This article looks at several undervalued quantum computing stocks for investors to consider. Quantum computing is an innovative technology that utilizes the principles of quantum mechanics to tackle highly intricate problems beyond the capabilities of classical computers. With the availability of real quantum hardware, a concept envisioned only 30 years ago, hundreds of thousands of developers now have access.

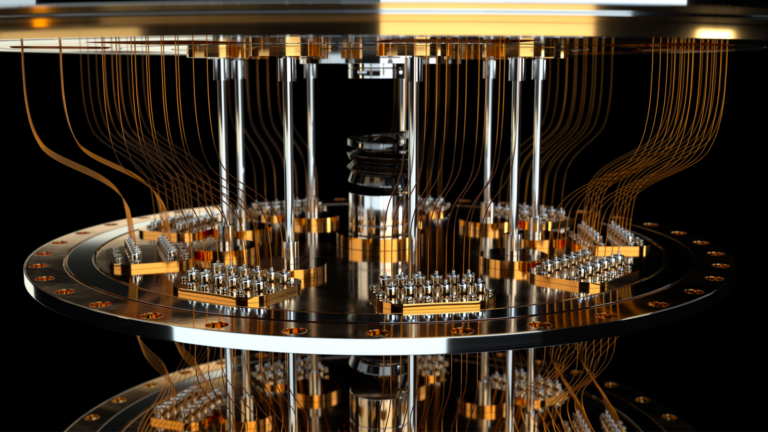

Engineers consistently release increasingly potent superconducting quantum processors, accompanied by pivotal advancements in software. This collective effort aims to achieve the speed and capacity required to revolutionize various industries.

In layman’s terms, quantum machines differ significantly from classical computers that have existed for over half a century, marking a transformative era in computational capabilities.

Supercomputers, comprising thousands of classical CPU and GPU cores, are the go-to for scientists and engineers facing complex challenges. However, their reliance on binary code and 20th-century transistor technology limits their effectiveness, especially for highly intricate problems involving numerous interacting variables.

Classical computers often falter when dealing with complexity, such as modeling atomic interactions or detecting subtle fraud patterns. Quantum computers, leveraging quantum physics principles, offer a promising alternative.

Operating with quantum bits (qubits) that exist in multiple states simultaneously, they present a potential solution to problems deemed unsolvable by classical computers. As the real world operates on quantum physics, quantum computing emerges as a revolutionary tool for tackling previously insurmountable tasks.

Quantum computers need to operate in an extremely cold operating environment, as low as -272°C, to prevent interference from thermal noise.

Let’s dive into the three most undervalued quantum computing stocks in January.

IonQ (IONQ)

IonQ (NYSE:IONQ) is a leading player in quantum computing, offering cutting-edge solutions. Utilizing trapped ions as qubits, IonQ stands out for its advanced quantum hardware. The company aims to deliver practical quantum computing power for various applications, ranging from optimization problems to complex simulations.

Last September, IonQ reported third-quarter results with $6.1 million in revenue, surpassing the upper end of its previously-communicated range. The outlook for 2023 full-year revenue and bookings has been raised once again.

The third quarter saw bookings of $26.3 million, bringing the year-to-date bookings to $58.4 million as of Q3. The company demonstrated robust growth in its commercial pipeline. It achieved a significant milestone with $100 million in cumulative bookings within the initial three years of its commercialization efforts, showcasing the strong demand for IonQ’s quantum computing solutions.

Shares are down about 24% over the last three months. IONQ has a market cap of $2.33 billion.

FormFactor (FORM)

FormFactor (NASDAQ:FORM) is one of the three undervalued quantum computing stocks, is a prominent semiconductor testing and measurement solutions provider. Specializing in advanced wafer probe cards, FORM facilitates the evaluation and testing of semiconductor devices during manufacturing. The company’s cutting-edge technologies contribute to developing high-performance electronic devices, including quantum computing products, across various industries.

Approximately 25% of FormFactor’s revenue falls under the “systems” category, encompassing machines utilizing probe cards. CEO Mike Slessor highlighted on an earnings call that these systems collaborate with fab customers, contributing to R&D efforts for advancing wafer and chip manufacturing techniques, particularly for materials like silicon carbide (SiC) and gallium nitride (GaN).

Notably, FormFactor’s “quantum cryogenics” systems, included in this unit, cater to the unique requirements of quantum computers, which operate in a closely monitored environment. FormFactor is vital in supporting companies developing quantum computers and chipmakers testing advanced chips and materials for extreme conditions.

For the third quarter of 2023, the company reported record systems segment revenue. Shares are up 16% over the past three months, with a market cap now at just over $3 billion.

IBM (IBM)

IBM (NASDAQ:IBM) said recently that it has developed hardware and software solutions reaching a groundbreaking point. This enables the execution of quantum circuits with 100 qubits and 3,000 gates, devoid of known answers. Accordingly, this marks a pivotal moment where quantum becomes a practical computational tool.

“I like to say users are using quantum computing to do quantum computing, and we are adding capabilities that open up quantum to an extended set of users that includes what we refer to as quantum computational scientists. We think this is proof enough that we’ve entered a new era,” the company said in a blog post.

IBM recently unveiled IBM Condor, a remarkable leap in quantum processing with a 1,121 superconducting qubit quantum processor. Built on cross-resonance gate technology, Condor achieves a 50% increase in qubit density, pushing the boundaries of chip design scalability and yield. Despite its significantly expanded scale, Condor’s performance remains comparable to its predecessor, the 433-qubit Osprey.

IBM stock is up about 20% over the past three months. However, its multi-year performance still lags other Big Tech stocks, leaving room for shares to re-rate higher on the company’s increasing exposure to next-gen technologies like quantum computing, AI, ML, etc.

On the date of publication, Shane Neagle did not hold (either directly or indirectly) any positions in the securities mentioned in this article. The opinions expressed in this article are those of the writer, subject to the InvestorPlace.com Publishing Guidelines.