In 2022, the New York Times ran a feature article titled “Electric Vehicles Start to Enter the Car-Buying Mainstream.” It showed how, in 2022, high gas prices helped double EVs’ share of new car sales…

Fast forward to 2023 when battery-powered cars now make up the fastest-growing segment of the auto market. First-quarter 2023 sales increased 44.9% year-over-year and are on track to surpass 1 million sold in 2023.

This incredible boom is creating “echo booms” in numerous industries.

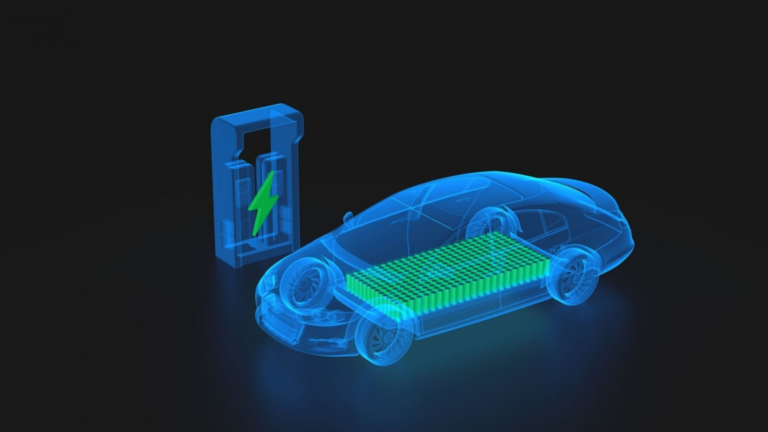

Building EVs on a scale where they can be practical and affordable for a mass market will require countless technological innovations applicable to many other fields. This is where I see investing opportunities, even if you don’t want to invest in an EV stock directly.

Computer vision, advanced battery chemistries and miniaturization, next-generation semiconductors, smart power grids , mass-energy storage technology, LiDAR sensors… and 5G-enabled everything…

The explosive new EV supply chain will spawn dozens of technological marvels. And those marvels will inevitably forge pathways for other radical changes and breakthroughs, even in markets we have yet to imagine.

So even if you’re not in the market for a new vehicle, tax incentives, advancing technological innovations, and the plummeting price of EVs – not to mention the fuel savings – are putting them within reach for “regular” folks.

There are billions flooding into the myriad offshoots of this megatrend, and with an opportunity so big… with so much momentum… investors could see dividends for years to come.

Are You On The “Right” Side Of This Wealth Shift?

On one side of our great divide, over 60% of Americans are living paycheck to paycheck. On the other, a few smart Americans have come across a unique window of opportunity… with the upside potential for 1,000% returns and higher. But you must act fast to claim your stake…

“But I Don’t Want a Tesla!”

As you’ve heard me say in the past, Tesla Inc.’s (TSLA) time as the preeminent industry leader is growing short. The price point on most models is still too steep for many middle-class Americans, and Elon Musk has become distracted by new hobbies like Twitter and political commentary.

In fact, my team and I have seen bumper stickers expressing displeasure for the controversial company on the backs of actual Teslas: “Make This Car Less Embarrassing Again” and “Bought Before Elon Went Full Elon” are just two examples.

But for many, the Tesla is still an attractive investment. The price has dropped on a few models, and the company is always improving its EVs’ performance. Plus, the White House announced in February that the Bipartisan Infrastructure Law would provide approximately $24.5 billion to companies like Tesla that provide EV charging, clean transportation, and battery components, critical minerals, and materials, including to Tesla, or will retrofit existing ports and create new charging ports for all EV models.

There’s no need to obsess about Tesla and the company’s future and its eccentric leader, when the EV sector is offering so many other ways to play the EV trend. But I do expect several companies to start outperforming Tesla in 2023 and beyond – by making a market-beating advance, as Tesla’s lavish valuation continues to shrivel.

The Rise of the Budget EVs

There are a lot of compelling reasons to look elsewhere for an EV, not the least of which is the Tesla Model 3’s base price of around $41,990. There are at least three EV base models currently priced at $30,000 – the Chevrolet Bolt, Bolt EUV, and Nissan Leaf.

According to Car & Driver magazine, we can expect more than 60 new EV models in the next five years, and that includes…

- A new, less expensive base-model Tesla (the Model 2)…

- General Motors Co.’s (GM) sub-$30,000 Equinox, scheduled to be shipped in fall 2023…

- And startup company Fisker Inc.’s (FSR) $29,900 PEAR crossover, due in the U.S. in 2024.

Many of these new models also come with a handy tax credit of up to $7,500, but only if they meet strict battery sourcing requirements. Last month, the U.S. Department of Treasury released those requirements

, and this week, the Department released a full list of eligible vehicles. That eligibility is based on whether companies use U.S.-based battery minerals and/or manufacture battery components in North America.

The list of eligible vehicles is pretty limited – only 11 EV models currently qualify – and players like Audi, BMW, and Volkswagen are completely excluded… for now.

Deglobalization Makes Sound Financial Sense

You’ve likely heard me discuss the deglobalization megatrend – the process of companies who mainly do business overseas bringing their operations to the United States. The quest to bring down the cost of EVs, meet strict governmental benchmarks for clean energy, and decrease overreliance on foreign supply chains means there’s a fortune to be made stateside. Just look…

Ford Motor Co. (F) recently inked a deal to spend $11.4 billion to build four EV sites in Kentucky and Tennessee, including a site called Blue Oval City… Ford’s first all-new production plant since 1969.

GM has linked up with LG Energy Solutions to build a massive EV battery plant in Spring Hill, Tennessee. At the same site, GM has also launched production on the all-electric Cadillac Lyriq. In fact, the automaker says that by 2035, it doesn’t plan to sell anything but electric cars. And it plans to make a lot of them – along with the batteries to power them – in Tennessee.

Meanwhile, Nissan Motor Co. Ltd. (NSANY) has built an EV battery plant in Smyrna, Tennessee… Mercedes-Benz has opened an EV battery plant in Woodstock, Alabama… and Volkswagen’s (VWAGY) first American-made EVs are just starting to roll out of its plant in Chattanooga, Tennessee…

BMW is about to spend $1.7 billion on an EV and battery plant in Greer, South Carolina…

And those are just companies you’ve heard of.

Electric vehicles and all of its related sectors are coming home… and with that, comes unbelievable wealth-growing opportunities. You don’t have to look far to capitalize on this megatrend, but I suggest you start now.

Get all the details here – including one of my top picks in the EV sector, absolutely free.