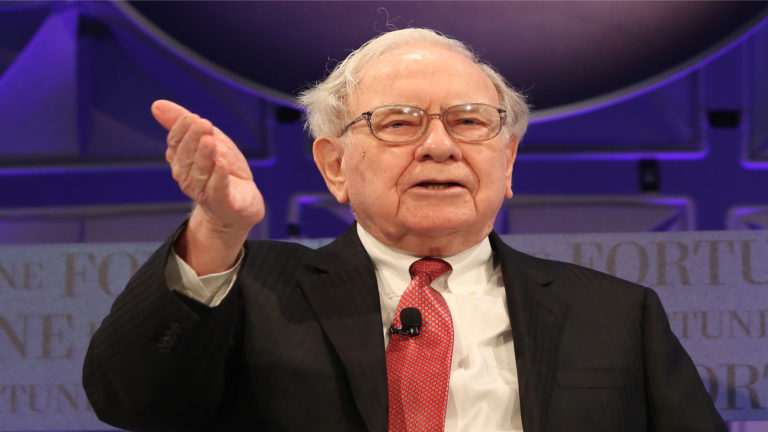

Warren Buffett’s investment philosophy has delivered consistent returns over decades. That said, it’s not surprising that his investments are closely followed by thousands of investors — making Warren Buffett stocks a hot commodity.

As equity markets trend higher after the coronavirus pandemic driven meltdown, investors are looking for fresh exposure to equities. Therefore, it’s a good time to look at some of the top Warren Buffett stocks to buy.

These stocks have robust cash flows, in addition to steady growth visibility. Moreover, my top four picks from the legendary investor’s portfolio are as follows:

- Costco Wholesale (NASDAQ:COST)

- Apple (NASDAQ:AAPL)

- The Coca-Cola Company (NYSE:KO)

- Amazon (NASDAQ:AMZN)

So, with all of that in mind, let’s dive in.

Top Warren Buffett Stocks: Costco Wholesale (COST)

COST stock has been a long time holding of Warren Buffett. Overall, I believe that the stock has upside potential in the coming years — and is therefore worth considering for the portfolio.

If we go through the fundamentals, there are ample reasons to be bullish on COST stock. The company has a strong balance sheet with a cash buffer of $11.8 billion and long-term debt of just $7.6 billion.

From a dividend perspective, the company-initiated dividends in May 2004. Dividends have grown at a constant annual growth rate (CAGR) of 13% and currently stands at $2.80 per share. So with robust cash flows, I believe that the company’s dividends will continue to grow.

It’s also worth noting that in the last twelve months, the company generated cash fees of $3.5 billion. Furthermore, the renewal rate in U.S. and Canada was 91%, whcih indicates strong consumer loyalty.

With the company just starting to expand in China, there is immense scope for fee-based cash flow upside. Besides China, I see India as another high-growth market for the company in the long-term.

Overall, the bottom line is that the company has clear growth and cash flow upside visibility. In turn, this will ensure that COST stock trends higher and dividends swell in the coming years. And these factors make Costco among the top Warren Buffett stocks to buy.

Apple (AAPL)

AAPL stock is also in the legendary investors portfoli,o and is among the top Warren Buffett stocks to buy. Talking about the resilient business model, AAPL stock has continued to trend higher even as the novel coronavirus has impacted near-term business growth.

Looking beyond the current headwinds, 5G is likely to deliver growth for Apple in the coming quarters. The company also has a more diversified portfolio of product offerings, which could potentially trigger sustained growth. Furthermore, services revenue reached an all-time high in the last quarter. And as the services revenue swells, the company’s cash flows will accelerate. Similarly, the company’s growth in the wearable segment has been robust.

From a cash flow perspective, Apple is likely to report an annualized operating cash flow of $85 to $90 billion. The core business is a cash flow machine, and that allows the company to create shareholder value. In addition, inorganic growth focused on innovation driven companies is also a positive catalyst.

Overall, AAPL stock is attractive with sustainable cash flows and focus on shareholder value creation.

The Coca-Cola Company (KO)

The novel coronavirus pandemic has impacted the restaurant business, which has resulted in a slowdown for Cola-Cola. However, any weakness in KO stock should be considered as a good accumulation opportunity.

With 58 consecutive years of annual dividend increase, there is no doubt that the company is a long-term value creator. Additionally, with diversified presence in 200 countries and with a strong portfolio of 500-plus brands worldwide, the company is well-positioned to continue its growth.

Importantly, the company’s growth is not limited to soft drinks. The company has made strong inroads in the business of daily and plant-based beverage, sports drinks and fruit juices. So as consumers becomes increasingly health conscious, the company has a quality product offering.

Moreover, UBS analyst Sean King said:

“We remain buyers of KO as a proven executor against near-term challenges and long-term for its organic growth potential and superior FCF generation.”

This perfectly sums-up the reason for Cola-Cola being among the top Warren Buffet stocks to buy. Free cash flow generation in the long-term will continue to take the stock higher, along with sustained growth in dividends.

Amazon (AMZN)

Warren Buffett has also been bullish on AMZN stock. When we look at the fundamentals and business growth, there are ample reasons to follow the legendary investor in holding this stock.

From a stock price perspective, Amazon recently touched all-time-highs — and I believe that the positive momentum will sustain. Analysts expect the company’s earnings growth to average 24.5% on an annual basis over the next five years. This itself is a big reason to buy the stock.

Besides the core e-commerce business, the cloud business is a game-changer and cash flow machine for Amazon. In the retail business, Amazon is likely to benefit in the long-term from exposure to emerging markets. Markets like India and Southeast Asia can ensure that the e-commerce business growth remains healthy.

For the 12-months ended March 2020, Amazon reported operating cash flows of just under $40 billion. That said, strong cash flows will allow the company to pursue organic and inorganic growth.

Overall, Amazon will deliver strong earnings growth and cash flow upside in the coming years — which will translate into the stock trending higher. So, without a doubt, the company is among the top Warren Buffett stocks to buy.

Faisal Humayun is a senior research analyst with 12 years of industry experience in the field of credit research, equity research and financial modelling. Faisal has authored over 1,500 stock specific articles with focus on the technology, energy and commodities sector. As of this writing, he did not hold a position in any of the aforementioned securities.