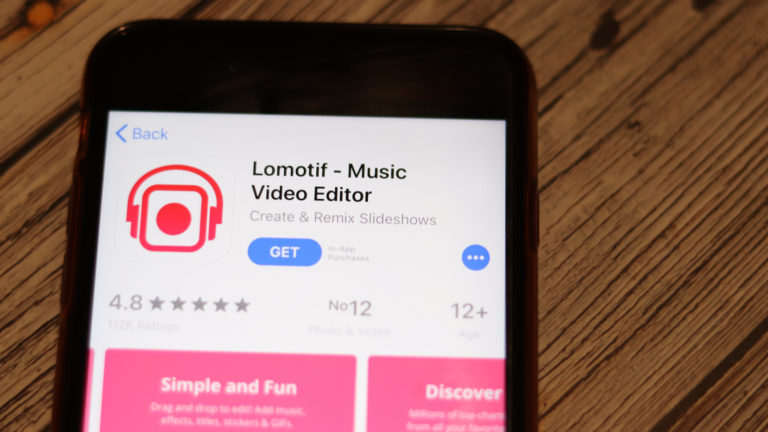

Shareholders of Vinco Ventures (NASDAQ:BBIG) are hoping that 2023 will turn out to be a better year than 2022. The acquisition of Lomotif, a rival to ByteDance’s TikTok, may help out towards that goal.

In December, Vinco announced it had purchased all of the ZVV equity interest of ZVV Media Partners, which included short video application Lomotif. Since its inception, the app has received over 225 million installations across 200 countries. A Vinco spokesperson added:

“Vinco Ventures leadership is extremely confident in its fast-tracked and collaborative mission to make the company a major player in the media and entertainment space. This is another step towards that goal and the company will continue to identify and pay close attention to brands that can complement and scale operations.”

Meanwhile, BBIG stock holders are looking forward to Jan. 30. That’s because Jan. 30 is the date on which Vinco previously stated it would file its delinquent Form 10-Qs for the quarters ended June 30 and Sept. 30. The company can choose to file the 10-Qs at any time before Jan. 30.

According to Yahoo! Finance, zero analysts provide coverage or financial estimates for BBIG. This isn’t surprising, as analysts often stay away from low priced stocks.

5 Investors Betting Big on BBIG Stock

Tracking institutional ownership is important, as these large investors provide liquidity and support for stocks. During Q3, 90 13F filers disclosed ownership of BBIG, an increase of two filers from the prior quarter. 16 institutional investors reported initiating a new stake, while 14 investors reported liquidating their entire position. Meanwhile, the institutional put/call ratio sits at 0.09, down from 0.19. That’s equivalent to 2.44 million puts and 26.12 million calls, implying a bullish options stance. With that in mind, let’s take a look at the largest shareholders of Vinco:

- BlackRock (NYSE:BLK): 13.97 million shares. BlackRock purchased 1.96 million shares during Q3.

- Vanguard: 9.05 million shares. Vanguard purchased 254,044 shares during Q3.

- State Street (NYSE:STT): 4.03 million shares. State Street purchased 898,913 shares during Q3.

- Geode Capital Management: 3.8 million shares. Geode purchased 876,034 shares during Q3.

- BHP Capital: 2.51 million shares. BHP purchased its entire stake during Q3.

It should also be noted Five Narrow Lane, formerly the largest shareholder of BBIG, recently reported selling a majority of its stake. As of Dec. 31, the fund owned 1 million shares, compared to 22.55 million shares during Q2.

On the date of publication, Eddie Pan did not hold (either directly or indirectly) any positions in the securities mentioned in this article. The opinions expressed in this article are those of the writer, subject to the InvestorPlace.com Publishing Guidelines.