In the wake of the worst mass shooting in U.S. history, one fear has tragically materialized — the threat of homegrown terrorism. After the barbaric Islamic State terrorist group claimed responsibility for the cowardly massacre in an Orlando, Florida nightclub, a paradigm shift occurred. No longer are conflict borders situated in far off foreign lands, but they are, instead, right here in the U.S. That places increased attention towards security stocks as defense-oriented companies must now focus domestically.

While policymakers will rightfully focus on the broader “War on Terror,” the impact towards security stocks should not be overlooked. Not only do conflict borders cover virtually the entire world, they are also agonizingly mobile.

By granting would-be terrorists U.S. passports, they are provided opportunities to access networks with nefarious agendas. In addition, citizenship grants incredible rights and privileges that cannot easily be invalidated unless there is an overt reason to do so.

This vulnerability in the manner in which we prosecute terrorism plays into the greatest threat posed by a radicalized insurgency — asymmetrical warfare. We are living in an unprecedented era where one civilian with a twisted ideology can inflict exponential harm.

By necessity, policymakers must focus on the vetting process of our immigration system, perhaps even overhauling it altogether. The visceral danger of asymmetrical warfare means that only a handful of radicalized individuals need to get in before they render horrendous damage.

That makes security stocks all the more critical. It is no longer a matter of gaining control of a military zone; the War on Terror is right here on our doorsteps. That means implementing domestic security protocols and surveillance measures. Further, many security stocks specialize in digital counterterrorism, fighting the power of ideology before it manifests in murderous catastrophes.

Here are three security stocks that are on the front lines against domestic terrorism.

Security Stocks to Buy: Kratos Defense & Security Solutions, Inc (KTOS)

Click to Enlarge

Known more for its unmanned systems product line, the priorities for Kratos Defense & Security Solutions, Inc (KTOS) may soon change. True, government and military contracts for surveillance drones may make for more interesting headlines, but homegrown terrorism concerns will undoubtedly be the focus moving forward.

In addition, the senseless murder of NBC’s “The Voice” singer Christina Grimmie highlights the importance of security for a number of public events. This is where KTOS can make a significant contribution.

The shift would be a welcome source of potential income. Currently, the public safety and security division for Kratos is barely above break-even. Fundamentally, Kratos has also been stymied by a lack of sales growth. After nearly $1 billion in revenue in 2012, KTOS has produced three years of lagging sales.

Part of the problem has been the company’s insistence on growing its popular but unprofitable unmanned systems division. But, the new threat of domestic terrorism, along with government contracts for security systems, could turn Kratos’ sales woes around.

There’s also technical evidence that Kratos may be on the early cusp of a recovery. Having fallen 62% over the last five years, Kratos buyers are looking to build support at the psychological trading level of $4 per share. Previous attempts to sink KTOS below this level have only been temporarily successful, so risk-tolerant investors are betting this won’t happen again.

It’s a tough call to be sure, but Kratos is backed by a strongly bullish tailwind pushing security stocks higher. That could ultimately be the deciding factor.

Security Stocks to Buy: CACI International Inc (CACI)

Click to Enlarge

Defense contractor

CACI International Inc (CACI) knows first-hand what it means to execute under pressure. Late last month, CACI won a $50 million contract with the U.S. Navy to continue providing program management support for the Naval Surface Warfare Center.

More significantly, CACI International was awarded a multi-contract project with the Department of Defense to assist in their anti-drug trafficking efforts. With homegrown terrorism now considered an imminent threat, the opportunities for CACI to deliver their security solutions will only increase.

On the financial side, CACI International is a much more stable opportunity than lesser-known security stocks. Against the competition, it ranks better than average on profitability margins and return on equity. CACI stock is also fairly priced against both trailing and forward earnings.

Where it has been lacking is in sales growth. Since 2010, revenue has grown less than 4%. But, with that said, its first quarter of fiscal year 2016 saw a 19% sales improvement year-over-year. In addition, the counterterrorism expertise of CACI International should logically jump in demand.

The overall stability of CACI is reflected in the technical charts. Year-to-date, shares are up more than 5%. CACI has also traced a bullish trend channel that has lasted for several years. While they don’t have the best financial metrics, it’s hard to imagine that Wall Street won’t give serious consideration to CACI in light of the recent tragedy.

In short, CACI International is a proven entity whose services have gotten much more valuable.

Security Stocks to Buy: Leidos Holdings, Inc.

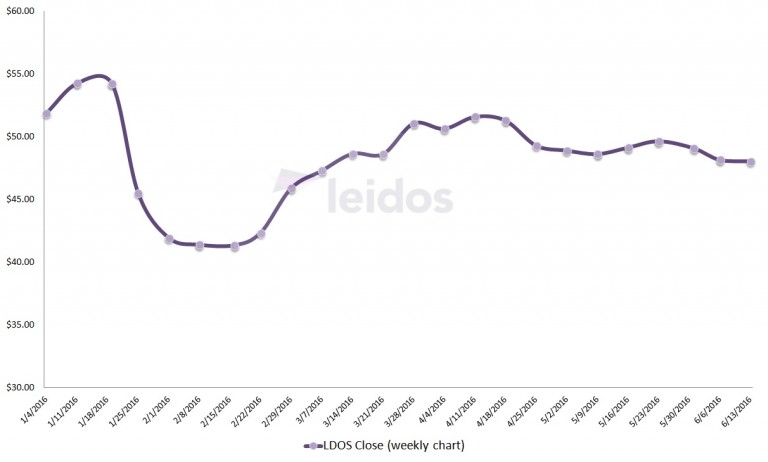

Click to Enlarge

As society dives deeper into the era of digitalization, it has become readily apparent that there are counterweights to its conveniences. This is where Leidos Holdings, Inc. (LDOS) comes in. Leidos’ security services have assisted all branches of the U.S. military, as well as federal law enforcement agencies.

Their expertise in counterintelligence and data analytics will be especially critical, given the manner in which radicalization has proliferated through the internet. In addition, LDOS develops inspection systems that are essential for transportation safety.

Fundamentally, Leidos is very similar to CACI. LDOS shares benefit from better-than-average margins and proven efficiency in generating earnings growth relative to other security stocks. But along with its peers, Leidos has suffered recently from a lack of earnings growth.

Again, that may change dramatically under the current security framework. LDOS has already seen a sign of things to come when it was awarded a $250 million contract with the U.S. Army, specifically for the purposes of counterintelligence against terrorist networks.

In terms of investment risk, LDOS stock is somewhere in between KTOS and CACI. While it has some of the financial characteristics of CACI, Leidos shares are down 15% year-to-date. At the same time, LDOS is riding a long-term bullish trend channel, whereas KTOS investors are betting big on a possible recovery.

What is clear is that LDOS has a strong track record that both government agencies and Wall Street appreciate.

In the long run, Leidos offers a unique mix of security expertise that will garner intense demand.

As of this writing, Josh Enomoto did not hold a position in any of the aforementioned securities.