- Rio Tinto (RIO) stock is great for dividend collectors and value seekers alike.

- Moreover, the company’s financial performance should quell the concerns of anyone who’s hesitant to invest in mining companies.

- Investors should ride the bullish commodities wave and take a long position in Rio Tinto.

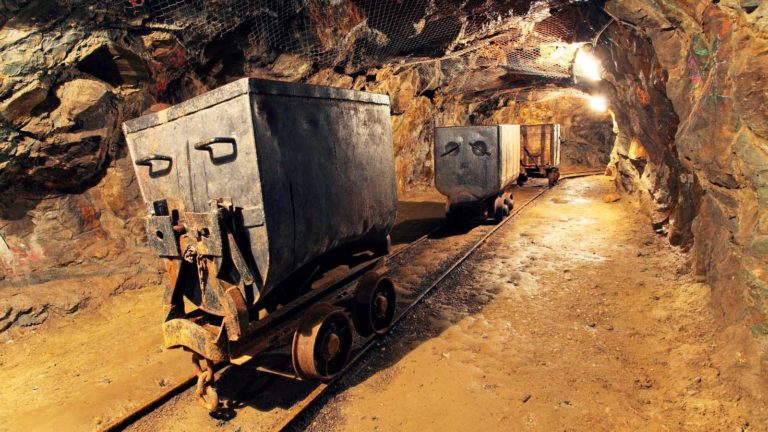

Australia’s Rio Tinto (NYSE:RIO) is a mining company with operations focused on gold, copper, nickel and iron ore. RIO stock has risks inherent to any mining-sector investment, but it is among the best picks in the natural resources category.

Unfortunately, mining stocks sometimes have a reputation for being extremely volatile and unstable. Truly, there’s no need to pigeonhole an entire segment of stocks as Rio Tinto is a financially solid business.

Besides, InvestorPlace contributor Joel Baglole put Rio Tinto on his short list of nickel mining stocks to buy as supply concerns mount. Baglole’s point is duly noted — and as we’ll see, Rio Tinto is also focused on a high-need commodity that could be a major revenue generator.

| RIO | Rio Tinto Group | $81.50 |

What’s Happening with RIO Stock?

RIO stock has traded as high as $95.97 within the past 12 months. It’s been frustratingly directionless, but there’s room to run and a breach of $100 should bring more buyers into the fold. The stock price is up 23.5% year to date, which compares to a 27.5% gain in the VanEck Steel ETF (NYSEARCA:SLX). The miner is the largest holding (13.6%) in the 26-stock exchange-traded fund’s portfolio, that also includes Cleveland-Cliffs (NYSE:CLF).

Does the stock deserve to trade in the triple digits, though? Consider this: Rio Tinto’s trailing 12-month price-to-earnings multiple is ridiculously low at 6.26.

Value hunters should, therefore, definitely have RIO stock in their crosshairs. Yet, there’s even more good news for prospective shareholders.

Amazingly, Rio Tinto pays out a forward annual dividend yield of 9.59%. Now, that’s what you’d call a company that values and rewards its shareholders.

So, RIO stock is trading at a compelling valuation and long-term investors can reinvest their dividend distributions. With that strategy, you can leverage the magic of compounding to build wealth over time.

Meanwhile, you’d be investing in a financially sound business. At year-end 2021 as compared to year-end 2020, Rio Tinto grew its net cash generated from operating activities by 60%; increased its net cash flow by 88%; ramped up its consolidated sales revenue by 42% and, astoundingly, improved its net earnings by 116%.

Cashing in on Commodities

Notably, those figures represent 2021 versus 2020. Just imagine how much better Rio Tinto can do in 2022, a year when supply shortages and geopolitical turmoil are making commodities scarce and expensive.

Baglole focused on Rio Tinto’s nickel asset holdings, which could yield strong revenue over time. As he pointed out, Rio Tinto owns a 75% stake in the Finnish Enonkoski nickel project and is involved in bringing the Minnesota-based Tamarack Nickel Project online.

As important as nickel is, though, investors should also consider Rio Tinto’s involvement with the lithium market. Lithium has multiple uses, but the one that traders frequently discuss is lithium’s use in electric vehicle batteries.

In this vein (pun fully intended), Rio Tinto’s crown jewel is the Jadar project in Serbia. It might take a while, but once the Jadar project is in full production, the mine is expected to produce roughly 58,000 metric tons of lithium carbonate per year.

On top of that, Rio Tinto just announced that it finalized the acquisition of the Rincon lithium project in Argentina. Reportedly, the company had previously agreed to purchase the project from Rincon Mining for $825 million.

Rio Tinto Chief Executive Jakob Stausholm touted the benefits of this potentially mineral-rich acquisition, saying, “Rincon strengthens our battery materials business and positions Rio Tinto to meet the double-digit growth in demand for lithium over the next decade, at a time when supply is constrained.”

What You Can Do Now

Sure, there’s risk involved in mining-sector investing. Yet, RIO stock is among the lowest-risk assets in the mining segment today.

You don’t have to miss out on the commodities boom in 2022. For exposure to a financially solid business with a focus on nickel, lithium and other high-need minerals, consider starting a small position in Rio Tinto today.

On the date of publication, David Moadel did not have (either directly or indirectly) any positions in the securities mentioned in this article. The opinions expressed in this article are those of the writer, subject to the InvestorPlace.com Publishing Guidelines.