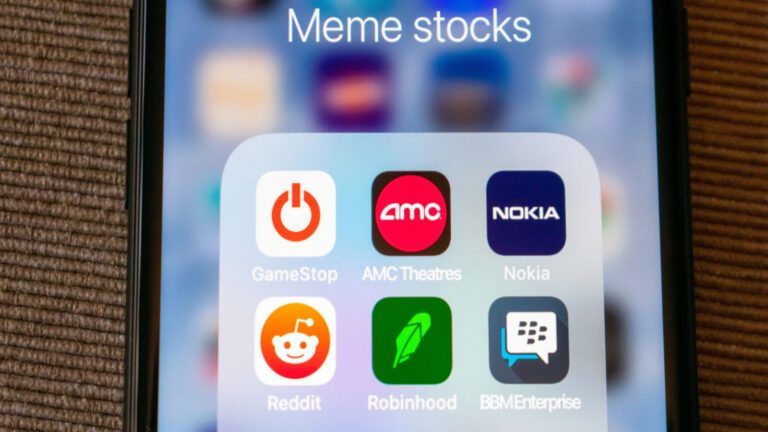

Meme stocks are staging a comeback in 2022’s second half, it seems. Among the runners this week are GameStop (NYSE:GME) stock and AMC Entertainment (NYSE:AMC) stock. It looks like those stocks are catching a broader revival in short-squeeze mania, led by Bed Bath & Beyond (NASDAQ:BBBY).

Typically, Reddit traders will look for certain qualities in a good short-squeeze target. They like it when a stock is relatively low-priced, as in less than $100. Also, they tend to prefer stocks with sentimental value, and Bed Bath & Beyond could definitely be considered an underdog.

After all, the big-box retail chain has had to deal with high inflation and its negative impact on consumer spending. The same could be said about GameStop and AMC Entertainment as well.

There’s also an interesting connection among two of these companies. Specifically, GameStop Chairman Ryan Cohen reportedly

bought out-of-the-money call options on 1.6 million Bed Bath & Beyond shares. It’s possible, then, that traders observed Cohen’s apparent confidence in meme stocks and consequently went all-in on GameStop and AMC Entertainment shares.

Big Moves in Meme Stocks, Including GME Stock and AMC Stock

If you’re a fundamentals-based investor, then you might wince at the lack of profitability of these companies. Don’t look for GameStop’s or AMC Entertainment’s trailing-12-month price-to-earnings (P/E) ratios, as they don’t have one. That’s because these companies weren’t profitable over the past year.

Still, questionable fundamentals have never stopped Reddit traders from pushing meme stocks higher. They managed to get AMC stock up to $60 last year, and this year they’ve catapulted it from $10 to $23.

Meanwhile, GME stock soared to $80 in 2021, and has rallied from $20 to $42 this year. Granted, these share-price moves aren’t as dramatic as last year’s, but this could be just the beginning of a much bigger runup.

Only time will tell whether there’s gas left in the tank or the current meme-stock frenzy will run out of steam. Today, GameStop shares were barely in the green, and AMC stock fell 5%. So, caution is definitely advised. Short squeezes can be exciting while they’re happening, but they can also end abruptly and without warning.

On the date of publication, David Moadel did not have (either directly or indirectly) any positions in the securities mentioned in this article. The opinions expressed in this article are those of the writer, subject to the InvestorPlace.com Publishing Guidelines.