Hello, Reader.

Amidst the buzz and bright lights of the stock market’s obsession with artificial intelligence, many investors overlook a crucial factor…

The energy sector plays a pivotal role in powering this digital revolution.

And the actions of tech giant Alphabet Inc. (GOOGL) showcase this interplay.

The tech giant is investing billions of dollars to build new data centers, which are critical for AI training and development. As noted in a recent environmental report, the company’s AI-driven success accompanied a 17% increase in total data center electricity consumption in 2023. Furthermore, Alphabet’s carbon emissions rose 13% since last year and surged 50% since 2019.

That’s just one (admittedly very large) company.

The spike in electricity demand due to AI will only continue to increase, especially as tech giants like Google pour their resources into creating newer and bigger data centers.

So, in today’s Smart Money, let’s dig into how this energy consumption is good news for both renewables and gas producers… and their investors.

A Natural Alliance

Last year, global investment in all forms of energy hit a record-high $2.8 trillion, according to the International Energy Agency (IEA). Of that total, fossil fuel investments accounted for about $1 trillion, while renewable energy investments accounted for the remaining $1.8 trillion.

Even though oil and gas investment trailed behind renewables, it is not going away. In fact, Alphabet’s recent carbon emissions numbers underscore the persistent and growing role of fossil fuels in powering our digital future.

By 2030, overall electricity demand is projected to surge up to 20%. AI data centers alone are expected to consume an additional 323 terawatt hours of electricity demand; that’s seven times greater than New York City’s 48 terawatt hours of electricity demand.

This massive uptick is likely going to ignite a natural gas boom.

Wells Fargo projects a seismic shift in gas consumption driven by AI’s significant energy needs. By 2030, daily gas demand could surge by a staggering 10 billion cubic feet (bcf). To put this in perspective, that would represent a 28% jump from the current 35 bcf/day used for U.S. electricity generation. This would boost the nation’s total gas consumption by 10%, pushing it well beyond the current 100 bcf/day mark.

Additionally, according to the newest Global Energy Perspective by the McKinsey & Co. research group, global natural gas demand is all-but-certain to grow for the next 15 years, and perhaps for as long as the next 30 years. Crude oil demand is also on track to continue growing for at least a decade.

A Sustainable Solution

Natural gas isn’t the only side of the energy sector getting a boost from AI demand.

According to a Goldman Sachs report released in April, the surge in demand from AI and data centers will be met by a mix of energy sources. While natural gas is expected to fulfill 60% of this increased demand, renewables would cover the remaining 40%.

However, analysts do warn that getting renewables up and running pretty much immediately faces hurdles. Wells Fargo analyst Roger Reed highlighted a key challenge: the time-consuming process of constructing power lines to transport green energy to data centers.

This infrastructure lag means that while renewables are part of the long-term solution for energy demand, they can’t single-handedly meet the surging demand in the short term.

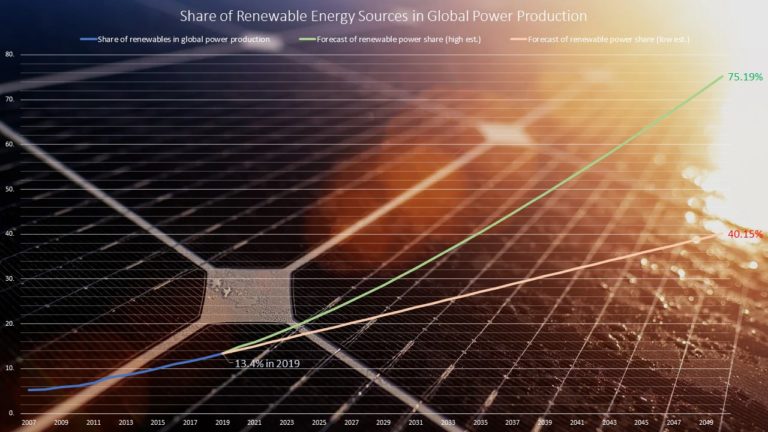

However, the outlook remains a positive one for renewables. Judging from the grim share-price trajectories of “green” stocks, one might assume that renewable energy deployments around the globe are falling. But that’s not the case.

Last year, global solar photovoltaic deployments skyrocketed 85% year-over-year to a record-high 420 gigawatts (GW) of capacity. Combined with 2022’s deployment of 228 GW and 2021’s 168 GW, the world installed 816 GW of solar capacity during the last three years – or more than double the entire capacity the world had installed before 2020.

A rapid turnaround is unlikely, but a gradual turnaround is probably a good bet.

Renewable energy stocks have suffered such relentless selling pressure for the last three years that they reflect only doom and gloom. Therefore, many stocks in the sector could soar, as they begin to convert their profit potential into genuine profit growth.

So, while electricity-hungry AI giants like Alphabet, Amazon.com Inc. (AMZN), Microsoft Corp. (MSFT), and Meta Platforms Inc. (META) are currently signaling a natural gas boom, that surge is setting the stage for renewable energy’s resurgence.

As massive, trillion-dollar investments continue to flow into all forms of energy generation and storage – both renewables and fossil fuels – we investors do not need to “choose sides.” We can invest opportunistically in both renewables and fossil fuels.

To learn how to play both sides of the energy sector – and receive my latest recommendations – learn how to join me at Fry’s Investment Report. Look out for the July issue this Friday, where I’ll continue to examine AI and the other megatrends I’m following and their impacts… and make a new AI-related stock recommendation.

(If you are already a member of Fry’s Investment Report, you can log in here.)

Regards,

Eric Fry