Nanotech stocks offer big opportunities at the fraction of an atom.

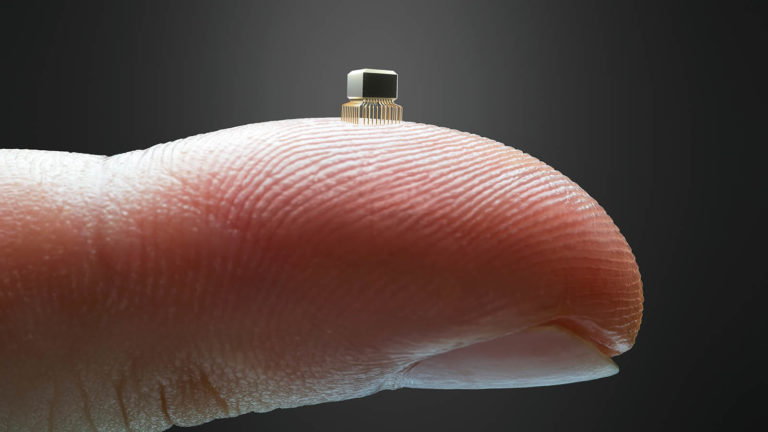

Such tech innovation is conducted at nanoscale – which has a dimensional range of about one to 100 nanometers. To give you an idea of how small that is, a strand of your DNA is 2.5 nanometers in diameter. A strand of hair is 80,000 to 100,000 nanometers wide. A sheet of paper is maybe 100,000 nanometers thick.

But as small as it is, it offers sizable opportunity as it changes the world around us.

It’s allowing us to create new, exciting innovation with computers, memory chips, healthcare, pharmaceuticals, biotechnology, even the military.

In fact, nanotechnology is enabling technology for new classes of sensors, communications, and need for surveillance, says the National Nanotechnology Initiative. “The DOD also invests in nanotechnology for advanced energetic materials, photocatalytic coatings, active microelectronic devices, and a wide array of other promising technologies.”

With biotech, “Nanotechnology is becoming the driving force behind a variety of evolutionary and revolutionary changes in the medical field. The impact of nanotechnology on drug delivery has helped to improve the efficacy of available therapeutics and will likely enable the creation of entirely new therapeutic entities,” write the authors of Nanotechnology in Drug Delivery and Tissue Engineering: From Discovery to Applications.

By 2024, the global nanotechnology market could exceed $125 billion by 2024, says Research and Markets. All as it continues with its broad impact on nearly all sectors in the world, including technology, energy, defense, autos, and even food.

As nanotechnology advances, some of the best nanotech stocks to consider are:

Taiwan Semiconductor (TSM)

The first on this list of nanotech stocks is Taiwan Semiconductor. The company leads the tech market with nanotech innovation. It’s one of the world’s largest microchip makers, creating the very processors that provide support for iPhones, laptops, game consoles, and Internet infrastructure, among other things. Most recently, it was the first to offer 7-nanometer chip production with large volume. “Smaller nm chips offer greater performance and improved power efficiency,” says Barron’s contributor Tae Kim.

The company also just announced it will spend up to $12 billion on a semiconductor foundry in the United States. “This project is of critical, strategic importance to a vibrant and competitive U.S. semiconductor ecosystem that enables leading U.S. companies to fabricate their cutting-edge semiconductor products within the United States and benefit from the proximity of a world-class semiconductor foundry and ecosystem.”

After pulling back with the broader market, TSM stock is now consolidating just under $52 a share. From here, I’d like to see this nanotech stock break higher to challenge double top resistance at $60.

Thermo Fisher Scientific (TMO)

Thermo Fisher and NanoPin Technologies are collaborating to advance blood-based infectious disease detection technology with the development of liquid chromatography mass spectrometry-based workflows.

“This will enable healthcare providers to reduce time to results, determine infection stage and monitor patient response to prescribed treatment. The quantified information gleaned from the combined technology will support clinical decision-making and the provision of personalized patient care unique to their disease state,” according to the Thermo Fisher site.

Also, back in 2016, Thermo Fisher acquired FEI Company. This gave Thermo Fisher a bigger foot in the door with nanotechnology. For example, its transmission electron microscopes (TEMs) is one of the only ways to image nanomaterials.

In fact, according to the Thermo Fisher site, “Electron microscopes fire electrons and create images, magnifying micrometer and nanometer structures by up to ten million times, providing a spectacular level of detail, even allowing researchers to view single atoms.”

NanoVirides Inc. (NNVC)

NanoVirides develops anti-viral medication using nanotechnology. According to the company’s Company Overview, “A nanoviricide is designed to specifically attack enveloped virus particles, on the same sites that they use to bind to cells, and dismantle them, blocking reinfection cycle, going beyond what antibodies and immunotherapeutics do.”

The company also just announced that its nanoviricides coronavirus drug candidates demonstrated high anti-viral effectiveness in studies against multiple coronaviruses. A May press release from NanoViricides states:

The Company believes the fact that these nanoviricides anti-coronavirus drug candidates are highly effective against two distinctly different coronaviruses that use different cellular receptors is very significant. Specifically, it provides confidence to the Company and rational basis to scientists that even if the SARS-CoV-2 coronavirus mutates, the nanoviricides can be expected to continue to remain effective.

Ian Cooper, a contributor to InvestorPlace.com, has been analyzing stocks and options for web-based advisories since 1999. As of this writing, Ian Cooper did not hold a position in any of the aforementioned securities.