Business leaders often talk about thinking big. But when it comes to nanotech stocks, the future is all about focusing on the small things.

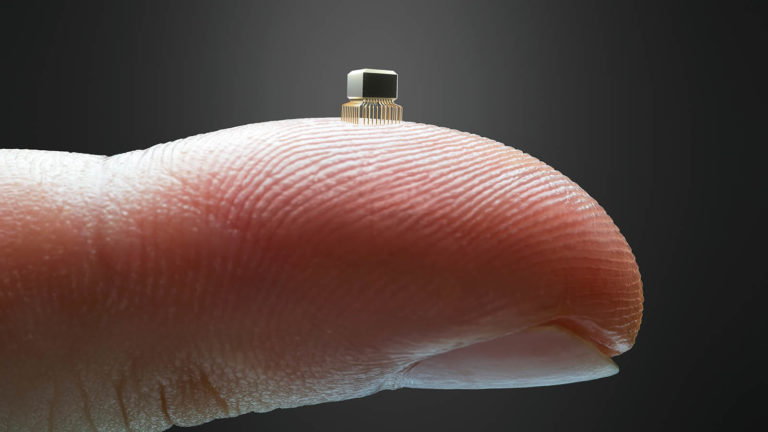

According to the European Commission, nanotechnology represents a scientific and engineering discipline that’s “devoted to designing, producing, and using structures, devices, and systems by manipulating atoms and molecules at nanoscale.” Nanoscales refer to having one or more dimensions of the order of 100 nanometers (or 100 millionth of a millimeter).

Stated differently, nanotechnology centers on density; that is, being able to pack various capacities in an extremely small space. According to Grand View Research, this field features enormous potential and applications across various scientific domains, including chemistry, biomedical science, mechanics and materials science.

In terms of hard numbers, the global nanotech market reached a valuation of $3.69 billion in 2022. By 2030, the ecosystem could be worth $36.85 billion, or a compound annual growth rate (CAGR) of 33.1%. With projected expansion like that, it pays to at least consider these nanotech stocks.

Veeco Instruments (VECO)

Based in Plainview, New York, Veeco Instruments (NASDAQ:VECO) falls under the semiconductor sector; specifically, it works in the field of semiconductor equipment and materials. Per its public profile, Veeco focuses on thin film process equipment primarily to develop electronic devices. It’s one of the top nanotech stocks thanks to the microscopic precision needed to develop these high-performance semiconductor devices.

To be sure, VECO stock has already enjoyed a robust performance so far this year. However, it’s one of the small middle-capitalization plays, making it an intriguing idea for the long haul. One aspect that’s impressive is its financial performance. Between the second quarter of 2023 to Q1 2024, the company’s average earnings per share reached 46.3 cents. This translated to an earnings surprise of 23.6%.

During the trailing 12 months, Veeco did incur a net loss of $17.25 million or 36 cents per share. However, revenue hit $687.41 million. Overall, for fiscal 2024, covering experts anticipate a recovery, with EPS possibly rising 7.1% to hit $1.81. Further, sales could increase by 8% to hit $719.47 million. Therefore, VECO makes a solid case for nanotech stocks to consider.

Bruker (BRKR)

Headquartered in Billerica, Massachusetts, Bruker (NASDAQ:BRKR) falls under the healthcare sector, specifically dealing with medical devices. Per its corporate profile, Bruker with its subsidiaries develops, manufactures and distributes scientific instruments, along with analytical and diagnostic solutions. Many of its tools – such as electronic microscopes – are vital for nanotechnology research and development.

Financially, BRKR stock makes a case for top nanotech stocks thanks to its consistency of performance. Between Q2 2023 to Q1 2024, the company’s average EPS reached 64.3 cents. This translated to an average earnings surprise of 13.63%. Notably, the company beat all of the past four of its bottom-line profitability targets.

During the TTM period, Bruker posted net income of $401.6 million, translating to earnings of $2.73 per share. Revenue during this cycle reached $3 billion. For fiscal 2024, analysts anticipate on average a slight dip in EPS to $2.66. However, revenue could see a 14% rise from the prior year to hit $3.38 billion.

In fiscal 2025, EPS could move up 18% to land at $3.14. On the top line, revenue may see an 8.6% lift to reach $3.67 billion. All in all, BRKR makes another solid case for nanotech stocks.

Luna Innovations (LUNA)

If you want to dive into the extremely speculative side of the sector, consider Luna Innovations (NASDAQ:LUNA). Falling under the technology sphere, Luna is involved in the scientific and technical instruments industry. According to its profile, Luna provides fiber optic tests, measurements and control products worldwide. Its advanced optical solutions feature relevance for entities seeking nanoscale measurements and monitoring.

To be fair, Luna’s speculative nature shows when it comes to its earnings performances. It hasn’t been hit or miss. Rather, it’s been more miss or not miss. However, the company does enjoy generally positive analyst coverage that goes back to November of last year. The latest call from Needham’s Alex Henderson is a “buy” with an $8 price target, which is massive.

During the TTM period, Luna posted a net loss of $1.12 million, or three cents per share. Revenue in the cycle landed at $116.61 million. Now, due to accounting errors, some of the numbers that have been broadcasted are not fully reliable. Obviously, that’s a concern.

Still, if you want to take the risk, analysts see fiscal 2024 revenue to rise to $165.24 million. That’s a sizable leap from prior top-line performances, making it a high-leverage gamble among nanotech stocks.

On the date of publication, Josh Enomoto did not have (either directly or indirectly) any positions in the securities mentioned in this article. The opinions expressed in this article are those of the writer, subject to the InvestorPlace.com Publishing Guidelines.