Continued good news about the economy is starting to thaw parts of the market that have been quietly chugging along in recent years — especially in small-cap tech.

For most of these stocks, the recovery began from rock-bottom levels last year. But as the economy stabilized and slowly strengthened, these stocks started their rise. Simply put, these seven small-cap tech stocks to buy are ready to rock ‘n’ roll.

There are two main factors at play here. First, in a growing economy, small stocks usually perform better than large stocks. They’re starting from a smaller base of business and a growing order base makes the grow much faster. It’s like comparing a mature plant to a seedling. The same amount of water has a greater effect on the growth rate of the seedling.

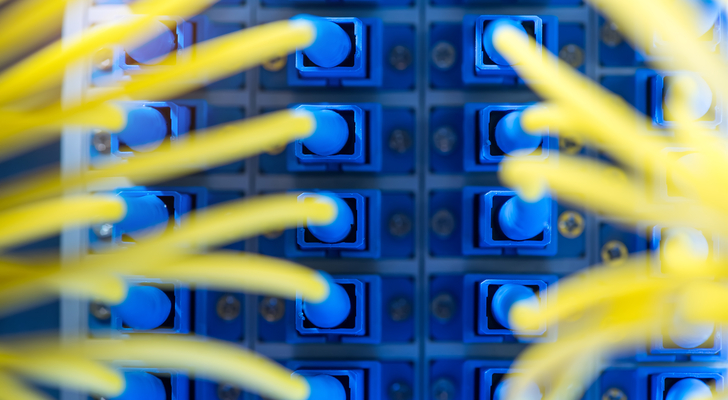

Second, we’re in the beginnings of a cyclical upturn in tech. There is a new wave of demand for cutting-edge equipment that will take broadband and telecommunications to the next level. These companies are laser focused on important niches in this trend.

![]()

Small-Cap Tech Stocks to Buy: Oclaro (OCLR)

Oclaro, Inc. (NASDAQ:OCLR) is an optical networking company. And while its slogan “100G and beyond” is reminiscent of the Buzz Lightyear’s “to infinity and beyond,” OCLR is not toying around.

It is a serious player in optical networking for high-speed global networks, offering transmission products and modules to telecom firms, enterprise networks and data centers.

While this puts in competition with some of the big players in networking like Cisco Systems, Inc. (NASDAQ:CISCO), its focus on its core markets and high-speed components gives it a very big audience as the need for speed ramps up yet again.

Its biggest advantage now is its solid position in China. As China begins to recover, it will once again look to modernize and upgrade its computing and telecom speeds, which means growth is just beginning again for OCLR.

![]()

Small-Cap Tech Stocks to Buy: Applied Optoelectronics Inc (AAOI)

Applied Optoelectronics Inc (NASDAQ:AAOI) is another company in the fast-growing fiber optic space.

For a great deal of its public life (it IPO’d in late 2013) it hasn’t made much of a stir. But over the past year, the stock is up 177%. And over the past three months it’s up 100%-plus. Just in February it was up 49%.

We have reached the limits that copper wire can take us. Early on in the first wave of the internet boom, copper was touted as a viable source of moving information from point A to point B. After the dot-com bubble burst in 2000, most optical networking companies dried up and blew away.

Some bigger telecoms were still committed to laying fiber — and investing in fiber optic networking — but smaller players didn’t have a lot of places to sell their wares.

That has changed now. And as the world recovers from the financial crisis, more companies see technology as the answer to their needs more than manpower. This stands to benefit AAOI mightily.

![]()

Small-Cap Tech Stocks to Buy: Yirendai (YRD)

Yirendai Ltd – ADR (NYSE:YRD) has a couple things going for it right now.

First, as one of China’s top online lenders — consumer loans for home remodels, durable good purchases, travel and continuing education — and online financial services for individual investors, it occupies a unique niche in the growing credit sector in China. It even allows people to finance loans to others, acting as the middleman.

Second, YRD is going to be a big beneficiary of the growing middle class and aspiring working class looking to improve their lot. As the Chinese economy recovers, this is the front line of that recovery. Small loans to start a business, going back to school or upgrading appliances, are all part of that initial growth.

The stock is up a staggering 215% in the past 12 months, but has come off a bit in recent days, which makes this a good time to step in.

![]()

Small-Cap Tech Stocks to Buy: Advanced Energy (AEIS)

Advanced Energy Industries, Inc. (NASDAQ:AEIS) is a good example in the recovery of the tech manufacturing sector. Since 1981, it has supplied power control and management systems and technologies to industries around the world.

What does this mean? Say you run a semiconductor manufacturing plant. You need to make sure your power supplies are “Five Nines” (99.999%) reliable every day you are operational. AEIS would be the company you go to to make sure your power consumption and supplies are efficient, effective and most important, reliable.

The fact that the stock has climbed 110% in the past 12 months is a very good indicator that its clients are growing their businesses again and looking to AEIS to help make that happen.

![]()

Small-Cap Tech Stocks to Buy: Extreme Networks (EXTR)

Extreme Networks, Inc (NASDAQ:EXTR) is fundamentally a network infrastructure equipment provider. Its focus is on the enterprise, healthcare, government, educational and metropolitan service providers around the globe.

In the past three months, the stock is up more than 30%, largely driven by its stalking horse bid for the assets of now-bankrupt competitor Avaya. EXTR has offered $100 million for the company at auction. Avaya’s book of business is valued by EXTR at around $200 million.

Obviously, to buy a company for half the value of its business would be a coup. The interesting piece is, since EXTR was first to bid — the stalking horse — it gets fees even if it eventually loses the auction, so it’s a win-win.

![]()

Small-Cap Tech Stocks to Buy: ePlus (PLUS)

ePlus Inc. (NASDAQ:PLUS) is an IT firm that specializes in working within the IT community to build out integrated IT systems for major firms across the U.S. It also has an office in London.

Basically, PLUS creates stability from the constant change that is going in many businesses today as they try to keep up with technology that will help their businesses run better. PLUS, with its engineers, architects and consultants listens to what its client needs and then provides an entire business solution, from equipment to third-party software.

PLUS is up more than 70% in the past year, and that’s actually just ahead of its five-year growth average of about 60% a year. Now, it’s just off its 52-week highs, but considering its long-term pattern, it looks to be in another growth phase.

That isn’t surprising considering the recovery in the U.S. market and the revival of the global economy.

![]()

Small-Cap Tech Stocks to Buy: Kemet (KEM)

Kemet Corporation (NYSE:KEM) is a very niche field, but is illustrative of what is happening in the broader tech space. KEM makes passive electronic devices.

Without going too deep, an electronic device needs an active component that controls current. Components that don’t — like capacitors, resistors, transformers, etc — are passive devices. Basically, KEM produces the building blocks for electronic devices from circuit boards to power drills.

And it recently announced that it is buying NEC’s EMD (electromechanical devices) division, which will further broaden its product lines in an entirely new direction. EMDs use an electrical signal to create a mechanical movement.

The larger point here is, the stock is up 230% in the past six months, which shows you that the pent-up demand for tech spending is finally finding its way into the marketplace.

Louis Navellier is a renowned growth investor. He is the editor of five investing newsletters: Blue Chip Growth, Emerging Growth, Ultimate Growth, Family Trust and Platinum Growth. His most popular service, Blue Chip Growth, has a track record of beating the market 3:1 over the last 14 years. He uses a combination of quantitative and fundamental analysis to identify market-beating stocks. Mr. Navellier has made his proven formula accessible to investors via his free, online stock rating tool, PortfolioGrader.com. Louis Navellier may hold some of the aforementioned securities in one or more of his newsletters.