Shares of MannKind Corporation (NASDAQ:MNKD) stock are rocketing higher yet again on Monday, up another 9% after a 10% rally on Friday. MNKD stock has seen jumps like this before, but in the case of its most recent rebound, I expect shares to remain elevated for some time.

And if they don’t? Fine by me. I’ll just snap up more MannKind stock at lower prices (I’ve been a shareholder myself for several years now).

And if they don’t? Fine by me. I’ll just snap up more MannKind stock at lower prices (I’ve been a shareholder myself for several years now).

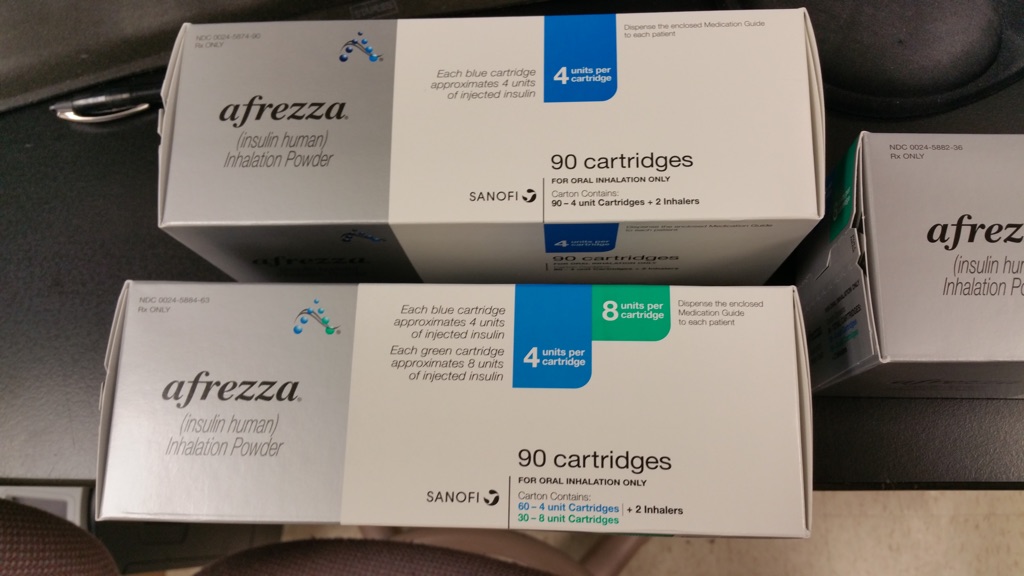

What initially sold me — and many other current shareholders, I’m sure — on MNKD stock was the incredible potential of its inhalable insulin drug, Afrezza. After its FDA approval last summer approved Afrezza to treat both Type 1 and Type 2 diabetes, I became an even bigger believer in MannKind.

Moving forward, there are three core reasons I believe MNKD stock won’t be slumping anytime soon:

#1: A Glowing Analyst Report

Wall Street research firm Jefferies came out with an overwhelmingly bullish note on MNKD stock late last week, helping ignite the recent rally. Afrezza sales in the early going have been sub-par, but with pharmaceutical giant Sanofi SA (ADR) (NYSE:SNY) handling the marketing and selling of Afrezza, MannKind is in good hands.

Jefferies analyst Shaunak Deepak agrees, and, after conducting a survey of 56 endocrinologists, outlined why he believes the stock is undervalued:

“Only a tenth of doctors screened had written an Afrezza script, we see MNKD’s efforts to expand access to spirometers and begin advertising in 3Q as key catalysts for uptake. With advertising, we expect the eventual rate of non-prescribers will fall closer to 12 percent. The 2015-2017 Afrezza use numbers implied by our survey suggest penetration rates nearly four times higher than we had previously modeled, and a $37 PT.”

Yes, that’s a $37 long-term MNKD price target. Not too shabby for a stock trading for less than $5.

#2: Competitors Potentially Crimped

MNKD has a huge runway as it continues to educate doctors (and patients) about its product, and Afrezza may also reap the benefits of a health warning in regards to some of its largest competitors’ products.

The Food and Drug Administration just put out a release warning of higher ketoacidosis risk in those who use SGLT2 diabetes treatments. According to the American Diabetes Association, “Diabetic ketoacidosis (DKA) is a serious condition that can lead to diabetic coma (passing out for a long time) or even death.”

Serious indeed. And now MNKD competitors with SGLT2 drugs like Johnson & Johnson

(NYSE:JNJ), AstraZeneca plc (ADR) (NYSE:AZN), and Eli Lilly and Co (NYSE:LLY) may each see lower sales of their SGLT2 diabetes treatments as cautious doctors and prescribers turn to other options.

#3: Technicals

Finally, the technical indicators seem to be pointing in the right direction. After spending all of May with a Relative Strength Index below 30 — indicating MNKD stock was severely oversold — RSI is gapping higher and just reached 50.

More importantly, MNKD broke through its 20-day simple moving average on Monday, and is now just 10% below its 50-day SMA. Another frequently watched technical indicator, MACD, just crossed above its signal line, marking yet another bullish technical indicator.

If MNKD can hold above its 20-day SMA, as it is today, then both the technicals and the fundamentals would be firmly pointing towards a sustained move higher. I love the qualitative story behind MannKind, and I believe that over the long-term, doctors and patients will recognize the convenience of Afrezza, sparking robust sales growth for years to come.

As of this writing John Divine was long shares of MNKD stock, and long Jan 2016 MNKD $7 call options. You can follow him on Twitter at @divinebizkid or email him at editor@investorplace.com.