Advanced Micro Devices (NASDAQ:AMD) makes graphics cards, and so does Nvidia (NASDAQ:NVDA). Since AMD just dished out numbers that fell short of expectations and subsequently up-ended the stock, odds are good that Nvidia stock is similarly vulnerable.

It’s a rationalization, however, that may well oversimplify the similarities between the two companies. Indeed, there’s more than enough difference between the two that savvy investors may want to use the market’s misguided assumptions as a buying opportunity.

Similarities Between AMD and Nvidia Stock

If you’re reading this, then odds are good you already know AMD didn’t perform quite as well as expected last quarter. Earnings beat and revenue met, but the company’s fourth quarter revenue outlook of $1.45 billion fell short of the $1.6 billion analysts were modeling. Investors may have been tacitly hoping for a better earnings and revenue performance in Q3 as well.

It was enough to prompt Bank of America Merrill Lynch analyst Vivek Arya to rethink everything he thought about Nvidia. Just a month after raising his target on Nvidia stock from $340 to $360, he lowered it all the way to $300 on Thursday after digesting AMD’s lackluster GPU performance for its quarter ending in September.

Perhaps he shouldn’t have been so quick to draw such sweeping conclusions about one based on the other’s results.

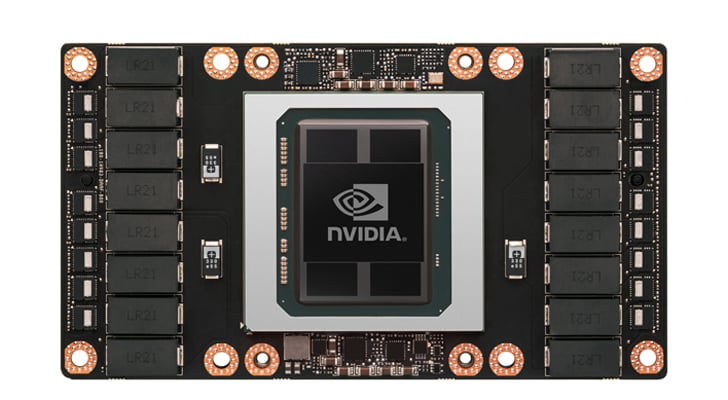

To be fair, both companies are still ultimately about the GPU, or graphics processing unit (the mini-computer that attaches to a computer’s main board to independently handle the graphical display). It can be a computing-intensive process, especially when it comes to making fast-paced, visually impressive video games playable.

As it turns out though, GPUs are ideally-suited to do more than just operate a computer screen. Though they aren’t great for handling deep, complex processes, GPUs are able to handle massive amounts of data and light number-crunching that makes things like artificial intelligence possible.

And, this is where Nvidia really starts to separate itself from rival AMD.

Differences Between AMD and Nvidia Stock

Selling graphics cards to gamers and to OEMs that make gaming computers is still Nvidia’s bread and butter. Last quarter, $1.8 billion of its $3.1 billion in revenue was driven by the video gaming market.

Data centers, however, are quickly becoming a breadwinner of sorts. Its second quarter data center revenue of $760 million may have only accounted for about one-fourth of the company’s sales, but that figure was up 83% year-over-year.

The advent of artificial intelligence had a great deal to do with that growth. Five of the world’s seven fastest supercomputers are powered by Nvidia GPUs, as the company has made a point of developing AI-specific machines.

That’s not to suggest Advanced Micro Devices GPUs aren’t being used in a similar way. AMD’s exposure to the artificial intelligence thus far, however, hasn’t been head-turning

.

Nvidia also has exposure to another market AMD hasn’t, self-driving cars and driver-assist platforms.

It’s still admittedly a modest piece of Nvidia’s revenue mix, adding only $161 million to the top line during the second quarter. It’s still a nascent industry though.

The market for autonomous vehicles is expected to grow at an annual pace in excess of 60% between 2020 and 2030, and Nvidia is well-positioned to capture its fair share of that market.

Still, video gaming and performance-oriented visualization remain crucial pieces of both companies’ near-term revenue and cash flow.

To that end, although the rollout of new AMD GPUs earlier in the year allowed it to chip away at some of Nvidia’s dominance, Nvidia has gained it all back in the meantime. Nvidia still controls about 69% of the graphics card market, versus AMD’s 30%. Most critics and reviewers still rate its products as the best in the industry, at various price-points.

Bottom Line for Nvidia Stock

None of this is to suggest Nvidia stock is bulletproof. If AMD, Intel (NASDAQ:INTC), Micron Technology (NASDAQ:MU) and all the other usual suspects within the computer technology sliver of the market continue to backpedal, Nvidia stock is apt to face the same fate. Fear can make investors indiscriminate sellers.

It is to say, however, that once the dust settles, the market may realize that Nvidia isn’t quite as subject to the cyclical headwinds most other hardware companies have to contend with on a regular basis.

Barring complete economic calamity, investments in data centers and artificial intelligence applications are going to happen. Ditto for self-driving vehicles, which was always a long-term project for Nvidia anyway.

It’s never wise to catch a falling knife, but wise investors will put Nvidia stock on their watchlist, knowing it’s not in the boat most investors and analysts want to keep putting it in.

As of this writing, James Brumley did not hold a position in any of the aforementioned securities. You can follow him on Twitter, at @jbrumley.