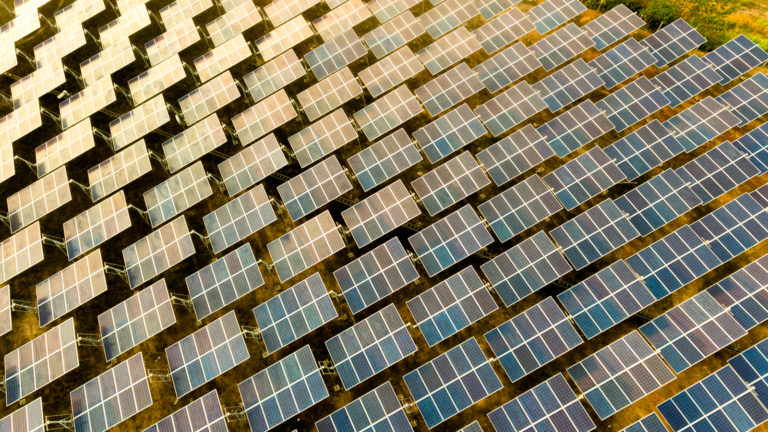

Solar stocks have been negatively impacted in the recent past due to macroeconomic headwinds. Further, industry competition has impacted margins, and there are overcapacity fears in countries like China. As a result, investor interest in the sector has declined. I, however, believe it’s the best time to consider exposure to the sector. There are several overlooked solar stocks to buy that trade at undervalued levels.

Once the near-term headwinds are navigated, the sector will create immense value. It’s worth noting that renewable energy capacity added to energy systems increased by 50% in 2023. Solar PV accounted for three-quarters of additions worldwide. Therefore, there are positives amidst the challenges.

I must add that “renewable energy power generation capacity needs to expand three-fold to 11,174 GW by the end of the decade to meet the 1.5 C Paris Agreement climate warming ceiling.” Of this, Solar PV capacity needs to hit at least 5,400 GW by 2030. If this target must be met, there are big impending investments.

Therefore, let’s talk about three overlooked solar stocks to buy for value creation.

First Solar (FSLR)

After a meaningful correction, First Solar (NASDAQ:FSLR) stock has remained sideways in the last six months. This seems like a good opportunity to accumulate before FSLR stock surges higher from undervalued levels. My view is underscored by the fact that the stock trades at an attractive forward price-earnings ratio of 12.4.

The first point to note is that as of Q4 2023, First Solar reported a backlog of 80.1 GW. During the year, the company reported a net booking of 28.3 GW. With potential booking opportunities of 66.5 GW, the company has clear revenue visibility.

It’s also worth noting that First Solar exited 2023 with a nameplate capacity of 16.6 GW. By the end of 2026, it expects to boost capacity to 25.2 GW. Of this, 14.1 GW will be in the United States. Therefore, the outlook is bright for the next few years for growth and capacity expansion.

Canadian Solar (CSIQ)

Canadian Solar (NASDAQ:CSIQ) stock has witnessed a deep correction of over 50% in the last 12 months. At a forward price-earnings ratio of 6.1, CSIQ stock looks deeply undervalued. A strong reversal rally seems to be on the cards, and I would not be surprised if the stock doubles in quick time.

By December 2024, Canadian Solar expects to have a solar module capacity of 61 GW. Further, the company’s battery energy storage capacity was 20 GWh as of December 2023. With a presence in over 20 countries, Canadian Solar will likely see steady growth in the coming years.

In terms of growth visibility, Canadian Solar has a 27 GW solar project pipeline. Additionally, the company has a total battery storage pipeline of 55 GWh. That provides clear revenue upside visibility.

For 2023, the company reported revenue of $7.6 billion. For the current year, revenue growth is likely at 18% year-on-year to $9 billion. Once there, EBITDA margin expands on a sustained basis and the stock will be due for re-rating.

Enphase Energy (ENPH)

Enphase Energy (NASDAQ:ENPH) is another overlooked solar stock to buy. After a meaningful correction in the first few quarters of 2023, ENPH stock has stabilized and remained sideways in the last six months. I expect the stock to trend higher from current levels on the back of positive business developments.

As an overview, Enphase is a supplier of microinverter-based solar-plus-storage systems. The company’s growth is backed by innovation, with Enphase having more than 400 granted patents globally. With a wide geographic presence, Enphase has shipped more than 73 million microinverters. Further, with a serviceable addressable market of $23 billion by 2025, I expect steady growth in the next few years.

An important point to note is that Enphase reported an operating cash flow of $696.8 million as of 2023. Further, as of December 2023, the company reported cash and equivalents of $1.7 billion. Therefore, there is ample flexibility to invest in product innovation. I must add that, with the growing EV industry, the company’s IQ EV Charger has the potential to support growth.

On the date of publication, Faisal Humayun did not hold (either directly or indirectly) any positions in the securities mentioned in this article. The opinions expressed in this article are those of the writer, subject to the InvestorPlace.com Publishing Guidelines.