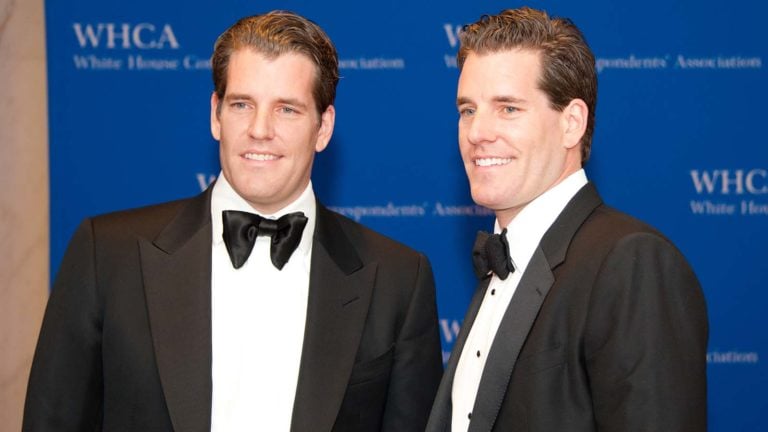

Cryptocurrencies like Bitcoin (CCC:BTC-USD) have gained a lot of traction in the investing community this year, but the Winklevoss twins have been loyalists to the digital currency since its inception.

As this Forbes article notes, “it (Bitcoin) sold for $8 in 2012 when the brothers began investing some $10 million in the digital currency.” This has helped the twins amass a collective net worth of $6 billion.

Tyler and Cameron Winklevoss are perhaps most well-known for their $65 million settlement with Facebook (NASDAQ:FB) founder Mark Zuckerberg. But the twins have since put their money to good use, becoming leaders of the new era of technological innovation. Their efforts to decentralize the digital marketplace and remove the gatekeepers have proven to be very successful.

The twins have investments across various crypto exchanges and NFT marketplaces but according to them, they’re just getting started. As more companies add Bitcoin to their balance sheet and digital art goes mainstream, there’s plenty of market share to be conquered.

Here’s a look at three crypto trends the Winklevoss twins are betting on right now:

- Bitcoin

- NFT Marketplace

- Gemini Crypto Exchange

Bet Like the Winklevoss Twins: Bitcoin (BTC-USD)

The Winklevoss twins’ biggest crypto bet was on Bitcoin. When the digital currency first hit the marketplace, it had its fair share of naysayers. But Tyler and Cameron Winklevoss blocked out the noise, investing more than $11 million in the currency.

Needless to say, their big bet paid a fortune. This year, Bitcoin soared to new highs, hitting a peak of $63,000 in April, a significant rise from its $7,000 price point over a year ago.

As work and school went digital, in light of the pandemic, so did currencies. Digital coins like Bitcoin gained major traction with many companies adding them to their balance sheet. Experts believe it will play a pivotal role in corporate cash in the coming years.

While the Winklevoss twins were by no means the pioneers behind Bitcoin, they were among the first to place their trust in the currency. According to Tyler and Cameron Winklevoss, this digital coin will be the best-performing asset of the decade.

NFT Marketplace

Another hot new venture the Winklevoss twins are backing is Nifty Gateway. The online platform allows users to buy and sell digital artwork, commonly referred to as NFTs.

Non-fungible tokens represent ownership of a digital asset. This ownership is tracked on a digital ledger called the blockchain. NFT’s have been around for a while but purchasing them was always a complicated task. Nifty Gateway, founded by Griffin and Duncan Cock Foster decentralize and simplify this process.

The company was eventually acquired by the Winklevoss twins, adding to their growing crypto empire. Given the remote nature of the world we live in, NFTs have become a pandemic phenom of sorts. Artists were able to commission their work at a hefty price. Mike Winkelmann, better known as Beeple, sold his artwork for a whopping $69 million on the platform.

Nifty Gateway also made NFT history this year as Christie’s hit the gavel on the sale of its first non-fungible token on the platform. As more businesses get in on NFTs, Nifty Gateway is poised for major upside. The company recently hit $250 million in sales and has an estimated net worth of up to $1.2 billion.

Gemini Crypto Exchange

Although the Winklevoss twins were invested in Bitcoin, they wanted to take a more personalized approach to trade the currency. The result of this was Gemini, a crypto exchange founded by the brothers in 2014. In addition to Bitcoin, the platform was the first of its kind to allow members to trade Ethereum (CCC:ETH-USD). Today, users can actively trade 20 currencies on Gemini. This includes an in-house Ethereum token, the Gemini Dollar, which is pegged to the U.S. dollar.

Gemini has experienced enviable growth rates in line with the bullish sentiments towards cryptocurrency in the last few years. The company now manages $25 billion in assets and saw the participation of individual investors nearly double this year.

To streamline itself alongside traditional financial institutions, Gemini recently introduced its “earn” feature. This allows users to store their cryptocurrency in interest-bearing accounts. According to the Winklevoss twins, interest rates offered can be as high as 7.4%.

Gemini is still smaller than peers like Coinbase but given the meteoric rise of cryptocurrencies the past year, the company has a long runway for growth.

On the date of publication, Divya Premkumar held a long position in BTC-USD. She did not hold (either directly or indirectly) any positions in the other securities mentioned in this article.

Divya Premkumar has a finance degree from the University of Houston, Texas. She is a financial writer and analyst who has written stories on various financial topics from investing to personal finance. Divya has been writing for Investor Place since 2020.