For investors in smart materials and photonics company Meta Materials (NASDAQ:MMAT), it’s been, shall we say, a rough road this year. Shares of MMAT stock currently trade around 10 cents apiece, and that’s including today’s move of about 8% higher in this penny stock.

This incredibly low share price and Meta Materials’ valuation compression (down more than 90% on a year-to-date basis) appears to be due to a range of operational issues. Like many unprofitable tech stocks, MMAT stock took off during the meme mania a couple of years ago. Since then, investor appetite for such stocks has waned, forcing companies like Meta Materials to aggressively implement restructuring plans to show investors a viable pathway toward profitability.

Today, Meta Materials announced the company expects to achieve roughly $20-$30 million in annualized cost savings moving forward, based on preliminary results from its restructuring plan. Additionally, the company noted that, due to “unexpected health reasons,” current CEO Jim Fusaro has resigned and will be replaced by the company’s CFO/COO Uzi Sasson, effective immediately.

Let’s dive into why this news is being viewed so positively today and what investors may want to make of this announcement.

MMAT Stock Surges Higher in Today’s Session

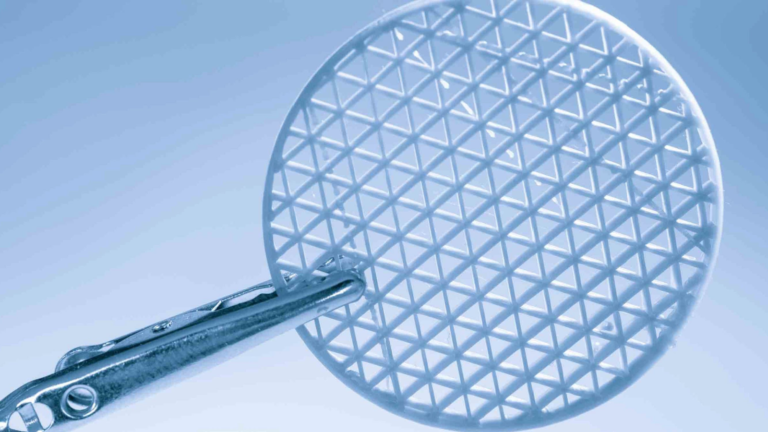

Meta Materials’ business model is one that is very diverse and provides growth investors with many verticals to explore in key high-growth areas of the economy. The company’s profile states:

“Meta Materials Inc., a smart materials and photonics company, develops, manufactures, and sells various functional materials and nanocomposites…Its customers are OEM providers in various industries, including aerospace, automotive, consumer electronics, communications, energy, banknote and brand security, and medical devices.”

That’s quite the list of target markets to go after, but it also suggests the company may have difficulty honing in on one or two key materials to aggressively pursue, leading to the need for its recent restructuring.

Accordingly, the fact that this restructuring appears to be reaping some fruit, and investors stand to gain in the order of $20-$30 million per year, perhaps this is a company worth taking a flyer on. After all, at a market capitalization of just $50 million, two years of these cost savings alone amount to the current value of the company.

Of course, plenty of risks exist when it comes to MMAT stock or any other penny stock trading around 10 cents. A reverse split will need to be engineered so the stock isn’t delisted, and investors will clearly need to change their tune on Meta Materials’ long-term growth prospects in order for any appreciation to take place.

That said, it’s true that today’s announcement is a positive step in the right direction. It’s fair that the market has given Meta Materials credit for the work it’s been doing.

On Penny Stocks and Low-Volume Stocks: With only the rarest exceptions, InvestorPlace does not publish commentary about companies that have a market cap of less than $100 million or trade less than 100,000 shares each day. That’s because these “penny stocks” are frequently the playground for scam artists and market manipulators. If we ever do publish commentary on a low-volume stock that may be affected by our commentary, we demand that InvestorPlace.com’s writers disclose this fact and warn readers of the risks.

Read More: Penny Stocks — How to Profit Without Getting Scammed

On the date of publication, Chris MacDonald did not have (either directly or indirectly) any positions in the securities mentioned in this article. The opinions expressed in this article are those of the writer, subject to the InvestorPlace.com Publishing Guidelines.