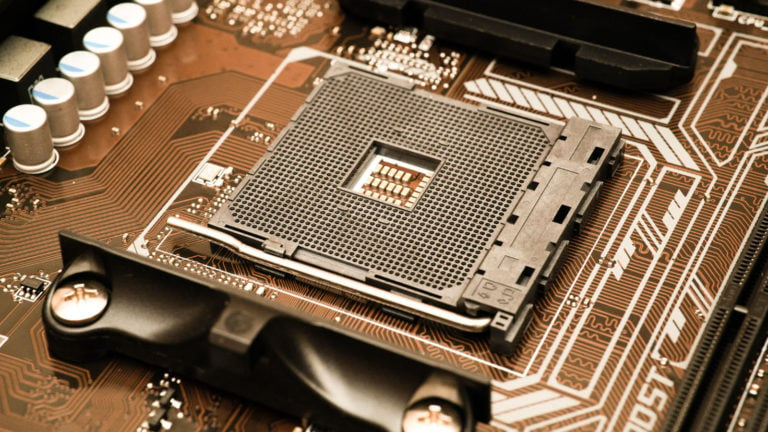

Chip stocks are on the move this morning thanks to a lot of news. Two adversaries of the U.S. are going to have a much harder time sourcing microprocessors from American tech companies. One such company is on its way out of Russia as tensions tighten between the nation and its neighbors. Meanwhile, President Joe Biden is working on restricting Chinese buyers’ access to chips.

InvestorPlace’s William White is reporting this morning on some positive movement for chip stocks across the board. However, the companies best benefitting from a busy morning are Advanced Micro Devices (NASDAQ:AMD) and Nvidia (NASDAQ:NVDA). These two companies are up 2% and 4%, respectively. Both are set to trade on higher-than-average volume by the market’s close due to a rush of buyers.

Motivating this buying spree, as White points out, are new restrictions the U.S. government is placing on China. In early September, the government announced a ban on exports of Nvidia and AMD chips to China. This ban means to stunt Chinese supercomputing and artificial intelligence computing industries.

This week, that news is being built upon still. The U.S. Commerce Department is allegedly set to unveil a new set of rules

on which types of semiconductors can be exported to China. The updated rules will come just after an executive order signed by Joe Biden, limiting the abilities of Chinese companies to invest in American tech.

Chip Stocks News: Nvidia Pulls Out of Russia

The chips war with China isn’t the only source of chip stocks’ movement today, either. Russia is also losing out on access to American chipmakers this week. Indeed, chipmaker Nvidia is looking to reduce its presence in the warring nation.

Russia’s invasion of Ukraine is entering its eighth month already, and with Vladimir Putin renewing his dedication to the war, it’s unlikely to end soon. The implications of this war continuing are costly on the part of Ukrainian citizens. They will also have massive implications worldwide as the country faces harsh sanctions on imports and cuts ties over its fuel exports to Western Europe.

Nvidia can feel the situation heating up, and it’s making a fast exit from Russia. “With recent developments, we can no longer operate effectively there,” said the company earlier this week in its announcement to discontinue its operation within the country. Nvidia, which had previously only halted shipments to Russia, kept a presence throughout much of the Ukraine invasion. After Putin’s remarks, though, it seems operating in the country is not feasible any longer.

As stated in his recent speech on Ukraine, Putin is attacking not just Ukraine, but western civilization as a whole. Multiple remarks made by the Russian leader point fingers at the influence the U.S. and Western European nations have had on Ukraine in the last decade.

The new attitudes could have quite the effect on the Russian economy. While Nvidia has decided to exit Russia, there’s reason to believe the Ukraine conflict could put the U.S. in a position to institute further restrictions on business in the country similar to what it’s doing in China.

On the date of publication, Brenden Rearick did not have (either directly or indirectly) any positions in the securities mentioned in this article. The opinions expressed in this article are those of the writer, subject to the InvestorPlace.com Publishing Guidelines.