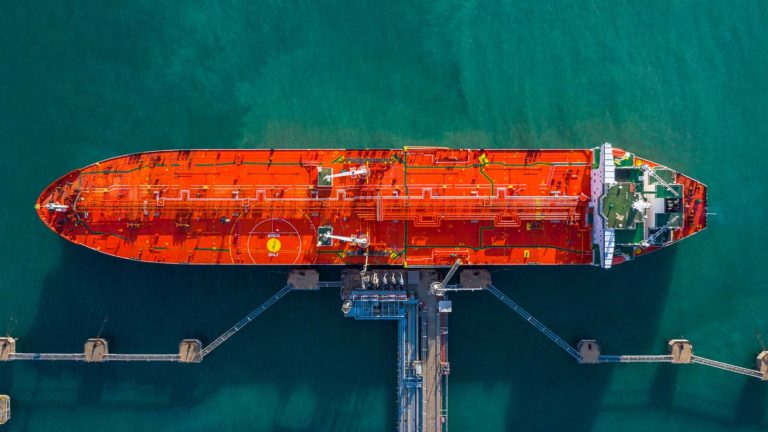

How does this benefit shipping stocks? Even with the supposed “end” to the oil price war, Brent crude (the type of oil transported via ship) continues to be in contango mode. This means you can buy Brent crude at today’s spot prices, then sell futures contracts, locking in a higher price. In the meantime, you store the oil via tanker until delivery is due.

As oil traders try to lock in guaranteed profits while contango lasts, shipping stocks stand to benefit, as charter rates skyrocket. Floating oil storage (aka tankers) is approaching its operating maximum.

Taking a look at major shipping stocks, these three stand out as high-dividend yielding names that could go higher thanks to oil price contango:

Let’s dive in, and see why these three names could be great buys in today’s market.

Shipping Stocks to Buy: Frontline (FRO)

Dividend Yield: 4.6%

Frontline is one of the largest publicly traded oil tanker companies. Based out of Bermuda, the company operates a fleet of 71 vessels. Yet, it’s not the size and scale of this company that matters. What matters is its ability to deliver high dividend payouts while leaving the door open for additional boosts in share price.

FRO stock currently sports a forward dividend yield of 4.6%. But, as the company has only recently reinstated its dividend, investors could see an even higher yield over the next year — especially if the current trend in charter prices continues.

Before suspending its dividend in 2017, the company was paying around 85 cents per share in dividends annually. In short, if contango continues, investors could see their dividends increase, as well as the company’s share price move higher, as income investors chase the higher yield.

One caveat: The contango play may already be played out in FRO stock. Shares have rebounded by more than 50% since their coronavirus-driven low of $6.09 per share in March. Shares now trade hands around $10.90 per share. Yet, given shares remain below their 52-week high of $13.33 per share, you can’t say additional runway is out of the question.

Nordic American Tankers (NAT)

Dividend Yield: 13.9%

In terms of dividend yield, NAT stock is a high-yielding name right now. Its forward yield currently stands at 13.9%. Yet, contango could still mean a windfall for the operator of Suezmax crude oil tankers.

As this Seeking Alpha contributor recently discussed, steep contango could mean significant near-term opportunity. And, as Nordic American CEO Herbjørn Hansson recently communicated to shareholders, the company’s dividend remains a high priority. In other words, the company could be hinting that investors should expect higher dividends, as the company’s fortunes benefit from the current tanker demand environment.

Granted, this remains a high-risk stock. Oil markets can turn on a dime. NAT stock is by no means a “dividend aristocrat.” But, with the company’s earnings set to rise in the near term, investors buying now could be seriously rewarded.

SFL Corporation (SFL)

Dividend Yield: 13.8%

Unlike the first two names mentioned above, SFL Corporation is a more diversified shipping stock. Only 11 of its 80 vessels are oil tankers. Yet, the company’s lessened dependence on oil price contango could make it a more solid dividend stock relative to pure-play tanker names.

SFL stock currently yields a staggering 13.8%! With such a high yield, it’s easy to be skeptical whether the company’s dividend is sustainable. Especially when you consider the novel coronavirus’ impact on the world economy.

Remarks from the latest earnings conference call provide little information regarding dividends going forward. SFL’s management stressed the high priority they place on the dividend. However, the company declined to provide forward guidance regarding future dividend payouts.

On the other hand, SFL stock has a strong dividend track record. The company has paid dividends 64 quarters in a row. However, dividend growth has been negative over the past few years.

In short, uncertainty may mean opportunity for investors entering the stock today. Shares have fallen from around $15 per share to around $10 per share since the start of the year. Shares have bounced back from coronavirus selloff lows. But, along with today’s high yield, there could be additional runway in the near term.

Thomas Niel, contributor to InvestorPlace, has written single-stock analysis for web-based publications since 2016. As of this writing, Thomas Niel did not hold a position in any of the aforementioned securities.