Plowed by rising debt levels and negative margins, Sprint Corp (NYSE:S) became the proverbial hot potato that no one wanted to touch. Since January 2014 until earlier this year, Sprint stock gave up 76% of market value. Even compared to choppy telecommunications investments like Verizon Communications Inc. (NYSE:VZ) and T-Mobile US, Inc (NASDAQ:TMUS), S stock was awful. But with its massive resurgence, should investors give Sprint a second look?

Otherwise, it has been a real mess. It hasn’t been uncommon for S stock earnings to undercut consensus by triple-digit margins. Not surprisingly, Sprint shareholders have headed for the exits, following the footsteps of the institutional money.

Many times, Sprint has played the part of the desperate boxer, throwing speculative swings at the hope of a knockout. Although it’s in a much better position now, the company still can’t shake the image of industry laggard. A prime example is T-Mobile’s recent unlimited data plan announcement, which was quickly mimicked by Sprint a mere few minutes later.

The Bull Case for Sprint Stock

On the other hand, S stock is up 76% year-to-date. That’s the kind of momentum you can’t afford to ignore! Sprint stock also undid all of the damage from last year. At the current market rate, shares are up 15% from the highest closing price achieved in 2015.

This is not a matter of scrapping for statistics. Sprint has been making very smart deals, with the just announced partnership with DraftKings a potential game-changer. Under the terms of the agreement, all qualifying Sprint Android smartphones will be pre-loaded with DraftKings’ mobile app.

This is a win-win for both parties. As the leader in fantasy sports entertainment, DraftKings will have another avenue by which to grow their ever-expanding business. For S stock, it only helps the mobile carrier’s long-term strategy. Fantasy sports participation has jumped exponentially year after year. Serving this key demographic is a no-brainer. In addition, women are increasingly involved in fantasy sports leagues, making for a surprisingly diverse consumer base.

The deal is in perfect harmony with Sprint’s efforts to jumpstart subscription growth. For its most recent Q1 FY2017 earnings report, the company added 180,000 monthly subscribers, smoking the consensus estimate of 112,000. It also marked the sixth consecutive time in which the company registered subs growth. As a result, some notable analysts were willing to rethink their assessment towards Sprint stock.

S Stock Is a Trader’s Dream

What will likely drive the retail investment community, however, are the phenomenal gains that are still possible for Sprint stock. Typically, the craziest moves are witnessed during a company’s initial phase, where not many people are willing to gamble on an unknown variable. That’s often the story with technology firms like Microsoft Corporation (NASDAQ:MSFT). MSFT was a guaranteed moneymaker in the 1980s and 1990s. Today, traders have to be a bit more careful.

Interestingly, with S stock, the opposite is true.

Click to Enlarge

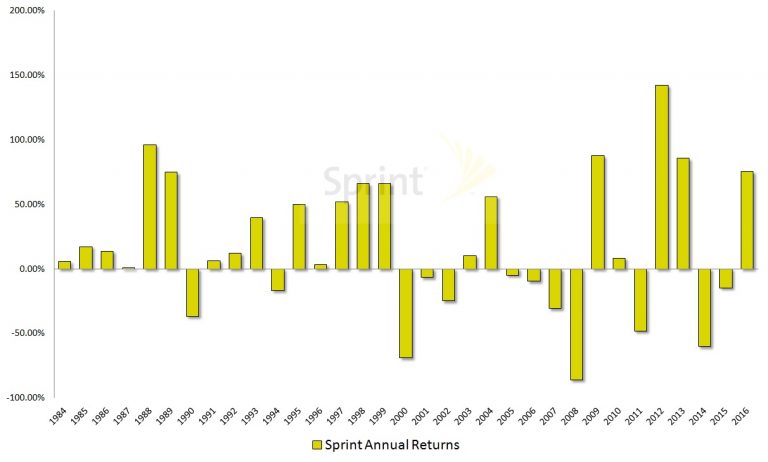

When shares were first publicly traded in the early eighties, Sprint stock went through some growing pains before asserting itself. A series of consistently strong performances led to an average annual return of nearly 30% between 1984 and 1999.

The following decade brought on one of the worst financial disasters in modern history, nearly crippling S stock.

But in the current decade, Sprint stock is averaging 27% annual returns. That stat is all the more remarkable considering that in 2011, shares lost 48% of their value, and a whopping 60% in 2014.

It boils down to simple math. When S stock has delivered investor profits over the last seven years, it averages 79% returns. Also, its 142% haul in 2012 was a record-breaker for the company.

By no means is Sprint stock an opportunity for everyone. There’s a lot of ugliness in the financials that is liable to bite them. Still, give credit where it’s due. Sub growth is up, deals are being made and traders are loving it.

As of this writing, Josh Enomoto did not hold a position in any of the aforementioned securities.