Cathie Wood’s decision to leave active management of ARK Investment’s 3D Printing ETF (BATS:PRNT) is raising concern about the whole sector. 3D printing stocks on the whole have done very poorly this year.

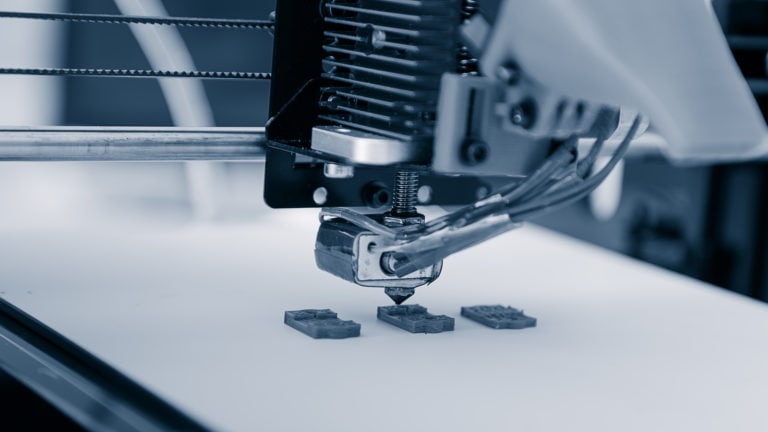

PRNT has lost 39% of its value in 2022, nearly double the loss of the S&P 500. It is focused on “additive manufacturing,” the creation of parts from printer-like machines that drip or cut precisely based on computer designs.

The market response is not only to sell PRNT, down 2.5% on Sept. 22 but to sell the leading players as well. 3D Systems (NYSE:DDD), the longtime industry leader, is down 7%. Velo3D (NYSE:VLD) is down 6%. Stratasys (NASDAQ:SSYS) is down 4%. Desktop Metal

(NYSE:DM) is down nearly 13%. Only 3D Systems is currently worth as much as $1 billion, and just barely.

Failure to Mass Produce

3D printing had a brief vogue a decade ago as Bre Pettis’ Brooklyn-based MakerBot, now owned by Stratasys, made consumer-priced 3D printers based on melting plastic and supported “maker faire” conventions for students and engineers.

The MakerBot, and a 3D Systems version called Cube, failed to catch on with the mass market. Companies then moved into industrial markets with specific use cases, like dental implants, knee replacements and wind turbines. But growth hasn’t followed. 3D Systems’ revenue in 2021 was $615 million, below the $646 million of 2017. The first two quarters of 2022 have seen a further slowdown. Profits have largely disappeared.

Stratasys, Velo3D and Desktop Metal have done little better, leading critics to call the whole idea a fad. The industry has, so far, failed to move beyond prototyping in most cases. Costs are too high for mass production.

3D Printing Stocks: What Happens Next?

Wood hasn’t given up on the field, recently buying shares in both Stratasys and Velo3D for her funds. But her step back gave critics another chance to criticize her “leading edge” technology investment strategy, and the failure of 3D printing stocks to launch.

Until 3D printing can deliver mass production at a cost competitive with other techniques, these stocks will remain in the dumper.

On the date of publication, Dana Blankenhorn held no positions in any companies mentioned in this article. The opinions expressed in this article are those of the writer, subject to the InvestorPlace.com Publishing Guidelines.