MicroVision (NASDAQ:MVIS) stock is trending on social media, and its shares climbed 6% in early trading before falling flat at the time of publication. That comes after the name soared 30% yesterday. Data indicates that a short squeeze may be developing in the name.

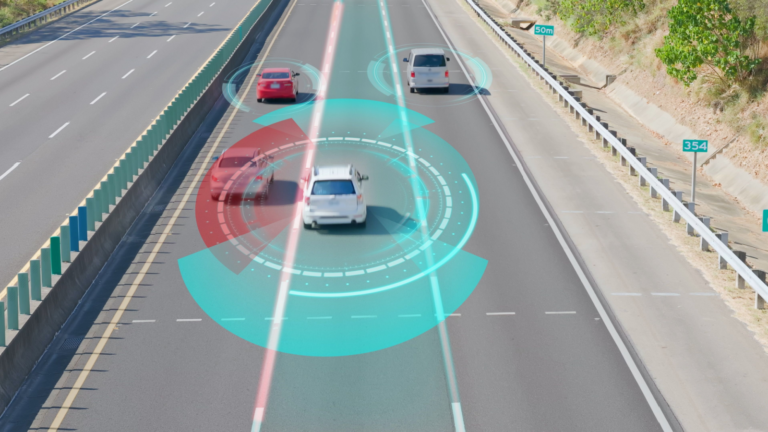

MVIS makes “automotive lidar sensors” that enable advanced driver assistance systems and autonomous vehicles. Additionally, its products utilize a form of artificial intelligence called machine learning.

Investors Appear to Be Betting on a Short Squeeze

Data on MVIS stock from Fintel appears to indicate that MVIS is a good candidate to undergo a short squeeze.

As of shortly after 9 a.m. Eastern today, according to Fintel’s data, there were zero shares

of the name “available to be shorted at a leading prime brokerage.” Earlier this morning, there were also no shares of the stock available to short at the brokerage before 30,000 freed up, which depleted again in less than an hour.

Also noteworthy is that short sellers were responsible for 58.4% of the “off-exchange” trading volume of the name on June 6. On June 5 and June 4, the same ratio came in at 63.2% and 54.63%, respectively.

Moreover, 30% of Microvision’s available shares are being sold short, and the interest rate that short sellers of the name have to pay rose to 63.7% today from 59.47% yesterday and 52.89% on June 5.

More Information on MVIS

On May 9, the company reported that its revenue had climbed 129% year-over-year to $800,000. Despite the low revenue total, the company predicts that its top line will come in at $10 million to $15 million for all of 2023.

In all of 2022, however, Microvision generated just $700,000 in sales, down from $2.5 million in 2021 and $3.1 million in 2020. In 2022, it reported an operating loss of $61.4 million versus an operating loss of $53.9 million in 2021.

On the date of publication, Larry Ramer did not hold (either directly or indirectly) any positions in the securities mentioned in this article. The opinions expressed in this article are those of the writer, subject to the InvestorPlace.com Publishing Guidelines.