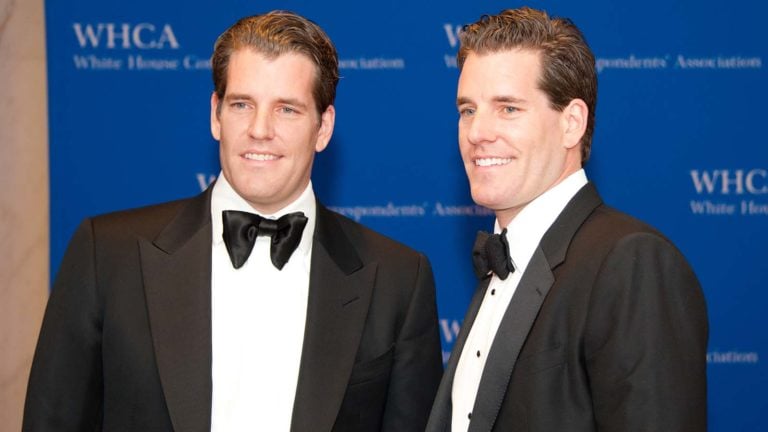

Cameron and Tyler Winklevoss are two of the most interesting figures in crypto. After allegedly having the idea for Facebook (NASDAQ:FB) ripped off of them by Mark Zuckerberg, the pair took him to court. A settlement of $45 million in FB stock and $20 million cash would fall into their lap as a result. One savvy investment in Bitcoin (CCC:BTC-USD) later, and the duo would find themselves to be some of the first Bitcoin billionaires ever. Now, they are at the forefront of all the latest crypto trends

The pair obviously have an intuition when it comes to the crypto. This means that when they talk, investors listen. After all, who doesn’t want to find the next Bitcoin?

With all that being said, the two superstar crypto investors have their hands in a lot of different blockchain investments. Let’s take a look at six crypto trends the duo are betting on for the future.

Crypto Trends: Betting Big on Bitcoin

Come on, you didn’t think Cameron and Tyler Winklevoss turned their back on Bitcoin, did you?

The big boss crypto is still the poster-child for the entire blockchain industry, and it’s certainly not going anywhere soon. In fact, Bitcoin seems to just be hitting its stride as it continues reaching new highs. There is a lot of speculation that Bitcoin could even make a run at $100,000 reasonably soon.

The Winklevoss twins are speculated to own an astronomical 1% of all BTC tokens. That amount of Bitcoin is worth well over $1.5 billion. Of their impressive share of the Bitcoin pool, they are rumored to have never spent any of it. The two are still all in on BTC. Apparently they, like most everyone else, sees Bitcoin as the best long-term investment in the cryptocurrency world.

BlockFi

A relatively recent investment by the pair of crypto entrepreneurs is that of BlockFi. BlockFi is an all-in-one wealth management tool for cryptocurrency investors.

As some of the most highly invested figures in the world of crypto, it’s obvious that the pair would be enticed by such a tool. Through Block-Fi, one can create an interest-accruing savings account using their crypto wallet. The platform also has its own exchange, notable for recently listing Dogecoin (CCC:DOGE-USD) amidst its huge upswings.

BlockFi has recently upped its valuation quite a bit during a round of fundraising. Finding support in industry giants like Coinbase (NASDAQ:COIN), Galaxy Digital (OTCMKTS:BRPHF) and SoFi, the company raised $350 million and brought its valuation to $3 billion. Winklevoss-owned Gemini Trust is also now the primary custodian for BlockFi.

Crypto Trends: The Gemini Exchange

Founded in 2014, Gemini Exchange is the first crypto venture created by the Winklevoss twins, and it is highly successful today. The Gemini Exchange was created originally as a way for crypto traders to easily access Bitcoin. In only a couple years time it would find its big claim to fame as the first exchange authorized to buy and trade Ethereum (CCC:ETH-USD).

Gemini Exchange has picked up a calling card as one of the most secure exchange options available to investors. Since its inception, Gemini has grown from just an exchange into a trust company,

now regulated by the New York State Department of Financial Services. Gemini’s custody services have secured $200 million since its inception.

Nifty Gateway NFT Marketplace

It seems like every meme, album or piece of digital artwork these days is turning into a non-fungible token (NFT). Naturally, the Winklevoss brothers were in on NFTs early… about two years early, in fact. In 2019, Gemini Trust purchased Nifty Gateway, the leading NFT marketplace. The platform is estimated to be worth around $1.2 billion today.

Nifty Gateway is a marketplace for NFT artwork. Think of it as the NFT version of Sotheby’s, where users try to outbid each other on digital art. Actually, that’s exactly what it is, considering the partnership deal Nifty Gateway inked with Sotheby’s last month. Nifty Gateway is a leader in NFT sales, and collaborates regularly with artists on Nifty-exclusive NFT packs. Currently, the digital art dealer is partnering with Harlem rapper A$AP Rocky on a series of NFTs. These huge collaborations are what make NFTs one of the biggest crypto trends of today.

Crypto Trends: BitClout Gets the Winklevoss Co-Sign

With the infamous Facebook background that precedes the Winklevoss twins, you would expect the pair to know a thing or two about social media. So when BitClout received an investment from the crypto kings, people started paying attention. In fact, the brothers were two of the earliest investors, along with trading giant Chamath Palihapitiya and Reddit co-founder Alexis Ohanian.

BitClout is the collision of the social media age and the crypto tour de force in one product. What makes the product so interesting is its tokenization of social currency. Users of BitClout have the chance to buy and sell digital coins based on social status. This means more popular users have more access to trading. The model is obviously bringing along a fair bit of controversy, but it is also generating positive buzz.

Protocol Labs

One of the earlier investments by Winklevoss Capital, the brothers put money on Protocol Labs back in 2014. The decentralized project exemplifies the ideology that “the idea of a centralized network is not going to exist” in the near future, according to the pair.

Protocol Labs operates as a platform for users to create a variety of decentralized services. The most widely known of these projects is Filecoin (CCC:FIL-USD), which rewards users for renting out free storage space on their computers. Protocol Labs is one of the earliest innovators in the trend of DApps that we are seeing today. As such, Protocol Labs is one of the most cutting-edge crypto trends of today.

On the date of publication, Brenden Rearick did not have (either directly or indirectly) any positions in the securities mentioned in this article.

Brenden Rearick is an Assistant News Writer for InvestorPlace’s Today’s Market team. He graduated from the University of Pittsburgh with a degree in Professional Writing and Political Science. His journalistic background spans many topics, and he prides himself on providing the most accurate and unbiased financial news.