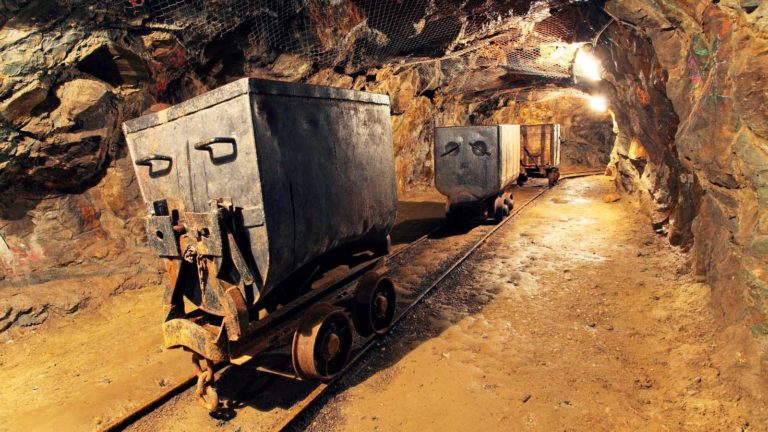

It has been a mixed year for mining exchange-traded funds. Investors that have embraced industrial miners ETFs or those mininig ETFs featuring a mix of industrial and precious metals have endured middling returns and elevated volatility.

Conversely, precious metals mining ETFs have been on torrid paces as central banks throughout the world, including the Federal Reserve, have trimmed interest rates to prop up stalling economies. Lower interest rates benefit assets such as gold and silver because those metals and related funds do not pay dividends or coupon payments.

Gold’s resurgence has lifted an array of mining ETFs this year because companies that extract the yellow metal from the earth are usually intimately correlated to bullion’s price action. While gold and the related ETFs have been soaring this year as commodities market observers have consistently boosted bullion price forecasts, there are risks, namely market participants shifting back to riskier assets.

With those risks in mind, here are some mining ETFs to consider and ideas for how to deal with these funds over the near-term.

SPDR S&P Metals & Mining ETF (XME)

Expense Ratio: 0.35%, or $35 annually per $10,000 invested

The SPDR S&P Metals & Mining ETF (NYSEARCA:XME) is a prime example of a struggling mining ETF and those struggles can be sourced to the fund’s diversified approach, meaning its roster is comprised of industrial and precious metals producers.

The $440.52 million XME “seeks to provide exposure to the metals & mining segment of the S&P TMI, which comprises the following sub-industries: Aluminum, Coal & Consumable Fuels, Copper, Diversified Metals & Mining, Gold, Precious Metals & Minerals, Silver, and Steel,” according to State Street.

About half of XME’s weight is allocated to steel producers, more than double the weight the fund assigns to precious metals miners. Steel prices are volatile and vulnerable to significant downside if major global economies are stalling or flirting with recessions. Couple that with XME’s penchant for being much more volatile than other industry funds and this mining ETF looks more like a trade over the near-term, not an investment for long-term players. Unless you can actively monitor positions in XME, stay on the sidelines with this mining ETF for the time being.

VanEck Vectors Steel ETF (SLX)

Expense Ratio: 0.56%

Speaking of steel prices, the VanEck Vectors Steel ETF (NYSEARCA:SLX) is another volatile bet in the mining ETF arena. SLX has been all over the place as of late, slumping 4.52% last week, a slide that trimmed a September gain down to 6.91%, which hadn’t done much in terms of eating into a 12-month slide of 23.54%.

Although it’s not even a top 10 holding in SLX, US Steel (NYSE:X) has been a major culprit behind SLX’s weakness.

Last week, US Steel said “its third-quarter earnings would be sharply lower than previously forecast due to lower steel prices and deteriorating conditions in Europe, sending shares sharply lower,” according to Fox Business.

Putting SLX on the “avoid” mining ETF list over the near-term isn’t difficult because steel prices are heavily levered to economic activity in China and Europe, two regions that are showing signs of sluggishness in their respective economies.

VanEck Vectors Coal ETF (KOL)

Expense Ratio: 0.64%

The VanEck Vectors Coal ETF (NYSEARCA:KOL) is lower by 9.6% year-to-date and pin-pointing when this mining ETF is going to bounce back is a dicey proposition. Coal equities have been punished by increased adoption of and lower prices offered by alternative energy sources, such as solar. The International Energy Agency (IEA) is expecting renewable energy capacity to increase 12% this year.

So one issue for coal is that electric utilities, particularly in developed markets such as the U.S., are shifting away from coal to cleaner burning alternatives. The second factor to consider and it’s related to the aforementioned SLX, is that if steel demand slides, so will demand for metallurgical coal. That’s the variety of coal used to make steel.

There are other anecdotes that underscore the weakness in the domestic coal industry. For instance, wind power is about to surpass coal as a power source in Texas for the first time. Additionally, mines are being shuttered in some key U.S. coal regions, indicating the near-term case for coal equities is murky at best.

Global X Silver Miners ETF (SIL)

Expense Ratio: 0.65%

Up 20% this year, the Global X Silver Miners ETF (NYSEARCA:SIL) has been one of 2019’s more impressive mining ETFs. The $526.7 million SIL is nine and a half years old and tracks the Solactive Global Silver Miners Total Return Index. The average market capitalization of SIL’s holdings is $2.44 billion, meaning this mining ETF is essentially a small-cap bet.

Like gold mining ETFs, SIL reacts to silver’s price action. If some recent, ambitious forecasts prove accurate, that will be beneficial to SIL owners.

“Right now, we want to trade silver up to $20. We think gold is going to stabilize at $1,500 and we see silver moving to $20, so that’s a 12% move we think we can capture in the next probably eight weeks. We see that as pretty much a certainty, and we’re willing to bet on that,” said E.B. Tucker, director of Metalla Royalty & Streaming, in an interview with Kitco News.

Fine print: like many of the other mining ETFs out there, SIL is a volatile bet. It has a standard deviation of 24.70%, so if silver prices stumble, this mining ETF will be punished.

VanEck Vectors Gold Miners ETF (GDX)

Expense Ratio: 0.52%

The VanEck Vectors Gold Miners ETF (NYSEARCA:GDX) is one of this year’s best mining ETFs with a gain of 36%, which has been fueled by rising gold prices. The $12 billion GDX is one of the largest mining ETFs, making it a bellwether for investors seeking added upside when bullion prices rally.

Essentially, GDX’s risk/reward profile is levered to gold prices. What investors need to be aware of is GDX’s tendency to overshoot gold prices in either direction and volatility as highlighted by this mining ETF’s three-year standard deviation of nearly 24%.

Another consideration with GDX and rival gold mining ETFs is how much risk mining companies are willing to take on. Over the past several years, gold miners reined exploration budgets and capital spending as a way of shoring up their balance sheets following years of profligate spending. However, high gold prices, which are in place today, have a way of motivating miners to increase activity to exploit those higher prices.

A “surge in gold prices and overall optimism reviving across the gold mining sector have finally encouraged miners, developers and explorers to pour more money into drilling campaigns,” according to Mining.com. “In July 2019, companies reported exploration results for 171 projects … which is the highest count observed since the beginning of 2019.”

As of this writing, Todd Shriber did not hold a position in any of the aforementioned securities.