China-based EHang Holdings (NASDAQ:EH) disclosed that China’s aviation regulator had approved its autonomous aerial vehicle. EH stock is soaring 53% on the news in early trading.

EH stock soared 50% in early morning and premarket trading. However, it has since pared back those gains to around 25%.

More About EHang’s Aerial Vehicle and the Approval

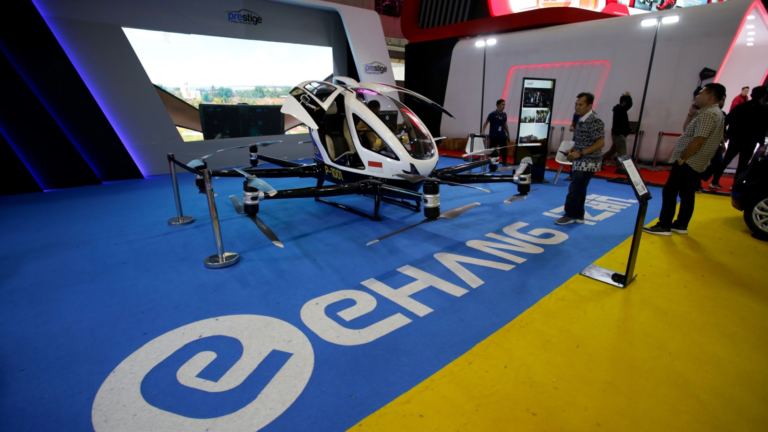

Called the EH216-5, the aerial vehicle is an “unmanned electric vertical take-off and landing aircraft.” Electric vertical take-off and landing aircraft, or eVTOLs, are small aircraft that carry several passengers and land like helicopters. However, because the eVTOLs are powered by electricity instead of the jet fuel utilized by most helicopters, the eVTOLs are much cheaper to operate.

The EH216-5 was approved by the Civil Aviation Administration of China (CAAC). According to EHang, the regulator’s decision means “that the EH216-S’s model design fully complies with CAAC’s safety standards and airworthiness requirements.”

Moreover, in the wake of the approval, the vehicle can carry passengers and charge for rides, EHang reported.

The company indicated that its aircraft is the first autonomous eVTOL to be approved in the world. Its CEO, Huazhi Hu, in an interview with CNBC, said that it intends to begin selling the vehicle overseas in 2024.

Potential Implications of the News

EHang’s market capitalization is currently $1.5 billion. While that is not low, I believe that it is cheap enough to enable the shares to rally a great deal if investors become excited about the company’s outlook.

Supporting that theory is the fact that Joby Aviation (NYSE:

JOBY), a leading U.S.-based eVTOL developer, currently has a market capitalization that exceeds $4 billion.

In the long term, EHang’s eVTOL could potentially limit the market share of Joby and its competitors, including Archer Aviation (NYSE:ACHR).

On the other hand, because there are some doubts about Chinese regulatory standards in the West, it could be many years before EHang’s vehicle enters Europe or the U.S.

On the date of publication, Larry Ramer did not hold (either directly or indirectly) any positions in the securities mentioned in this article. The opinions expressed in this article are those of the writer, subject to the InvestorPlace.com Publishing Guidelines.