Vinco Ventures (NASDAQ:BBIG) finally produced its 2021 financial results on April 18. The problem is there is no way to value Lomotif, its main asset, and looks like BBIG stock is too expensive.

The company said that it now has $87.6 million in unrestricted cash on its balance sheet as of the end of the year. It also appears to have 150.11 million shares on its balance sheet. That means that the gross unrestricted cash is worth just 58.35 cents per share (i.e., $87.6m/$150.11m shs).

But the problem with this is that there are $70.1 million in current liabilities on the balance sheets, as well as $2.6 million in convertible notes. Even if we just subtracted the current liabilities, the net result will be $17.5 million in net cash on the balance sheet. That works out to a value of just 11.7 cents per share.

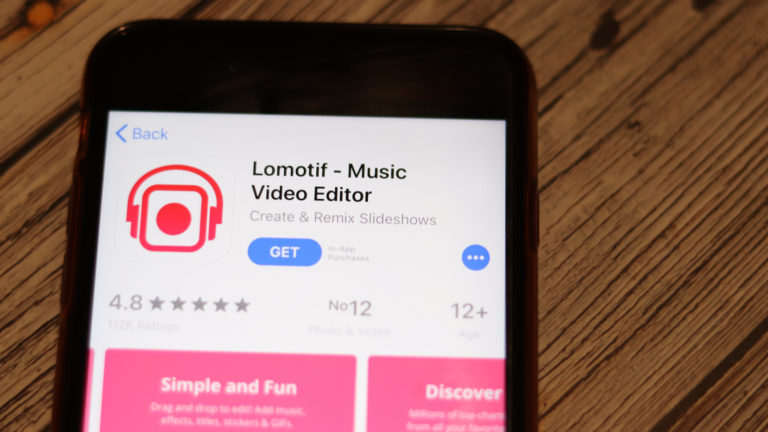

The problem is that BBIG stock trades for $2.40 per share as of April 20. The difference between these two valuations has to do with what Lomotif and Vinco Venture’s stake in the company could be worth.

Valuing BBIG Stock

So far the company is producing losses. In fact, last year it burnt through $43 million in operating cash flow losses in 2021. If this continues this year, it will eat through half of its cash balance.

I cannot figure out any way to value the company’s stake in Lomotif. Vinco Ventures talks about various events where Lomotif produced millions of views (and apparently ad revenue). But it has provided no guidance whatsoever about how much revenue the brand will produce for Vinco Ventures this year.

This makes BBIG stock a speculative investment at best since there is no reliable way to guess how much its stake in Lomotif and LomoTV is worth. As a result, most value investors may want to stay away from the stock, at least until there is some intelligent way to value the company.

On the date of publication, Mark Hake did not hold (either directly or indirectly) any positions in the securities mentioned in this article. The opinions expressed in this article are those of the writer, subject to the InvestorPlace.com Publishing Guidelines.