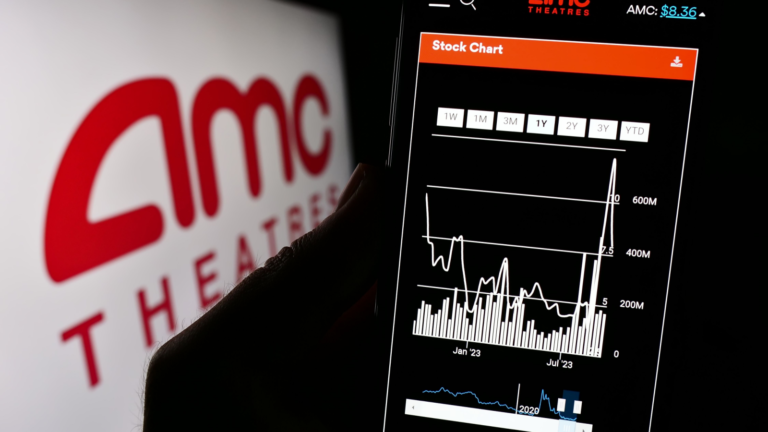

AMC Entertainment (NYSE:AMC) stock has spent all but 14 days trading in penny-stock hell so far this year. Except for a couple of short bursts like when it jumped 135% in two days trading, meme-stock investors hoping for a 2021-style revival aren’t likely to get their wish.

Although I’m the last person on earth that would write something positive about AMC stock — I recently called it “radioactive” — part of what I do as a writer is to examine possible events that could turn a stock from toxic to must-own.

As I scour the internet looking for a possible catalyst to lift AMC out of penny-stock hell, there doesn’t appear to be anything obvious to hang my hat on as evidence the turnaround is imminent.

However, Bloomberg recently reported on the company’s push to lower its debt and extend upcoming maturities further out, thereby reducing the near-term pressure on the company.

While I see this move as nothing more than rearranging the deck chairs on the Titanic, it appears to be the company’s best and only solution to escape penny-stock hell.

Here’s why.

A Short Term Solution for AMC Stock

As Bloomberg points out, it has approximately $4.5 billion in long-term debt on its balance sheet as of March 31.

Of the $4.5 billion, its Q1 2024 10-Q shows that 64% matures in 2026.

There is $1.9 billion in a Senior Secured Credit Facility-Term Loan at 8.435% interest, $951 million in 10%/12% Cash/PIK Toggle Second Lien Subordinated Notes due 2026 (if it opts for the payment-in-kind option), 12% interest is added to the balance of the notes.

Lastly, there is a small amount ($51.5 million) in 5.875% Senior Subordinated Notes.

The first two are the debts it’s most interested in pushing out. The annual interest payments on those two are approximately $255 million. In 2023, the company’s total interest expense was $411 million.

If you excluded $255 million from 2023 interest payments, it would have generated an operating profit of $181 million rather than a $74.3 million operating loss.

The only problem is that nearly $2.9 billion in debt doesn’t just disappear.

Bloomberg’s article does point out that AMC could convert $164 million (plus $6.9 million in accrued interest) of the $951 million in 10% notes mentioned above into 23.3 million shares of its stock, so the total debt outstanding is more like $4.32 billion.

If it can push the 2026 debt out another 5-10 years at lower interest rates than 8.435%-10%, that reduces its interest expense and more time to figure out a permanent solution.

The Downside of Such an Arrangement

When you consider a company’s total debt, it’s not just the bonds that count, but also the operating lease liabilities.

At the end of the first quarter, AMC’s total debt was $8.99 billion, down from $10.75 billion at the end of 2021. As a result, its net debt is also down, from $9.16 billion at the end of 2021, to $8.37 billion as of March 31.

So, that’s good news, right? Absolutely. Except, the payments on the leases are far more onerous than the interest on its long-term debt.

As its Q1 2024 10-Q shows, between 2024 and 2029, its minimum annual payments on its operating leases is $4.42 billion, or an average of $736 million per year.

It can’t go without making these payments — I’m not a credit expert by any stretch of the imagination — or, I’m confident, it would likely break some of the covenants on its long-term debt.

So, while kicking the long-term debt down the road reduces one payment problem, it does nothing to help alleviate the cash flow strain the operating leases put on its ability to make interest payments on its debt.

It’s a classic case of the chicken or the egg.

It could close theaters, which reduces lease payments, but that reduces revenue and potential cash flow, which would get its lenders in a tizzy, bringing the debt problems front-and-center once more.

Can It Escape Penny-Stock Hell?

My opinion of AMC remains the same.

It won’t be able to extract itself from the troubles it faces without finding new revenue streams beyond the usual theater-related ones such as ticket sales and food and beverage concessions.

Higher prices have enabled movie theater chains to remain in business despite the fact ticket sales themselves have been falling since 2002. That year, 1.58 billion tickets were sold at an average ticket price of $5.81, 46% less than the $10.78 average in 2024.

While I would never say never, I can’t imagine ticket sales ever getting back to 2002 levels, which means no matter what AMC does to rework its debt, the company will continue to fight an uphill battle that it’s bound to lose.

It is for this reason penny-stock status has become the norm for AMC stock.

On the date of publication, Will Ashworth did not have (either directly or indirectly) any positions in the securities mentioned in this article. The opinions expressed in this article are those of the writer, subject to the InvestorPlace.com Publishing Guidelines.