Hello, Reader.

If the global energy industry were an Oscar-winning motion picture, it would be Everything Everywhere All at Once.

This 2022 Best Picture winner explores the concept of the “multiverse”, the idea that essentially anything – or everything – is happening in a parallel timeframe, across different universes.

The energy sector, likewise, is experiencing an “all at once” moment.

Because of the relentless global imperative to “transition” toward renewable energy sources, trillions of investment dollars are pouring into technologies like solar, wind, hydrogen, and energy storage.

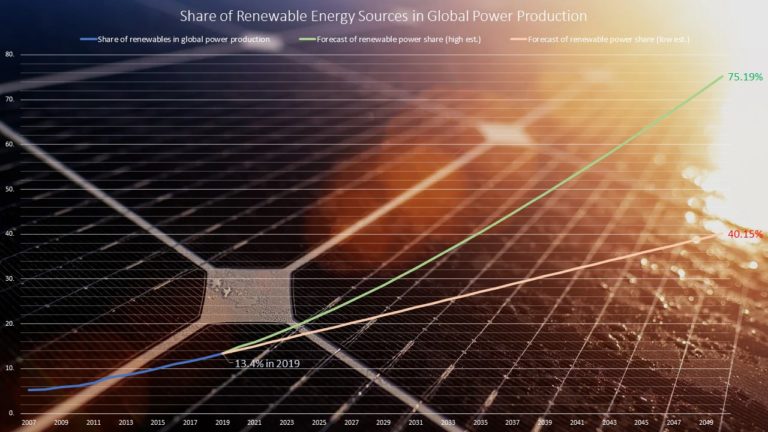

But all renewable sources, combined, still provide less than 20% of the world’s energy needs, and so massive investment continues to pour into “old energy” industries like oil & gas production.

In effect, the world is simultaneously constructing and maintaining two different energy systems – a new, renewable one, and an old, fossil-fuel-based one.

In other words… Energy Everywhere All at Once.

This massive, global endeavor is so complex and costly that Will Thomson, founder of Massif Capital, describes it as “the single largest, most far-reaching industrial activity ever proposed. It [makes] the economic ramp-up in the United States at the beginning of World War II look like a minor event.”

So, massive, trillion-dollar investments continue to flow into all forms of energy generation and storage – both renewables and fossil fuels. Therefore, we investors do not need to “choose sides.” We can invest opportunistically in both renewables and fossil fuels.

To borrow from a memorable episode of Seinfeld, we can invest in “this and that.” Both “sides” of the energy transition are offering compelling investment opportunities, albeit for entirely different reasons.

So, I’d like to use today’s Smart Money to dive deeper into the renewable energy sector and the opportunities within it. We’ll take a closer look at the pockets in the sector that are doing well, and then I’ll share a renewable energy stock that possesses significant rebound potential.

Let’s dive in…

Renewing the Renewable Sector

As the alter-ego to oil & gas stocks, the renewable energy sector has been a graveyard for capital during the last three years. Most stocks in the sector have utterly collapsed since late 2021.

Back then, clean energy companies were flying high. They had become stock market darlings because investors expected them to quickly capture large market shares and produce robust profitability. But that did not happen. Instead, their profit growth trajectories sputtered, along with their share prices.

For example, the shares of solar component leader, Enphase Energy Inc. (ENPH), soared 1,300% from late 2019 to late 2021. But since then, they have tumbled 55%. I mentioned in the February edition of Fry’s Investment Report that all the leading “green Energy” ETFs have shed about two-thirds of their value since late 2021.

To judge from these grim share-price trajectories, one might assume that renewable energy deployments around the globe are also falling. But that’s not the case.

Last year, global solar photovoltaic (PV) deployments skyrocketed 85% year-over-year to a record-high 420 gigawatts (GW) of capacity. Combined with 2022’s deployment of 228GW and 2021’s 168GW, the world installed 816GW of solar capacity during the last three years – or more than double the entire capacity the world had installed before 2020.

A doubling of global solar capacity in three years does not look like a slowdown. Other pockets of the renewable energy sector, like green hydrogen and energy storage, are growing even faster than solar, albeit from a much smaller base. Nevertheless, the renewable energy sector in the stock market has become toxic… at least for the moment.

A rapid turnaround is unlikely, but a gradual turnaround is a good bet. Renewable energy stocks have suffered such relentless selling pressure for the last three years, that they reflect only doom and gloom, and close-to-zero upside potential.

Therefore, many stocks in the sector could soar, as they begin to convert their profit potential into genuine profit growth.

Disconnect Spells Opportunity

To some extent, the renewable energy industry is still advancing through its “training wheels” phase. Solar, wind, hydrogen, and energy storage have not yet achieved fossil-fuel-level energy return on investment (EROI), but these technologies are moving in that direction. Thanks to technological advances, they are becoming increasingly efficient year-by-year, and therefore increasingly competitive with fossil fuels.

At some point, the training wheels will come off and the lines between renewable energy and “old energy” will vanish. We will simply have energy – a plurality of energy technologies that can serve a variety of specific end uses.

As this massive “group project” proceeds, it will spawn innumerable investment opportunities. No other industry on the planet is attracting nearly $3 trillion per year in investment dollars. That’s an enormous sum.

Ironically, the exact industries that are attracting this investment tsunami are the same ones that are noticeably unpopular with stock market investors. That disconnect spells opportunity.

Currently, few renewable positions in Fry’s Investment Report possess significant rebound potential. As such, they are speculative buys.

To be clear, the opportunities in the renewable energy sector are not automatic. But you can, and should, invest selectively in the sector.

With that in mind, here’s a speculative renewable energy stock I like right now…

Plug Into Profits With Plug Power

Plug Power Inc. (PLUG) is a company that is attempting to become the leading U.S. provider of comprehensive hydrogen fuel cell turnkey solutions. It operates in every major facet of the “hydrogen economy,” including building the largest green hydrogen production network in the U.S.

Thanks to the company’s comprehensive offerings, it has struck several major deals with high-profile customers like Amazon.com Inc. (AMZN) and Walmart Inc. (WMT).

Plug Power has been around for more than two decades and has never turned a profit. But I believe a major turning point has arrived that could flip Plug’s chronic losses to strong profit growth.

Plug Power is far from the only renewable energy stock I like right now. In fact, last Friday, I recommended a new energy company in the April edition of Fry’s Investment Report. It is the ninth-largest energy company in the world, and, more importantly, it is enormously profitable. It is also debt-free and has been able to boost its dividend payouts and ramp up its stock-repurchase program.

The bottom line: This stock is an outstanding buy.

Click here and become a member of Fry’s Investment Report today to get access to my select renewable energy recommendations.

And keep an eye on your inbox for tomorrow’s Smart Money. In this issue, I’ll cover the oil & gas sector and the opportunities I see there.

(Already a Fry’s Investment Report subscriber? Click here to log in to our members-only website now.)

Regards,

Eric Fry