Memory chip maker Micron Technology (NASDAQ:MU) jumped 6% over the weekend, on the kind of news that usually moves oil stocks. Rival Samsung (OTCMKTS:SSNLF) said it was cutting its memory chip output, which bolstered support for the U.S. memory chip leader.

Micron stock rose to over $62 per share on April 10, after opening on April 7 below $57. Goldman Sachs increased its price target on the Idaho-based chipmaker to $70 per share.

Chip Stocks: Less Also Means Less

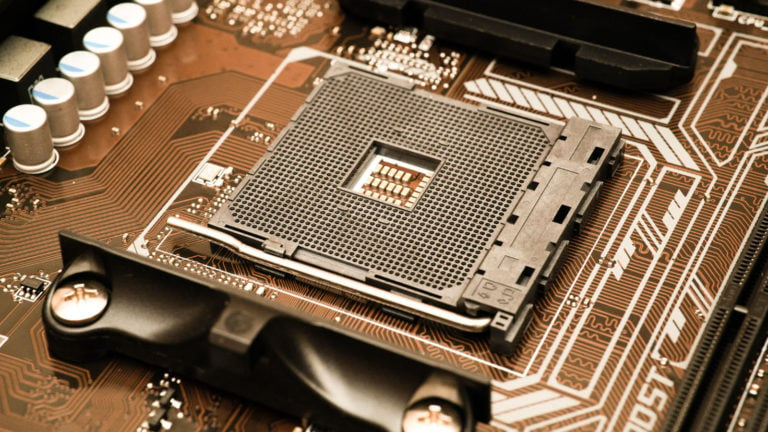

This was not true in central processing units (CPUs) and graphics processing units (GPUs), the workhorses of data processing. Taiwan Semiconductor (NYSE:TSM), the leading processor chip foundry, and Nvidia (NASDAQ:

NVDA), the leader in graphics processing chips, both fell over the weekend.

Taiwan Semiconductor remains the most important company in chips. It mastered the Extreme UltraViolet (EUV) techniques needed to bring circuit lines within a few microns of one another years before rivals. A monthly revenue drop is weighing on the stock today.

But that’s not the only pressure facing the Taiwan-based company. Chinese military drills, simulating an invasion of its home island, have it negotiating seriously with the U.S. about taking subsidies under the CHIPS Act. At issue are rules against excess profits and an application process that could expose its corporate strategy.

TSMC is in the process of building two new chip plants in Arizona that will cost $40 billion. The new plants will produce the company’s most advanced chips.

This is good news for customers like Nvidia, whose stock has been on fire so far in 2023. It’s up 86% to date, thanks to the hype around artificial intelligence (AI), which depends on its GPUs to crunch data quickly.

China is the target of U.S. trade sanctions and has chosen to go after Micron, investigating it over issues of supply chain disruption. But it’s unclear which rival would pick up that slack, which could render the investigation self-defeating.

What Happens Next?

The threat of an escalating trade war with China hangs over the entire world. But so far, the U.S. is winning where it counts, in advanced technology.

On the date of publication, Dana Blankenhorn held long positions in TSM and NVDA. The opinions expressed in this article are those of the writer, subject to the InvestorPlace.com Publishing Guidelines.