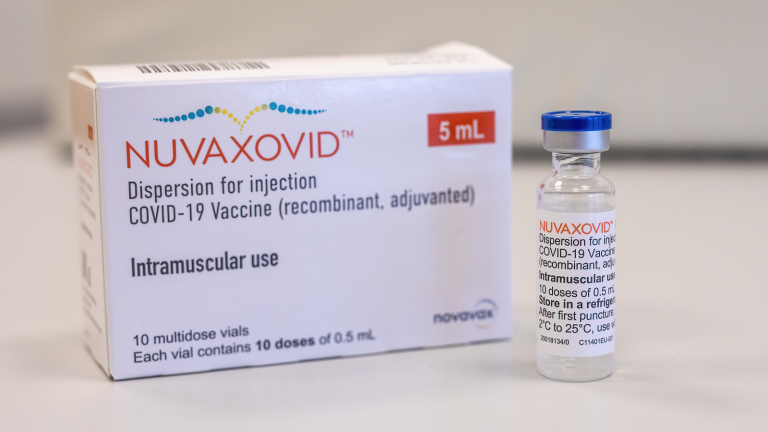

Novavax (NASDAQ:NVAX) got good news Wednesday morning. Swissmedic, the Swiss Agency for Therapeutic Products, gave Nuvaxovid, the company’s protein-based Covid-19 vaccine, conditional marketing authority (CMA). As a result, NVAX stock is 5% in early trading.

“We are proud that Switzerland is part of the growing list of countries to authorize Nuvaxovid and that people in Switzerland will have a protein-based COVID-19 vaccine option,” said Stanley C. Erck, President and Chief Executive Officer, Novavax.

Nuvaxovid is the first protein-based vaccine to gain approval from Swiss authorities for use in the country. All adults 18 and older are eligible to receive the vaccine. The Swiss government has ordered six million doses of its vaccine.

Every little bit helps when your share price is down 58% in 2022.

NVAX Stock and U.S. Approval

As CEO Stanley Erck’s words suggest, Novavax’s CMA from Switzerland is another notch in the company’s vaccine belt. In addition, Nuvaxovid was approved for use in Canada in February. To date, approximately 36 countries have given the company’s vaccine the greenlight.

Unfortunately, for the company and its shareholders, the biggest prize has yet to be given official approval by the U.S. Food and Drug Administration (FDA), and that’s been a significant headwind for Novavax’s share price.

One thing that could be holding up the FDA’s approval is it recently got a new leader. Dr. Robert Califf was sworn in

as the regulatory agency’s new Commissioner on Feb. 17. This appointment is Califf’s second time leading the FDA. He previously served as Commissioner from February 2016 to January 2017.

In addition, Moderna’s (NASDAQ:MRNA) CEO Stephane Bancel has said he doesn’t think the FDA will approve any more Covid-19 vaccines.

Where to From Here?

Investors can only view the latest news from Switzerland in a positive light regardless of what happens in the U.S. However, NVAX stock has been stubbornly bearish in 2022, despite the fact country after country keeps approving Nuvaxovid for use.

In early April, I suggested that NVAX was alluringly attractive for under $75. It’s now around $60, thanks to Switzerland’s approval. As I said before, aggressive investors ought to be interested in buying at these prices because it might not matter if the U.S. is on board for Novavax to generate significant revenues from its vaccine.

If you’ve owned Novavax shares for a while, today’s news couldn’t have come at a better time.

On the date of publication, Will Ashworth did not have (either directly or indirectly) any positions in the securities mentioned in this article. The opinions expressed in this article are those of the writer, subject to the InvestorPlace.com Publishing Guidelines.