Unless you’ve been sleeping under a rock, you know how incredible Nvidia Corporation (NASDAQ:NVDA) has been. Even though shares are down almost 20% from the highs near $121, its performance is still monstrous. NVDA stock is up 48% over the past six months and 170% over the past year.

Its exposure to a number of high-growth industries has made it a favorite spot for investors to go. In fact, it’s not just NVDA. Advanced Micro Devices, Inc. (NASDAQ:AMD), Micron Technology, Inc. (NASDAQ:MU) and NXP Semiconductors NV (NASDAQ:NXPI) — which was acquired for $110 per share — have all posted torrid growth over the past year.

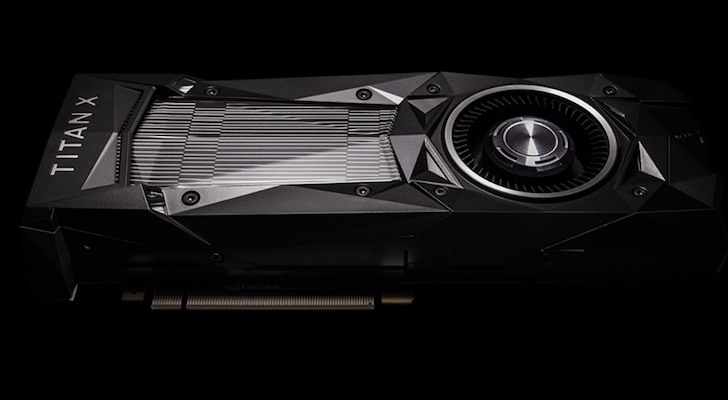

Simply put, semiconductor and chip stocks have been on fire and Nvidia has been their leader. Nvidia is diversified among a number of secular growth themes, including self-driving cars, data centers, gaming, machine learning, and artificial intelligence.

The question is, how much of that growth is priced in and does NVDA stock have further to run?

How to Handle NVDA Stock

It’s not a question of whether NVDA is a good company or whether Nvidia stock is a winner. It is a winner and a great company. But when to buy is very important after such a big run.

Click to Enlarge

Looking at the chart, you can see support sits at $95, (the blue line). Investors have a couple of options here. They could buy the stock at $95, if it falls there and holds.

They could also buy the stock now and use a close below $95 as their stop. This the short-term setup, but it’s not as attractive as a longer-term approach.

A more opportune setup would be for NVDA stock to fall below support. The goal here would be to see a pullback to its 200-day moving average at $82.50, (the blue circle). Considering the stock’s strong momentum over the past year, investors and institutions will likely pile into NVDA at its 200-day. If it falls there, it’s a high-probability bounce spot.

Obviously, timing is more sensitive for traders than it is for investors. Since investors are taking a longer-term approach, they can sit through some of the ups and downs. Although, it’s preferable to eliminate as much of the downs as possible.

On the fundamental side, Analysts expect Nvidia to earn $2.88 per share this year, up 12% from 2016. In 2018, they expect NVDA to grow EPS by 18%. Sales expectations for 2017 and 2018 call for growth of 16.3% and 12.3%, respectively.

Currently, shares trade at 38 times last year’s earnings and 29 times expected earnings. So far, the analysts have been behind the ball.

Are the Analysts Missing Something?

Nvidia has topped expectations in the last six quarters. But “topped expectations” is putting it lightly — the company has beat analysts’ estimates by an average of more than 50% in that span.

Let’s say NVDA is able to top analysts’ average expectations by 25% this year. That would mean Nvidia earns $3.60 in 2017 rather than $2.88. The $3.60 EPS estimate is actually below the Street-high estimate of $3.67. It’s also above analysts’ average estimate of $3.40 in EPS for 2018.

All this is to say that Nvidia might not be valued at its full potential. Sure, a lot of optimism is priced in — after all, it’s rallied more than 170% in the past year. But if NVDA continues to beat expectations by a wide margin, then the stock actually carries a lower forward valuation.

Bulls and bears can debate until they’re blue in the face about what the proper valuation is. But for savvy investors, that’s not the point. Rather, if we can buy shares of Nvidia on a pullback to its 200-day average, we’re not only setting ourselves up for a high-probability bounce. We are also grabbing a high-quality company with potentially undervalued secular growth at a discount.

Of course there’s a chance it may not work out or the stock may not pullback that far. But when investing, it all comes down to probabilities. And NVDA stock is likely to do well, so long as the company continues to do well. Both seem likely to do so and buying on a pullback gives us our best chance of success.

Bret Kenwell is the manager and author of Future Blue Chips. He can be contacted on Twitter via @BretKenwell. As of this writing, Bret Kenwell held no positions in any security mentioned.