Shares of Vinco Ventures (NASDAQ:BBIG) are up by more than 40% today. This comes despite the fact that the company received a delinquency letter from Nasdaq earlier this month. The letter warned that Vinco was in noncompliance with Nasdaq’s independent director, audit, and compensation committee requirements due to the resignation of Richard Levychin, Lisa King, and Brian Hart from the board of directors. Nasdaq requires a certain number of independent directors for certain committees.

The three directors resigned between June 27 and June 29. Vinco notes that “None of the resignations were as the result of any disagreement with the Registrant, its management, the Board or any committee of the Board, or with respect to any matter relating to the Registrant’s operations, policies or practices.”

What’s Going on With BBIG Stock?

Vinco and BBIG stock are no stranger to Nasdaq delinquency notices. Last November, the company received a notice for failing to file its quarterly 10-Q for the period ended Sept. 30 in a timely manner. In January, Vinco received another notice for failing to hold an annual meeting of shareholders within 12 months after the fiscal year end ended Dec. 31, 2021.

Flash forward to April of this year, and the company received yet another notice for failing to file a 10-K for the period ended Dec. 31, 2022. Since then, the company’s Securities and Exchange Commission (SEC) filings page shows that it has filed its 10-Q for both Q2 and Q3 of 2022. The page shows that Vinco’s last 10-K was filed for fiscal year 2021.

To make matters worse, Vinco decided to step back

from its acquisition of some of a360 Media’s assets in February. These assets included the U.S. and U.K. versions of the National Enquirer, the National Examiner and Globe. The company had previously set up VVIP Ventures, a joint venture with ICON Publishing, to acquire the assets. Vinco stated that the acquisition was no longer in its best interests, which resulted in the asset purchase agreement expiring.

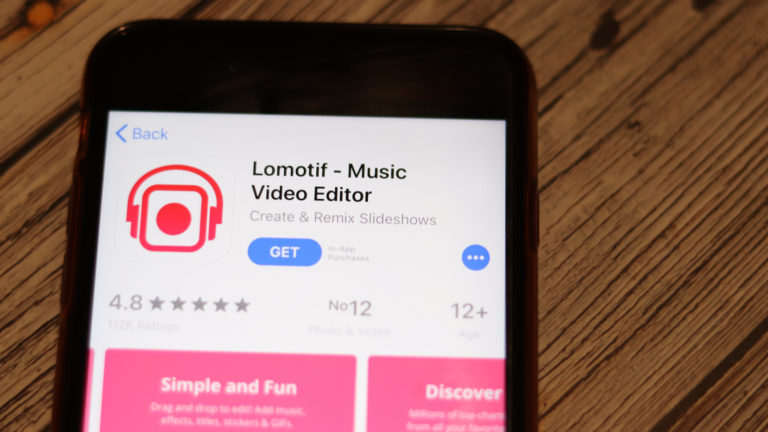

So, what’s next for Vinco? The company’s strategy of growing through acquisitions still seems to be in play. Shareholders have also latched onto Lomotif, Vinco’s TikTok competitor. However, Vinco was provided few progress updates on the application.

On the date of publication, Eddie Pan did not hold (either directly or indirectly) any positions in the securities mentioned in this article. The opinions expressed in this article are those of the writer, subject to the InvestorPlace.com Publishing Guidelines.