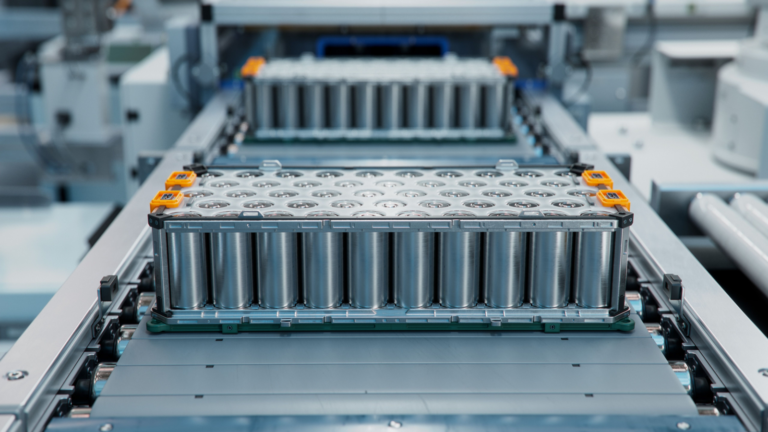

The Global X Lithium & Battery Tech ETF (NYSEARCA:LIT) shed more than 10% of its value in the past month, naturally leading to a drawdown in battery stocks.

Many might argue that the recent capitulation of battery stocks is a sign of things to come. However, I believe a buying opportunity has emerged.

What’s my basis? Well, the battery market is forecasted to grow by 16.7% annually until 2030, conveying systematic support. Moreover, various battery stocks are grossly undervalued and technically underpriced.

Considering the above, I decided to screen for three best-in-class battery stocks to buy in June 2024. Methodologically, I tapped into company-specific fundamentals, valuation multiples, and technical indicators. In addition, I assessed the prevailing sentiment related to each asset to ensure alignment.

Without further ado, here are three battery stocks to buy now.

QuantumScape (QS)

QuantumScape (NYSE:QS) stock shed nearly 20% of its value in the past month, which is ironic as JPMorgan deemed it a “rangebound” stock just before its capitulation. However, the past is the past, and we can only look ahead.

I believe QS stock is an excellent long-term buy. Given their application in the green economy, the company’s solid-state lithium metal batteries are highly touted. Although the firm has yet to produce revenue, it holds close relations with its joint-venture partner, Volkswagen (OTCMKTS:VWAGY), lending it the latitude to enter large-scale commercial production when its product line is finalized. In fact, analysts expect QuantumScape to deliver as much as $5 million in revenue during 2025.

As mentioned before, QS has plummeted in the past month. However, QuantumScape’s retreat has dragged its relative strength index down to about 36.2x, suggesting the stock is a technical contrarian opportunity.

Although a risky bet, QS stock seems like a chance worth taking.

Plug Power (PLUG)

Plug Power (NASDAQ:PLUG) is underappreciated in many ways. It appears like the kind of stock that will earn praise in broad-based bull markets and receive criticism in bear markets. However, I think the company will establish itself as a key player in the hydrogen space one day, concurrently leveling its stock out to a throughout-the-cycle stock.

Like QuantumScape, PLUG provides a solid contrarian opportunity.

PLUG stock has slid by more than 30% in the past month as the firm delivered a disappointing first-quarter earnings report. The firm’s revenue declined by 43% year-over-year to $120.3 million, and its net loss increased by $89.2 million to $295.8 million. However, much of the firm’s revenue decline was due to a seasonal sales impact, while its lower net profit margin was due to lower sales prices impacting overhead leverage.

I think investors have priced the aforementioned factors. In fact, I believe a better pricing-to-input cost environment will occur in late 2024, which could see Plug Power lift its five-year compound annual growth rate above its current base of 36.4%.

In essence, Plug Power’s growth will likely normalize. Normalization would give the stock a chance to recover, especially given that it is relatively undervalued with a price-to-book ratio of 0.6x.

Freyr Battery (FREY)

Freyr Battery (NYSE:FREY) is an integrated Norwegian battery producer. The firm banks on high-density, cost-competitive batteries that service stationary energy storage, electric mobility, and marine applications.

Similar to QuantumScape, Freyr Battery has yet to deliver revenue. However, the firm is gearing up for full automated unit cell production functionality within the next quarter. Moreover, after sourcing four preliminary projects, Freyr is refining its end market before commercial production, targeting energy storage facilities.

Furthermore, Freyr has $253 million in cash on its balance sheet, suggesting depth in liquidity, which allows it to emphasize product development. In other words. Freyr has the necessary tools to scale within the next few quarters.

FREY stock shed nearly 15% of its market value in the past six months, placing its RSI at around 38.9. As such, this stock is technically underpriced, especially as its commercial production date nears.

On the date of publication, Steve Booyens did not hold (either directly or indirectly) any positions in the securities mentioned in this article. The opinions expressed in this article are those of the writer, subject to the InvestorPlace.com Publishing Guidelines.