One of the absolute dumbest bits of speculation out there is that Apple Inc. (NASDAQ:AAPL) will acquire Netflix, Inc. (NASDAQ:NFLX). Adding to that pile of dumbness, were two dumb analysts at Citigroup Inc. (NYSE:C), Jim Suva and Asiya Merchant, who said that there was a 40% chance that Apple would buy Netflix. This is apparently up from 20-30% (as if one can quantify such things in the first place).

Dumb. Dumb. Dumb. Here’s why:

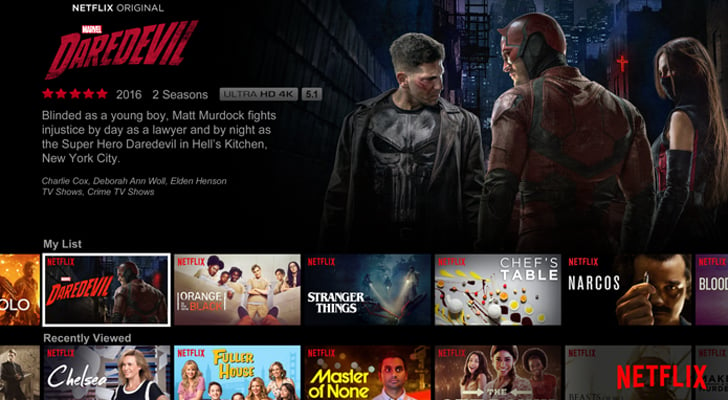

The Netflix Business Model

NFLX is essentially two businesses. The first, which is rapidly becoming obsolete, focuses on the distribution of streaming content. More and more services are doing this now, including Hulu and Amazon.com Inc. (NASDAQ:AMZN) and soon The Walt Disney Company

(NYSE:DIS). Of course, Apple is already streaming content, so it has no reason to purchase that part of the Netflix business.

NFLX is now a content producer. It is spending billions of dollars to produce content, essentially attempting to become a competitor to other original programming providers like HBO, Showtime, Amazon, and so on. NFLX is spending so much money that the company is burning through every dollar it borrows. It thus has negative free cash flow. It borrows money at relatively high interest rates to fund its programming. It makes very little profit.

But NFLX has no studio infrastructure. It is simply a capital provider, throwing money around to producers, who bring content to it. There’s plenty of terrific content, too.

There is nothing to buy here.

AAPL can do the exact same thing, and actually is committing a billion dollars to original programming. I suspect that is just a start. Over time, AAPL will ramp up production of original content. There’s nothing special that Netflix has in the content world. Apple can create its own content, hire its own internal creative content people (hey, I and many other outstanding writer/producers are available) and distribute it.

That just leaves Netflix’s existing content, also known as its library. Before the days of streaming, a studio’s library was a highly prized asset. That content could be licensed to network television, pay-TV, basic cable television, airplanes, DVDs/video, and so on. At the height of the industry, libraries might fetch as much as seven times their original cash flow.

Those days are gone. Say a company purchases just Netflix’s content. Let’s say Time Warner Inc. (NYSE:TWX) buys it up. It can then show that content on HBO, which it owns. It can show it on the CW (network TV). It can show it on TBS (Turner). It can turn around and license it to other channels while distributing that content on its own cable systems.

However, in the old days, studio or pay-TV content could be distributed across multiple ancillary channels over several months or years. If you didn’t have SHOWTIME, you’d have to wait for a show to hit DVD or network or cable TV.

But NFLX already has 52 million subscribers, so the potential audience for Netflix content is significantly smaller than what it might have been for a studio in the old days. Hence, the content is worth less. Morgan Stanley thinks it’s worth about $11 billion.

Bottom Line on NFLX Stock

So, why in the world would Apple pay $90 billion for Netflix? Suggesting that it would is so incredibly dumb the analysts should be fired.

Just because Apple has more than $215 billion in repatriated cash on its balance sheet, it should just go and buy something for eight times what its worth?

Ridiculous. Dumb.

Lawrence Meyers is the CEO of PDL Capital, a specialty lender focusing on consumer finance and is the Manager of The Liberty Portfolio at www.thelibertyportfolio.com. He does not own any stock mentioned. He has 23 years’ experience in the stock market, and has written more than 1,800 articles on investing. Lawrence Meyers can be reached at TheLibertyPortfolio@gmail.com.