Whether it’s the car you drive, the phone you talk to or the laptop with which you write, there’s few areas that haven’t been touched by lithium. It also has medicinal uses, particularly in the treatment of mental health disorders, as well as in developing medical equipment. As the lightest known metal, it has tremendous utilitarian value, and its potential is still being explored. Because of this undeniable trend, an investment towards lithium stocks could be one of the best decisions you can make.

This isn’t a matter of hyperbole. Entire nations have actually ramped up their supply chain in order to feed growing lithium demand. In 2014, Argentina and Chile increased their lithium production by 15% each, according to data from the U.S. Geological Survey. Overall, global production increased by 6%. More recently in 2015, world lithium production did slip down to 2.5%. However, Argentina continued to blast away, skyrocketing growth to nearly 19% year-over-year.

Thanks to innovative companies like Tesla Motors Inc (NASDAQ:TSLA), lithium demand will likely be robust in 2017 and beyond. According to Electrek, it’s “estimated that there’s about 63 kg of lithium in a 70 kWh Tesla Model S battery pack.” In American terms, that’s nearly 139 pounds. Depending on the source, a Tesla battery’s lithium component alone is valued between $600 to $1,300. Think about that the next time you call “triple-A” for a jumpstart!

The bullishness isn’t just limited to industrial news. Take the exchange-traded fund Global X Lithium ETF (NYSEARCA:LIT), which has several premium lithium stocks under its belt. During its debut year in 2010, LIT’s average volume was just under 73,200 shares. That number fell to 43,400 shares the following year, and then an average of only 12,700 from 2012 through 2015. But this year, volume has jumped to nearly 74,500 shares, which would be a new record should the momentum keep pace until Dec. 31.

All the evidence points to an exciting time for the “lightweight” metal. In turn, lithium stocks — which have been relatively obscure in past years — could provide electrifying returns. Even companies that should have no business existing other than for the fact that they’re looking for the metal have profited handsomely.

Here are four lithium stocks that you need to peg on your radar.

Lithium Stocks to Buy: Sociedad Quimica y Minera de Chile (ADR) (SQM)

Click to Enlarge

When diving into an investment like lithium, you definitely want to diversify yourself as much as possible. Although there are strong drivers pushing the industry, currently, “pure” lithium stocks are largely speculative affairs.

Although you could be right in picking the sector, what would be the point if the company of choice crumbled due to financial mismanagement? This is one of the big reasons why I like Sociedad Quimica y Minera de Chile (ADR) (NYSE:SQM).

There’s an old life adage that states “you get what you pay for.” It applies to the financial markets as well, if not more so. SQM would be considered one of the most stable stocks you can buy that’s a direct play on lithium. It has a fairly strong balance sheet, highlighted by a favorable cash-to-debt ratio. Also, its profitability margins, particularly the operating margins, are among the best in the global chemicals industry.

Because of its core strengths, SQM is likely not going to give you “ten-bagger” returns. Also, shares have gone up over 56% year-to-date. But given that SQM was once approaching $60 in 2012, a doubling of value is not out of the question. Furthermore, this idea isn’t just about the straight-up gains. Buying SQM exposes you to the tailwinds enjoyed by other lithium stocks, but with more peace of mind.

Sure, there are other lithium stocks marketed as the next big thing. SQM provides no such promises. However, it’s built to handle the lithium revolution for the long-term.

Lithium Stocks to Buy: FMC Corp (FMC)

Click to Enlarge

Arguably for most investors, the very first thing they notice about a financial opportunity is the price tag. Too often, that eventually becomes our sole basis for judging its future potential.

Without looking into the financials or any number of fundamental drivers, price we assume tells us everything. Either something is too cheap — and thereby, too speculative — or is too expensive and no longer has a chance for capital growth.

While some things can be determined through price, it’s the best practice to fully research the main angles of a stock or asset before making a final decision. And if we’re being honest, too many times we jump to conclusions because the “price is right.” But what we should do is to say that the “fundamentals are right.”

This is the case for FMC Corp (NYSE:FMC). Headquartered in Philadelphia, FMC is a diversified chemicals company which employs 5,500 people. Founded in 1883, FMC is not going anywhere anytime soon. This is especially important when considering a broader strategy towards a speculative commodity like lithium. Yes, you want some exposure to potential high-growth names. At the same time, you don’t want to lose your shirt. FMC keeps you in the lithium game through its sector-specific business division with substantially less fear of losing absolutely everything.

What investors can appreciate about FMC is that it runs a cohesive strategy. The other divisions within FMC are agriculture and health and nutrition. As the names suggest, there’s scientific overlap among the divisions, which can help reduce research and development costs. Also, FMC’s lithium applications are frequently distributed to the pharmaceutical industry, which by itself is a booming market.

The quality of the company’s management, as well as its positioning in lucrative sectors, makes FMC a compelling and high-grade lithium investment.

Lithium Stocks to Buy: Nemaska Lithium Inc. (NMKEF)

Click to Enlarge

Having preached about the risks of speculative investments, there’s an unavoidable reality about lithium stocks — a vast number of them are in fact speculative. I don’t particularly have anything against penny stocks.

But they do carry inherent risks, such as fewer regulations and extremely thin volume. Because of this, it’s very possible to get the lithium sector right, and individual lithium stocks wrong.

With the cautionary tales out of the way, it may be worth giving Nemaska Lithium Inc. (OTCMKTS:NMKEF) a quick glance. One common argument is that virtually all companies started small. And it doesn’t get much smaller than NMKEF. This is a company that if you look for news on NMKEF, you simply won’t find any. That being said, it is a legitimate operation, which is headquartered in Quebec City, and whose primary operation is the “exploration and evaluation of hard rock lithium mining properties and related processing of spodumene into lithium compounds in Canada.”

I warn against giving too much credence to exploration companies without due diligence. Sadly, and quite frequently, the term is abused to the point where it has no real meaning. That being said, there were real profits made in NMKEF. On a year-to-date basis, shares are up 189%! Against this year’s closing high, NMKEF is down more than 31%, which suggests ample room for further profitability.

Another important point to consider is the rise in volume. Like the broader lithium ETF, NMKEF has witnessed a surge in buying activity in recent years. For example, there have been multiple times this year where volume hit six figures. That really wasn’t the case in 2015, and volume in 2013 and 2014 was even more depressed.

Again, market professionals are buying into lithium from all corners. Should this momentum carry forward into 2017 and beyond, don’t be surprised to see NMKEF make even more explosive gains.

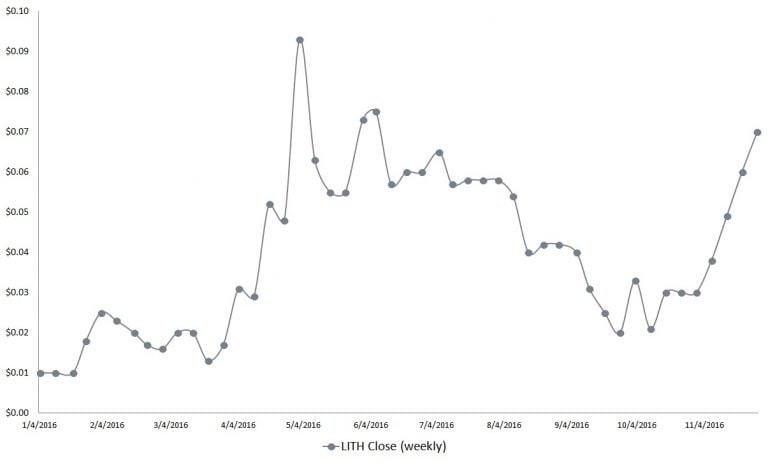

Lithium Stocks to Buy: U.S. Lithium Corp (LITH)

Click to Enlarge

With such a narrow market like lithium, it’s inevitable that a large portion of direct sector players are going to be over-the-counter offerings. That by itself isn’t a problem. There are plenty of companies — many of which are legitimate — that deliberately choose to be listed in the OTC exchanges. Primarily, the reason revolves around the cost of the listing.

Of course, most companies are listed in the OTC exchanges because other markets have standards. It’s a harsh statement to be sure, but one that is all too valid. U.S. Lithium Corp (OTCMKTS:LITH) falls firmly into this category. Want to read up on some of its news? Good luck — you won’t find much of anything. Searching for its investor relations phone number? Again, good luck getting through.

So why on Earth would anyone want to deal with LITH? From the description above, it could easily be a fly-by-night operation. However, scam companies don’t always have long-term bullish trend channels in the stock market to justify their existence. That’s exactly what LITH has done, which earns itself a mention on this list of lithium stocks.

From January 2, 2015, when shares were trading at fractions of a penny, until the waning days of November 2016, LITH has gained a whopping 1,600%. That is essentially bitcoin crazy. From this year’s election night until the end of Thanksgiving week, LITH almost doubled in value. This is simply a company that — without rhyme or reason — is currently one of the hidden gems in the markets. It also has a side business in the marijuana industry, which is simultaneously intriguing and frightening.

Yes, the company is crazy-risky, but there’s no better argument than performance. Should lithium demand push ever higher, look for LITH to keep proving the naysayers wrong.

As of this writing, Josh Enomoto did not hold a position in any of the aforementioned securities.