Hello, Reader.

I have something special in store for you. Today, we’re joined by Thomas Yeung. If you’re one of my paid-up subscribers, you might recognize him from Fry’s Investment Report (members can log in here), where he helps me keep readers updated on the recommendations in our model portfolio each week. He’s also a regular writer at InvestorPlace.com – our free news and analysis website – the former editor of Tom Yeung’s Profit & Protection, and a former Wall Streeter.

Starting today, he’s also joining me here at Smart Money to keep you updated about markets, investing… and everything in between.

Not to worry – I’m not going anywhere. You’ll continue to get your regularly scheduled Smart Money e-letters from me.

With that, take it away, Tom…

Regards,

Eric Fry

In January, a couple of amateur thieves dismantled a 500-foot radio tower in southeastern Oklahoma.

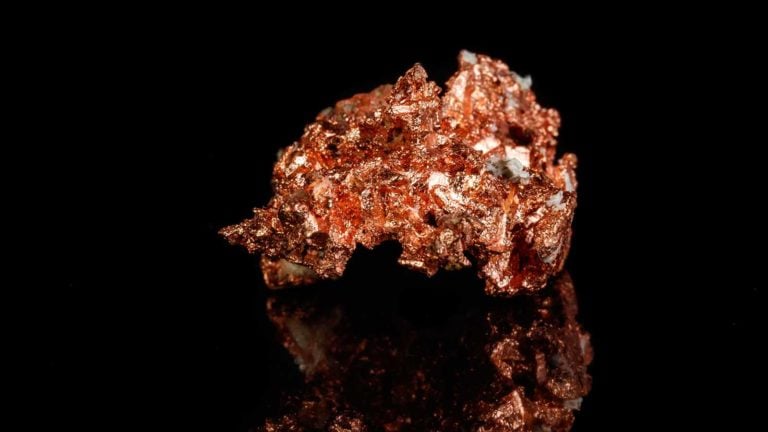

Their goal? To steal the copper wiring in the structure.

The bandits only made off with several dozen pounds of the metal… but copper has become so in-demand that even fixed structures are no longer safe. According to the U.S. Department of Energy, copper theft now costs businesses more than $1 billion a year.

While that’s bad for people (and radio towers) victimized by theft, the rise in demand for copper and other metals been great for commodity stocks, including some of the companies I cover for Eric in my weekly Fry’s Investment Report updates.

In fact, Freeport-McMoRan Inc. (FCX) – the globe’s top copper-producing company – has risen 320% since Eric added it to his portfolio in 2020, thanks to rising copper prices.

Of course, Freeport-McMoRan isn’t the only miner that wants a piece of the copper action.

So, in today’s Smart Money, let’s take a look at why it’s been so difficult for competitors to cash in on this metals boom…

And at how investors can cash in…

Copper Shortages = Investor Profits

Freeport’s most recent jump of about 5% earlier this month came after copper prices hit an all-time record on a short squeeze.

“Investors, traders and mining executives have warned for years that the world faced a critical shortfall of copper amid ballooning demand in green industries,” according to a Bloomberg analysis, “and the short squeeze on the Comex exchange in New York drove prices” to a record high.

This unusual “squeeze” – I go into more detail about what makes it so odd in my latest Fry’s Investment Report weekly update – tells us that there’s both immediate and long-term shortages of the red metal. The “squeeze” we saw last week wasn’t just traders attempting to close out their near-term positions on physical delivery issues… but they were also buying back copper years into the future.

This fact now has analysts revising up their long-term copper price estimates. On Monday, UBS upped its forecast for this year’s copper deficit from an earlier estimate of 73,000 tons to a stunning 390,000 tons. And next year’s deficit will be larger. They believe LME copper prices will reach $11,500 per metric ton by year-end and $12,000 by mid-2025 (up from around $10,500 today).

Essentially, the world is producing far too little copper to supply the insatiable needs of electric vehicles and artificial intelligence. Each EV requires 83 kilograms of copper, almost four times what a typical gas-powered car needs. The rise of AI is also boosting demand, because data centers use enormous amounts of copper for power and cooling systems. Even moderately sized data centers can require several thousand tons of the metal.

As a result, analysts now expect Freeport to generate $1.58 earnings per share this fiscal year and $2.19 in 2025 – a 19% compound growth rate. That should give significant further upside to Fry’s Investment Report’s remaining 1/3 position.

All this makes copper a very attractive business to be in – for mining companies, investors, and thieves alike.

But it turns out even multibillion-dollar companies are struggling to compete against Freeport and cash in on this trend. Last week gave us a perfect example…

Another Deal Bites the Dust

BHP Group Ltd. (BHP), an Australia-based mining company and the world’s No. 2 copper producer, dropped its attempts this week to buy out rival Anglo American plc (NGLOY), a U.K.-based diversified miner with large copper exposure (it’s the No. 4 producer). Anglo’s management had rebuffed previous attempts at a takeover, and BHP appears to have had enough of the rising price tag.

Bloomberg analysts explained the rationale of this deal…

The proposal by the world’s biggest miner to spin off two units and then buy the remainder of Anglo would create a global copper behemoth, heralding the industry’s return to mega-deals after more than a decade. Anglo has already rejected two non-binding offers from BHP — the last worth $43 billion — and unveiled its own plans for a radical restructuring.

If this all sounds terribly complicated, that’s because it is. Anglo American has spent the better part of the decade diversifying into everything from iron to diamonds to escape its dependence on the Chinese construction industry. BHP’s approach pretty much undoes these efforts, and Anglo’s response (i.e., breaking itself up) will do the same thing.

Squint hard enough, and this proposal looked entirely reasonable. Copper prices are at all-time highs, so surely creating a copper behemoth could be a good idea. As mergers and acquisitions (M&A) experts have long known, combining two lucrative businesses usually creates an even more lucrative business. Getting rid of Anglo’s non-copper business seems logical in today’s market.

The problem, of course, is that platinum and diamonds – two of Anglo’s businesses on the chopping block – were always meant as diversification plays. And prices of these precious materials are “zigging” just as copper is “zagging.” We’re in the middle of a cyclical downturn for both of those non-copper assets at the moment. In fact, Anglo’s 85% stake in DeBeers (purchased in 2011) was meant to ride Chinese diamond demand once its citizens were done buying houses and moving onto jewelry.

Selling these businesses also cancels out the enormous opportunity costs (not to mention the financial ones) Anglo American spent on these ventures. Every dollar spent on acquisitions usually means one less dollar available for expanding existing mines to lower unit costs.

Mining a Deal

These complex M&A deals have long haunted the mining industry. During 2005-2012, a series of ill-advised mining mergers happened just as prices of coal, steel, and – you guessed it – copper rose to new records on Chinese construction demand. Glencore plc (GLNCY) snapped up Xtrata… BHP attempted to buy Rio Tinto Ltd. (RTNTF)… even Caterpillar Inc. (CAT) got caught up in the frenzy, making a big offer for ERA, a Chinese coal mining equipment maker.

Most of these mergers tend to do poorly. Glencore ended up losing 85% of its market value by 2016… BHP spent a decade paying off debt… and Caterpillar’s board was sued by shareholders for ignoring glaring “red flags” that ended up with some lovely goodwill impairment. It was enough to put the mining industry into sleep mode for over a decade.

Even deals that seemed logical at the time generally leave acquirers with 1) businesses they don’t know how to run and 2) less cash flows to reinvest into those they do. Anglo American, for instance, was recently forced to write off $1.6 billion of DeBeers’ value (it turns out maintaining a diamond “cartel” is harder than it looks). Meanwhile, its average cost of copper production sits at $1.83 per pound (or $2.32 after adding in total costs)

Freeport itself has gone a different route. The company has driven its cash costs down by reinvesting in its most productive mines, particularly its Indonesian Grasberg site… while ignoring the siren call of M&A sales pitches. Its average unit costs sit at just $1.51, making it an attractive long-term play.

While on the topic of mining, copper isn’t the only commodity fueling the EV industry…

A remarkable trillion-dollar lithium discovery was made in a deserted area of Nevada.

And there’s still time to capitalize on soaring demand for this resource that’s absolutely critical for our economic future and national security.

Click here to get the full story.

See you back here next week…

Regards,

Thomas Yeung, CFA

Markets Analyst, InvestorPlace.com