By now, many of you have heard of President Biden’s EV Acceleration Challenge. That’s the initiative’s name, with a goal of 50% of all new vehicle sales being electric by 2030.

In 2022, EVs accounted for about 5% of all automobile sales. A 10x jump in seven years seems unrealistic. But even if the administration only bumps that number to 25%, the automobile landscape will likely look much different in the next 10 years.

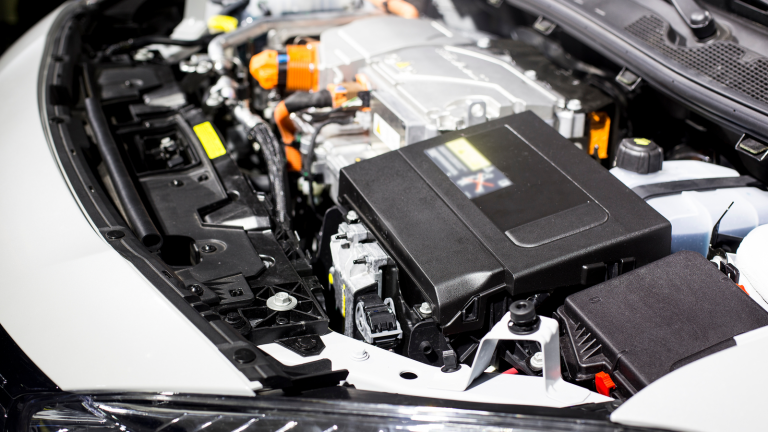

Part of this plan includes federal initiatives to boost domestic EV manufacturing and, equally importantly, the batteries that will power them. Currently, that means lithium-ion batteries. Not surprisingly, many automakers are entering into contractual arrangements with battery makers and mineral providers to ensure they can meet surging demand.

It also means the race is on to find alternatives to lithium-ion batteries. Or, at the very least, to maximize the efficiency of these batteries. There are several companies engaged in this effort. And this article highlights three companies with battery tech innovations to buy now. The best news is that one or more of these companies is likely flying underneath the radar of many investors.

| ENVX | Enovix | $12.50 |

| SLDP | Solid Power | $2.25 |

| CNXT | VanEck ChiNext ETF | $30.41 |

Enovix (ENVX)

Enovix (NASDAQ: ENVX) is one of the leaders in lithium-ion battery technology. But before we look at innovation in the sector, it’s essential to look at battery tech innovations with solid demand and supply of batteries. Right now, that means looking at companies trying to perfect the current standard.

Here’s a statistic to consider. Even before the EV Acceleration Challenge, analysts projected the EV market to grow to $155 billion by 2028. If that happens, the market will be seven times larger than in 2020. That supply-demand dynamic ensures that lithium-ion batteries will be the standard in the short term. It’s also why you can’t overlook it when buying battery tech innovations now.

But that doesn’t mean companies aren’t looking to make lithium-ion batteries as efficient as possible. And that’s the space that Enovix exists in. The company’s patented battery architecture includes using silicone instead of graphite as a lithium-ion anode. This should provide three essential benefits: enabling fast charging and extending cycle life and calendar life.

The company’s revenue and earnings are expected to grow at average rates of 171% and 29% in the next five years. At that rate, Enovix would be profitable by 2026. Analysts have set a mean price target of $30.23, a 139% increase from the price as of this writing.

Solid Power (SLDP)

One of the battery tech innovations worth watching in the world batteries is in solid-state batteries. Quantumscape (NYSE:QS) gets most of the headlines, but Solid Power (NASDAQ:SLDP) may be the savvy choice for risk-tolerant investors with a long time horizon.

Unlike lithium-ion batteries, all the electrodes inside a solid-state battery are solid. This results in a much smaller battery than a lithium-ion battery. So much more minor that two solid-state batteries can fit in the place of one lithium-ion battery and provide double the range. That’s why these are earning the nickname of “forever” batteries.

Solid Power recently received $5 million from the U.S. Department of Energy. And as Muslim Farooque recently noted to InvestorPlace readers, the company has nearly $500 million in liquidity to help it push its products across the finish line.

With all that said, investors should proceed cautiously. SLDP stock is down over 70% in the last year, and the company isn’t expecting to be profitable until 2029 at the earliest. But if you believe in the long-term outlook for the company, Solid Power stock could be an excellent speculative buy at its current price of $2.27.

VanEck ChiNext ETF (CNXT)

The last stock pick on this list is the VanEck ChiNext ETF (NYSEARCA:CNXT). This exchange traded fund exposes investors to a basket of Chinese stocks that have exposure to battery tech innovations. One of those innovations is sodium-ion batteries. As the name suggests, sodium-ion batteries use sodium instead of lithium as the main chemical ingredient in the liquid electrolyte.

Notably, one of the leading names in this emerging space is the Chinese company Contemporary Amperex Technology Co. (CATL). This brings to light the challenges of finding battery tech innovations to buy now. Many of the companies producing these innovations are not publicly-traded. Or, in the case of some foreign companies, they don’t trade on a U.S. exchange.

Investing in ETFs is one way to gain exposure while smoothing your risk. The fund has over $27 million in assets under management, with an expense ratio of just 0.65%.

On the date of publication, Chris Markoch did not have (either directly or indirectly) any positions in the securities mentioned in this article. The opinions expressed in this article are those of the writer, subject to the InvestorPlace.com Publishing Guidelines.